How to Apply for an Online Loan at Tokopedia

Online loans are intended for general consumers

Financial products on Tokopedia are getting wider. Apart from offering investment Mutual Funds and emas, Tokopedia now also has two loan products, namely online loans and capital loans. Both have different targets, where online loans are aimed at consumers at large, while capital loans are specifically for lapak owners there.

Well, this time we will review how to apply for an online loan at Tokopedia, what are the procedures and steps.

Preparation

- Prepare an ID card

Steps to Apply for an Online Loan

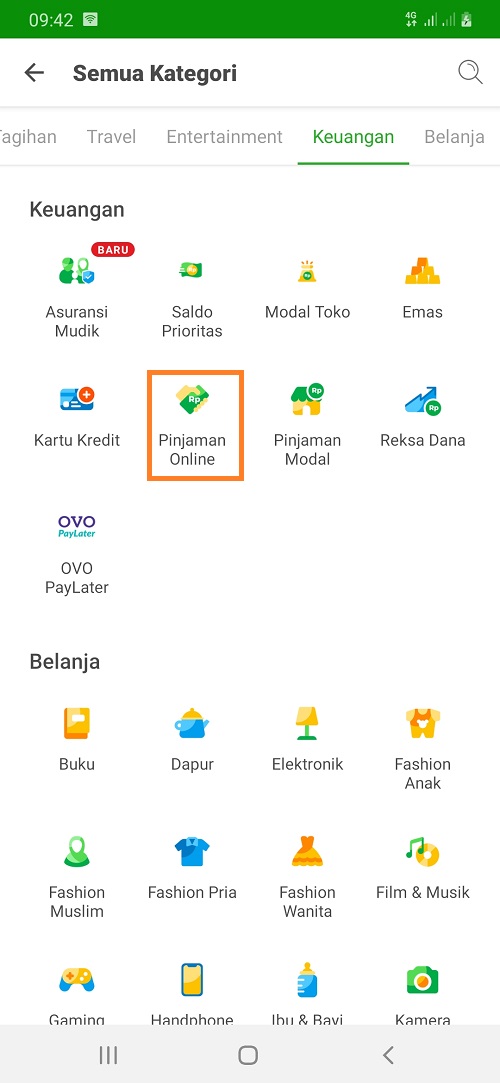

- Run the Tokopedia application then tap menu Finance - Online Loans.

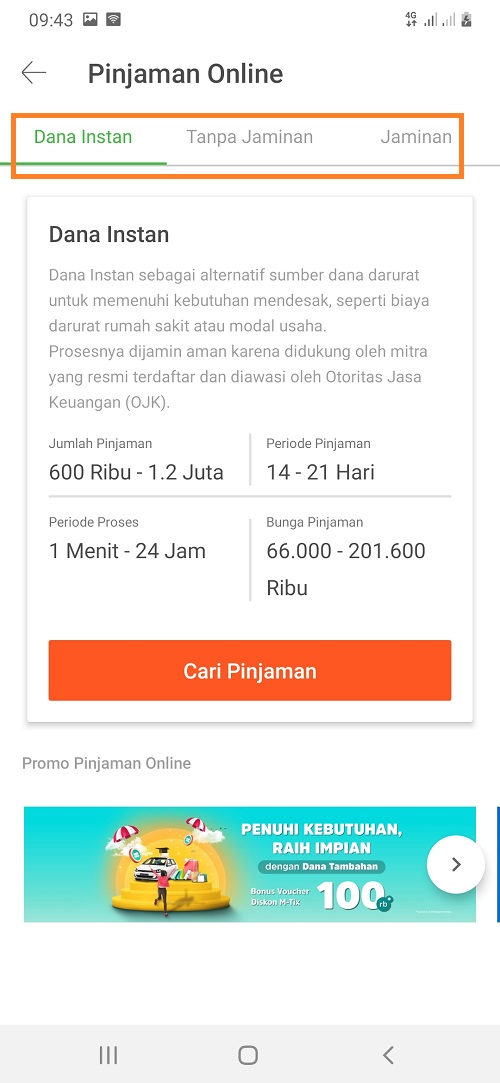

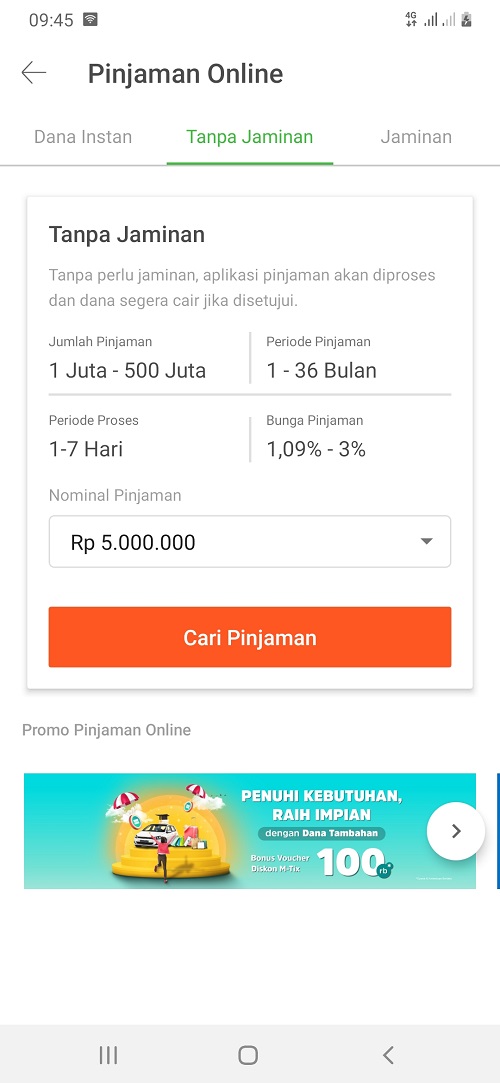

- Online loans themselves consist of three product options, instant funds, unsecured and guaranteed. We will try instant and unsecured funds products, while for guaranteed products the process is almost the same as without guarantees.

- So, now choose an instant fund product and tap the button Find Loans.

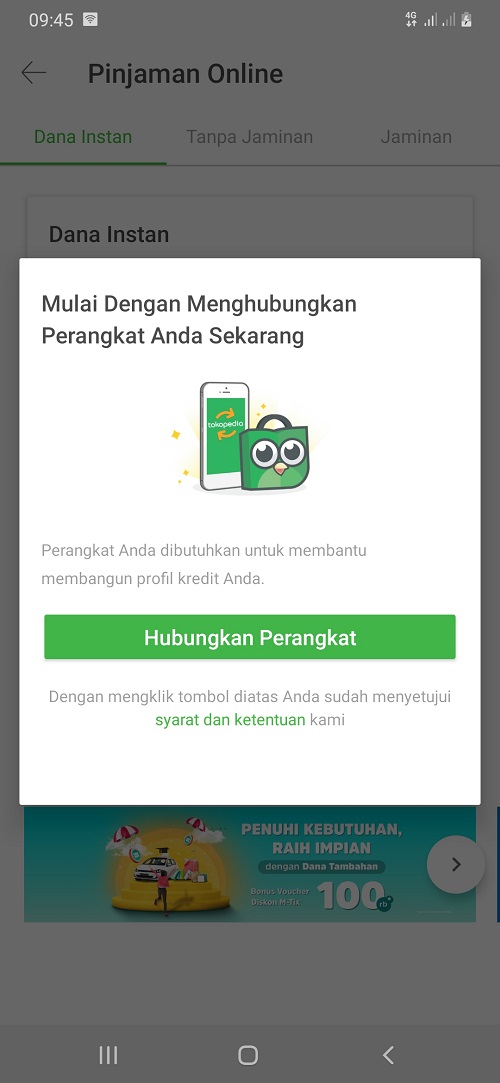

- To be able to apply for this type of online loan, you must first connect the device. The system will automatically read the mobile number you registered in your Tokopedia account.

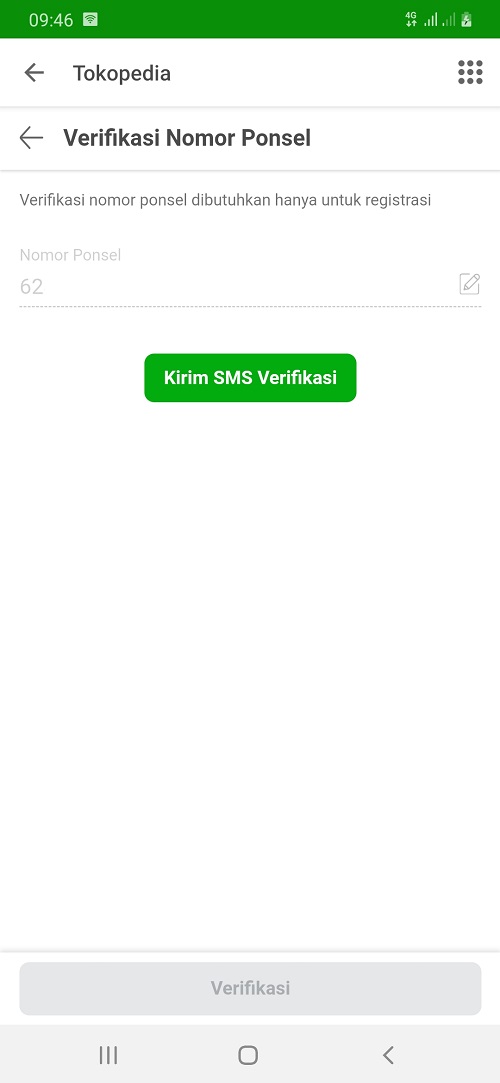

- Continue by touching the Send Verification SMS button, wait for a short message from Tokopedia then enter the six-digit code sent in the SMS into the verification form.

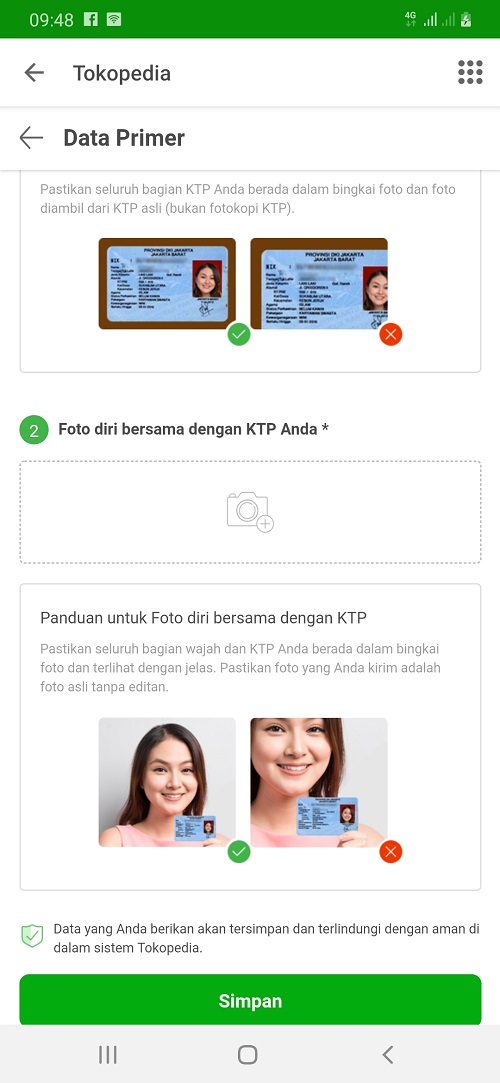

- After successful verification, the system will ask you to upload a photo of the identity card and also a selfie photo holding the card. Both photos must be clear and intact.

- After this process is completed, you will be asked to fill in complete biodata according to the truth. When all data is filled in, Tokopedia will verify manually. If approved, the loan will be disbursed to the account that you have also included in the form.

- Now let's try to apply for an unsecured type of online loan. Determine the loan amount then tap the button Find Loans.

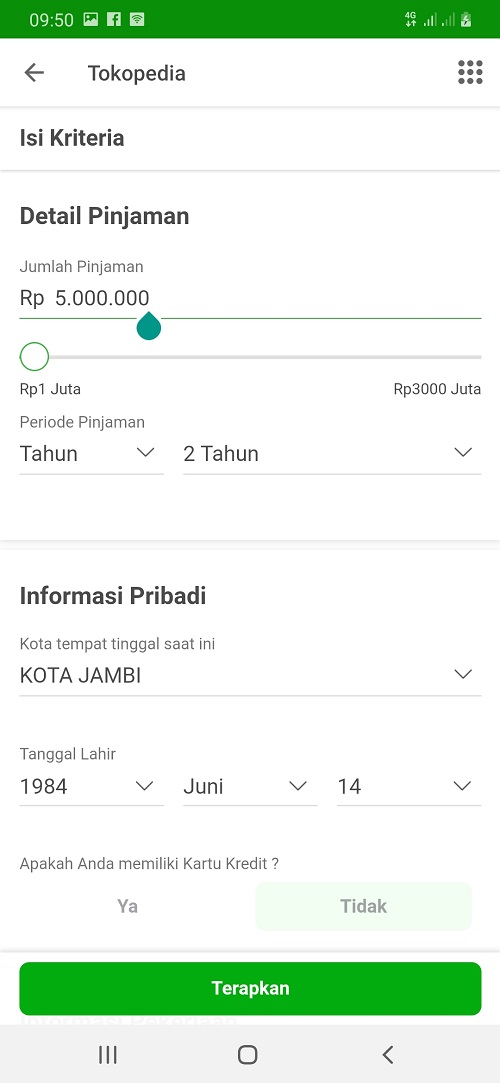

- Fill in your complete bio, including your business information.

- When everything is filled, tap the button Apply.

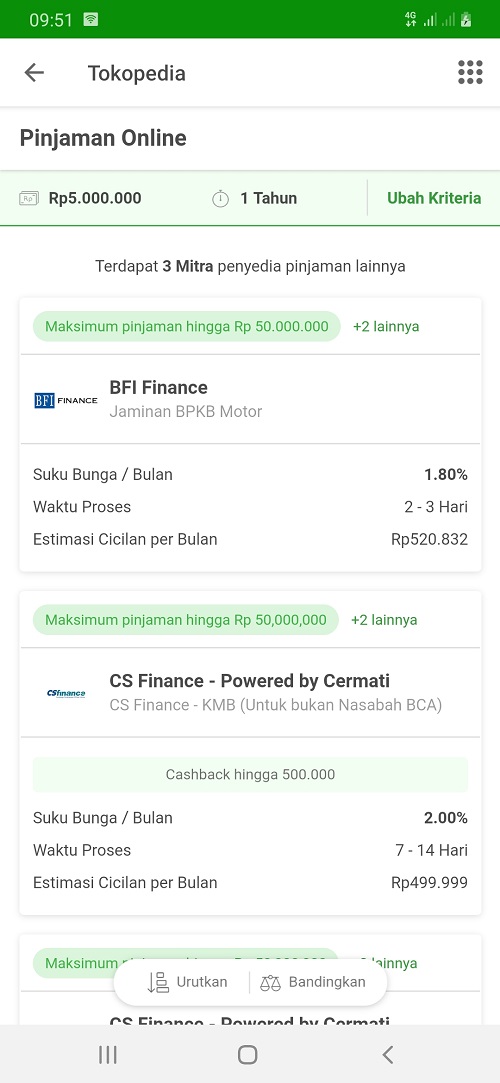

- The next system will find an online loan partner that matches your criteria.

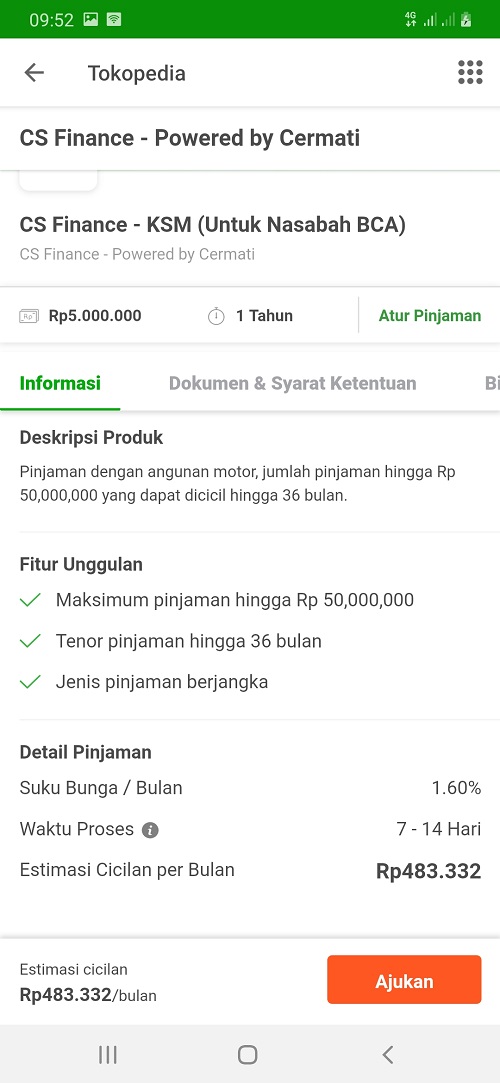

- Just choose, which one you want.

- Each selected partner has certain document requirements and criteria. You can read about it in the menu Document $ Terms of Conditions. If everything is clear, just tap the button Submit.

- Similarly, the system will also ask for a photo of the original identity card and also a photo of you holding the card.

- Next, you will be asked to fill in some additional information and when this stage is completed, you just have to wait for the verification process.

The online loan approval process is not the same from one partner to another. But in general, the verification results will be completed within 1x24 hours.

Sign up for our

newsletter