Lapkeu GOTO H1 2022: Record Increase in Income and Loss

Target a positive contribution margin in the first quarter of 2024, supported by positive margins from on-demand services (first quarter 2023) and e-commerce (fourth quarter 2023)

GoTo's weapon to continue pursuing a profitability position is to take advantage of integration between group ecosystems which continues to be accelerated. The Company prioritizes product differentiation, shifts from an incentive-based business, and as a result cross-platform usage increases. The Company also gets room to sharpen its focus, and in the end the number of loyal customers increases with high-value monetization.

In reaching a position of profitability, as a consequence the company has to disburse a lot of initial investment. According to the financial statements presented in the first semester (H1) 2022, the company suffered a loss attributable to the owners of the parent entity of Rp13,64 trillion, an increase of 117,28% yoy. Meanwhile, in the first semester of 2022, the company experienced a net loss of IDR 6,28 trillion.

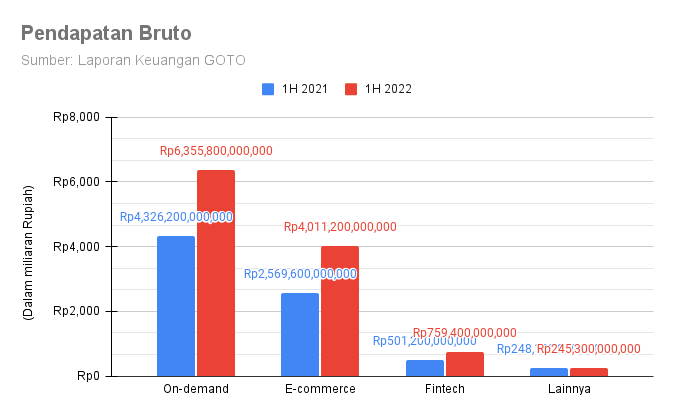

Actually, business Gojek and Tokopedia did pretty well this time of year. GOTO posted net revenue of IDR 3,38 trillion, up 73,32% yoy from IDR 1,96 trillion in the same quarter in the previous year.

In detail, income from service fees shot 102,93% on an annual basis to Rp7,99 trillion. Then, advertising fees rose 417,77% to Rp1,16 trillion, delivery services rose 24,33% to Rp907,71 billion. Rewards for transactions and payments are now recorded at IDR 424,39 billion.

However, this revenue was eroded from promotional costs to customers which increased by 115,27% to Rp7,34 trillion. For comparison, promotion costs to customers amounted to Rp3,41 trillion. Then, general and administrative expenses rose from Rp3,84 trillion to Rp5,76 trillion. Product development expenses increased to Rp2,13 trillion from Rp649,78 billion.

Other expenses, namely depreciation and amortization expenses amounted to Rp1,54 trillion from Rp838,82 billion. Finally, operating and support expenses rose to Rp937,9 billion from Rp628,57 billion.

Adjusted EBITDA target and contribution margin breakeven

GOTO's management stated that the company currently has a priority to accelerate the pace towards profitability, in which the continued gradual increase in contribution margin and adjusted EBITDA will occur in the coming quarters.

"This will be pursued by the level of take rate improvement, rationalization of marketing expenses, as well as identification and retention of loyal consumers," said GOTO Group President Director Andre Soelistyo in an official statement.

For the third quarter of 2022, the company has set the following work guidelines:

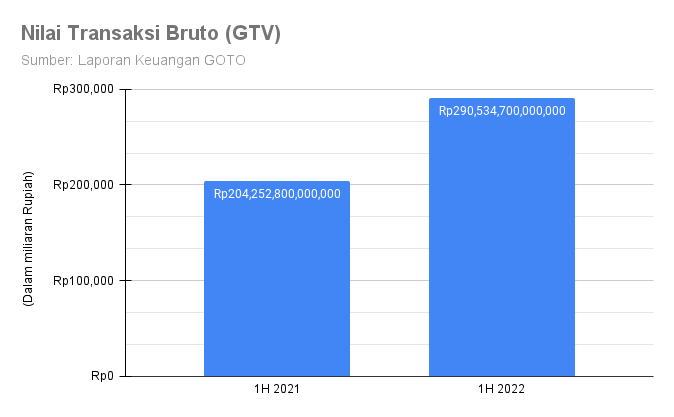

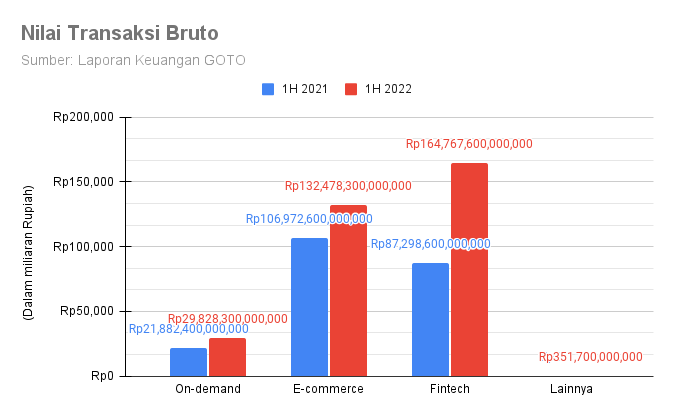

- Quarterly GTV in the range of IDR 151 trillion to IDR 156 trillion

- Quarterly gross revenue in the range of IDR 5,7 trillion to IDR 6,0 trillion

- Contribution margin as a percentage of quarterly GTV in the range of -1,3% to -1,2%

More Coverage:

Meanwhile, for the break-even target (breakeven) contribution margin, the company stipulates the following work guidelines:

- GOTO Group's contribution margin becomes positive starting in the first quarter of 2024

- Segment contribution margin on-demand service to be positive in the first quarter of 2023

- Segment contribution margin E-commerce to be positive in the fourth quarter of 2023

"The above guidelines are based on current market conditions and reflect the company's preliminary estimates, all of which are subject to various uncertainties, including those related to the impact of the COVID-19 pandemic."

Sign up for our

newsletter