Hypefast Reportedly Received Series A Funding Worth 203,5 Billion Rupiah (UPDATED)

Hypefast invests in and acquires Digital & E-commerce Native Brands startups that have the potential to be developed into global brands

*Update as of 23 July 2021: Hypefast corrected that the company acquired a startup "Digital & E-commerce Native Brands" instead of "Direct to Consumer". Both have differences in terms of product brand distribution, namely through e-commerce and their own channels.

-

Hypefast is reported to have booked a series A funding of $14 million or the equivalent of 203,5 billion Rupiah. From the data we obtained, this round was led by Monk's Hill Ventures with the participation of Jungle Ventures, Strive, and Amand Ventures.

When contacted, Hypefast Founder & CEO Achmad Alkatiri chose not to comment on this funding.

He said that the company is currently focusing on growing the brands in its portfolio. To date, there have been more than 20 brand in its network, managing more than 150 teams across Southeast Asia. With the business model being implemented, Hypefast also admits that it has profitable since his first year.

As is known, Hypefast invests and acquires startup "Digital & E-commerce Native Brands" which has the potential to be developed into brand global. In addition to capital support, the brand owner also gets a lot of support from marketing, production and operations, to the use of data to help business analysis.

Brand acquired, such as developers of fashion, food, personal care products, and so on -- which are produced, marketed, and sold directly to consumers through various channels, particularly online marketplace such as Tokopedia, Shopee, etc. Two examples of startups are Boonles and NOORE Sport Hijab.

D2C is gaining momentum

D2C startup or new economy is indeed the center of attention in the midst of today's digital developments. In Indonesia, several investors are starting to take D2C startups seriously, including East Ventures, Alpha JWC Ventures, ANGIN, BRI Ventures, and Salt Ventures.

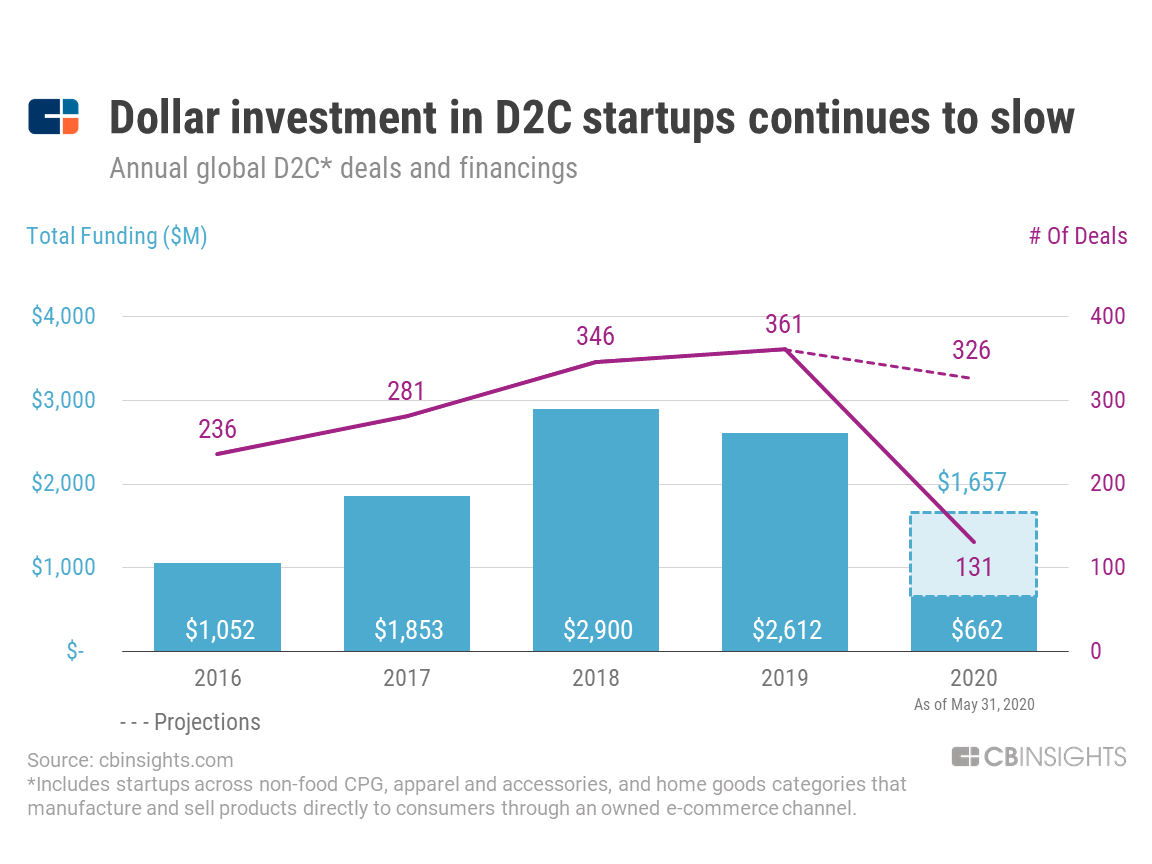

In the global arena, especially the United States, the investment round for D2C startups has been quite fast since the last few years. However, according to CBInsights data, global performance declined in 2020, one of which was caused by the pandemic.

In Indonesia, D2C seems to be gaining momentum in the midst of the presence of [which is quite widespread] generation entrepreneur new. An important contributing factor is the high interest of consumers in shopping on the platform online marketplace – every year the trend is experiencing rapid growth posting a significant GMV. Latest data from Google, Temasek, and Bain&Company as of 2020 GMV E-commerce Indonesia reached $32 billion, the largest in the region.

Marketing creativity through digital channels, such as social media, makes developers brand gain attention and profit from the local market. The strategies vary, some collaborate to present products limited with an influencer well-known brands, create viral marketing strategies, and so on.

More Coverage:

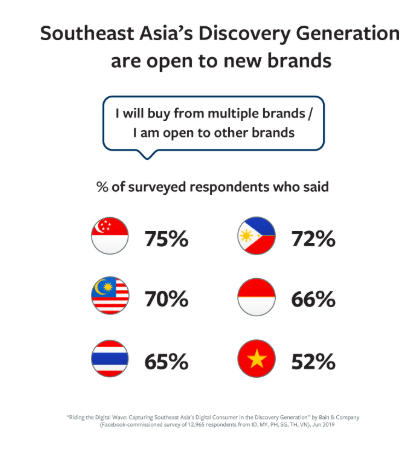

In addition, according to a survey that done Facebook, there is a tendency for consumers in Indonesia to buy products from many brand. This makes market competition more dynamic, compared to a customer base that is loyal to only certain products.

Digital giants in Indonesia also have a special interest in D2C startups. For example what is done decacorn Gojek, they take advantage of the accelerator program Xcelerate to enlist local D2C startups to nurture and assist through the strengths of its service ecosystem.

Sign up for our

newsletter