How does InfinID Simplify the Loan Application Process with Guaranteed Property Certificates

Established since November 2022, has pocketed seed funding from Insignia Venture Partners

Various data sources reveal that credit needs reach IDR 1.600 trillion annually and conventional financial institutions can only serve around IDR 600 trillion. That is, there is funding gap of IDR 1.000 trillion, which is the scourge behind the rapid development fintech in Indonesia.

This condition inspired Filman Ferdian (CEO), Vincent (COO), and Amalfi Darusman (CTO), who knew each other since college, to start InfinID in November 2022. Filman had previously worked at McKinsey and GoPay with the last position being Head.

While Vincent has experience working in various global and national technology companies, such as IBM, Microsoft, Gojek, Tokopedia, and Xendit. Currently he also serves as Deputy Chair of AFTECH's Digital Financial Innovation Department. Meanwhile, Amalfi is an engineer with experience in analytics and technology development who has worked as data scientist in the United Arab Emirates.

The three of them finally united last year. Armed with their work experience, it was concluded that fintech is the most relevant sector. The next question is looking for the right business opportunity in the sector fintech.

When contacted DailySocial.id, Filman said that based on market observations and personal experience, the three of them saw an opportunity to encourage transformation in the area of loans guaranteed by property certificates. There is huge market potential, but there are still challenges, including open access to the wider community and also a user experience that is not yet optimal. Because the average process takes more than six weeks.

"Therefore, we decided to presenting InfinID as a digital platform that focuses on loan acquisition facilities using property certificate collateral," explained Filman.

InfinID Products

InfinID takes a different approach in disbursing loans, by using property certificate collateral. In this case, the company becomes an aggregator that connects prospective debtors with financial services institutions (LJK) which can provide loan facilities guaranteed by property certificates.

Prospective debtors will be assisted in getting the most appropriate loan according to their conditions and needs. On the other hand, the company assists LJKs in managing the application, evaluation, service and monitoring processes by utilizing digital technology. The LJK products used by InfinID are multipurpose credit and business credit accompanied by collateral.

"We do not enter into KPR or loans without certificate collateral. As a digital platform we apply the principle of collaboration, so we are very open with LJKs at large, even other companies that fall into the digital platform category for loans such as IKD cluster organizers Financing Agent or aggregator."

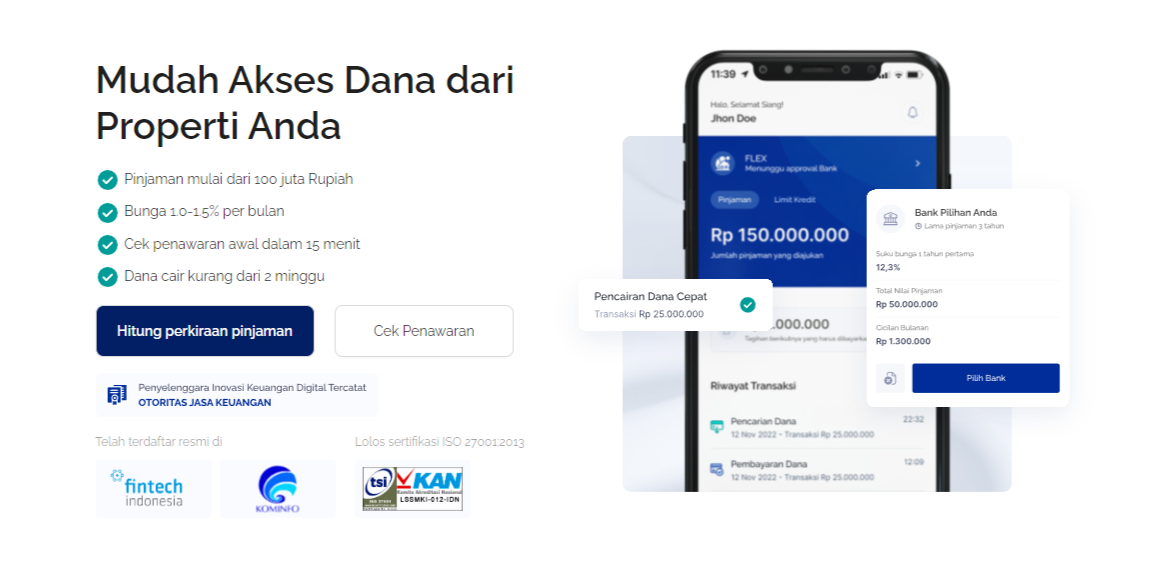

Loan limits available at InfinID start from IDR 100 million with interest ranging from 12%-18% per year. The tenor also varies, some are 3-5 years, some are long term, namely 15-20 years.

The company has three loan products, namely InfinID FIX, InfinID FLEX, and InfinID FLIP. InfinID FIX is a multipurpose loan intended for loans with large funds, but with low interest and a fixed payment scheme. Meanwhile, InfinID FLEX provides a more affordable credit limit with various flexibility, such as more affordable monthly payments.

Lastly, InfinID FLIP is the solution refinancing (takeover) KPR/multipurpose credit/business credit to other financial institutions with lower interest rates, longer terms and other conveniences.

There are four LJK partners who have partnered so far, namely BPR Artharindo, BPR Daya Perdana Nusantara, BPR Rifi Maligi, and Bank Sampoerna.

For risk management, the company does it thoroughly, starting from screening profiles of potential debtors that are tailored to LJK partner preferences, verifying comprehensive data to ensure the information submitted by prospective debtors is appropriate, including by utilizing LJK partners' data verification solutions and direct surveys.

"We continue to develop digital solutions to make property verification easier, such as assessing and checking property legality. In addition, we provide automated solutions that help LJKs implement the risk management mechanisms they already use, so they can analyze credit more efficiently and effectively up to the binding process credit."

The next plan

InfinID itself is only 10 months old. Even though it is still new, Filman ensures that the company's focus is on having a good business foundation, including developing a more efficient credit process, building technology to simplify processes for debtors and LJKs, and collaborating with a number of LJKs.

As a company fintech, InfinID also complies with applicable regulations. In May 2023, the company was successfully registered as a Digital Financial Innovation (IKD) organizer at the OJK for clusters financing agent. For system security, the company has completed ISO 270001:2013 certification to ensure the reliability of data security.

More Coverage:

The InfinID product has actually also been launched on the market. It is claimed that the company receives thousands of applications from prospective debtors every month for loans worth IDR 100 million-IDR 300 million. "The loan purposes that are often applied for are for renovations, building a business, debt consolidation to pay off KTA debts, loans online, and credit cards."

Filman said that in the future the company will continue to focus on improving the reliability of processes and technology so that it can serve the credit approval process in Jabodetabek, before it can expand to other cities. In addition, there will be more collaboration with other agencies and institutions that are felt to have an important role in developing a wider loan ecosystem with property certificate guarantees.

"Apart from that, we also have several product innovations, both in terms of technology and financial product schemes that we want to launch on the market in the next 6-12 months."

InfinID has received funding of an undisclosed amount from Insignia Venture Partners.

Sign up for our

newsletter

Premium

Premium