How to Create a QRIS Code as a Payment Method in the Halokas Application

Tutorial on creating and using the QRIS payment method in the Halokas application

The current trend of business digitization has brought business actors including MSMEs adapt to the digital world. With all the technology currently available, MSMEs can carry out their business activities digitally, including in providing business payment methods.

Indonesian Standard QR Code or Indonesian Standard Quick Response Code (QRIS) is one of the payment systems that can help businesses provide cashless payment methods for their customers.

This payment system developed by Bank Indonesia (BI) and the Indonesian Payment System Association integrates all non-cash payment methods in Indonesia. QRIS allows its users to make transactions for free without admin fees, by the way scan QR code.

The convenience provided by the QRIS payment system is something that businesses need to take advantage of to help their business activities. So, how can businesses use QRIS? Here's how to make QRIS in the Halokas application, see the review.

Steps to Create a Qris Code in the Halokas Application

Hello is a platform business to business (B2B) targeting MSMEs as its target market. This platform exists as a solution for businesses to overcome digital business problems they face, such as those related to the provision of non-cash payment methods.

Simply by becoming a user of the Halokas application, businesses can immediately take advantage of the 'Accept Payments with QRIS' feature, without the need to make another registration. Here are the steps for its use:

- Download the Halokas application on the Google Play Store/App Store.

- If you don't have an account yet, please register your business.

- After that, there are three options that you can choose to start using QRIS in the Halokas application. First, please go to the main page of the app and click 'Learn about Qris'. Second, you can also enter the 'Accept Payment' feature on the start page. Third, you can directly click on the QRIS logo in the middle of the menu bar at the bottom of your screen.

- Next, please enter the nominal that must be paid by your customer.

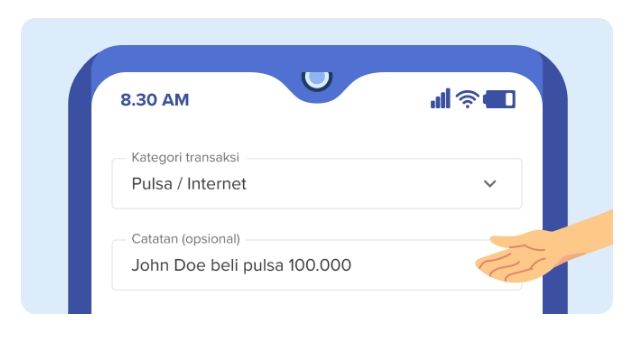

- Select a transaction category and enter notes if required.

- Click the 'GREAT QRIS CODE' button.

- Ask your customer to scan QRIS with their e-wallet or mobile banking application to start making payments.

- After the customer has successfully paid, you will receive a notification on your Halokas application.

- Transactions will be automatically recorded in your business' 'Transaction History' menu.

For information, the QRIS obtained by business actors has an expiration date. QRIS created to accept customer payments will be valid for one hour. If within one hour the QRIS code has not been received,scan by the customer, then the business actor needs to create a new QRIS code.

In addition, Halokas also bears MDR costs (Merchant Discount Rates) of 0.7% of the total payment and will return it in the form of a bonus.

Benefits of the Qris Code Payment Method for Businesses

From its QRIS payment service, Halokas offers advantages for MSMEs as application users. What are the promised benefits? Here are some of them:

- Make it easier for customers and business actors to make and receive non-cash payments through QRIS, from all payment platforms, both bank and non-bank, that are used by the public.

- Halokas bears the MDR fee (Merchant Discount Rates) of 0.7% of the total payment and will return it in the form of a bonus.

- All types of transactions made will be exempt from applicable fees.

- QRIS disbursement of funds will be transferred to your account within one working day.

- If the value in each QRIS payment has reached a certain value, Halokas offers business capital loans quickly.

This is an explanation regarding how to create and use the QRIS payment method in the Halokas application.

Sign up for our

newsletter