Investree Pockets 142 Billion Rupiah Debt Funding from responsAbility

responsAbility is an investor partner of one of the institutional lenders at Investree, namely Accial Capital which first entered as a lender since 2017

Investree again announces funding debt $10 million (over 142 billion Rupiah) from responsAbility Investments, a Swiss asset manager focused on follow-up investments. responsAbility is an investor partner of one of the institutional lenders at Investree, namely Accial Capital who first entered as a lender since 2017.

Funding debt This will be redistributed to finance the financing needs proposed by borrowers or SMEs in Investree. For responsAbility, channeling funding to Investree means directly contributing to the United Nations Sustainable Development Goals (SGDs), in relation to limited access to finance for SMEs that limits job creation, triggers inequality, and hinders economic development.

Investree Co-founder & CEO Adrian Gunadi said, this is a very big stepping stone for Investree because in their third funding round, Accial Capital invites one of its co-investors, ResponAbility to participate in funding through the Investree platform.

“In line with responsAbility's vision and mission as the 'home' of sustainability investment specializing in impact, we will target funding from the responsAbility-Accial Capital partnership to finance projects borrowers We are the ones who have significant economic, social and environmental impacts on life, especially in the midst of the recovery period due to this pandemic," said Adrian in an official statement, Thursday (28/10).

One of the projects that Investree has carried out is to help empower women who are ultra-micro traders in the Gramindo ecosystem. These traders have group characteristics, consisting of women without access to banks and running businesses using conventional and sharia schemes. Now the number has reached 5.700 on the Investree platform.

For responsAbility itself, this is a unique credit transaction model in Southeast Asia, especially in Indonesia because it is in tandem with Accial Capital to provide financing support to SMEs through the Investree platform.

Deputy Head of Financial Inclusion Debt responsAbility Jaskirat S. Chandha said, “We are very pleased to be able to partner in this innovative structure to provide working capital funding that is urgently needed by SME borrowers in Indonesia. Financial technology is a key driver of financial inclusion. We are delighted to have found the right collaboration at Accial Capital and Investree with the required expertise.”

Investree enters its 6th year

At the age of 6, the company has grown far beyond just a company . During 2021 alone, the company has empowered 5 thousand ultra micro women entrepreneurs who need financial support to develop their simple businesses.

Next, take digital freight forwarders Count on to offer access to customs financing and taxes for Andalin clients through Buyer Financing products. This collaboration aims to help ease the client's cost burden so that they do not have to incur large initial costs, so that the company's cash flow management can be optimized.

As of September 2021, Investree booked a total loan facility of Rp 12 trillion, up 51% yoy from last year, and the value of disbursed loans was Rp 8 trillion. In terms of the number of lenders and borrowers, at the end of the third quarter of 2021, there were already 46 thousand Actioncalendar and 6 thousand borrowers who are members of Investree cumulatively. Quantity comparison Actioncalendar individual and Actioncalendar institutions that fund are at a percentage of 40:60.

Investree's contribution to the industry in Indonesia is also real. Investree's outstanding loans contributed 8,3% to the national productive outstanding loans. As of September 2021, their TKB90 is 98,22% - better than the national average of 93,3%.

The portion of the productive sector is still minimal

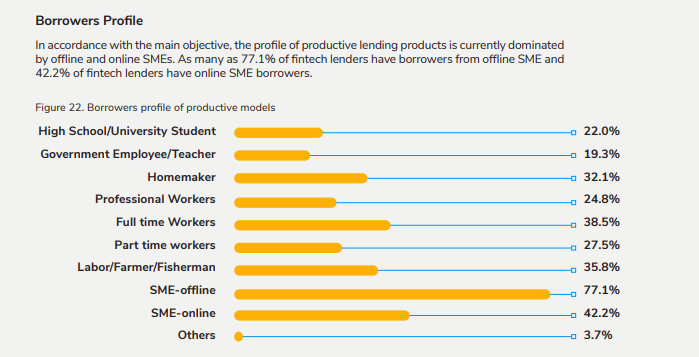

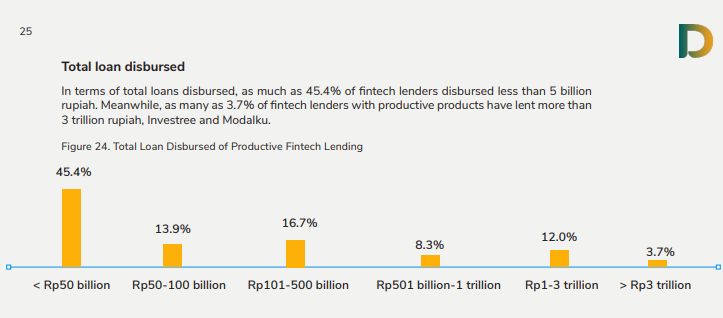

According to reports from DSInnovate and AFPI last year, 36,1 million borrowers in the productive sector borrowed Rp. 2,5 million to Rp. 25 million. Only 17,6% of them borrowed more than Rp500 million. This sector still needs to be further boosted by regulators, especially during this pandemic, many MSMEs need to be hit and must survive.

More Coverage:

Sign up for our

newsletter