Halofina Presents Virtual Assistant for Personal Financial Planning

Will be released to the public August 28, 2018 in the form of "soft launching"

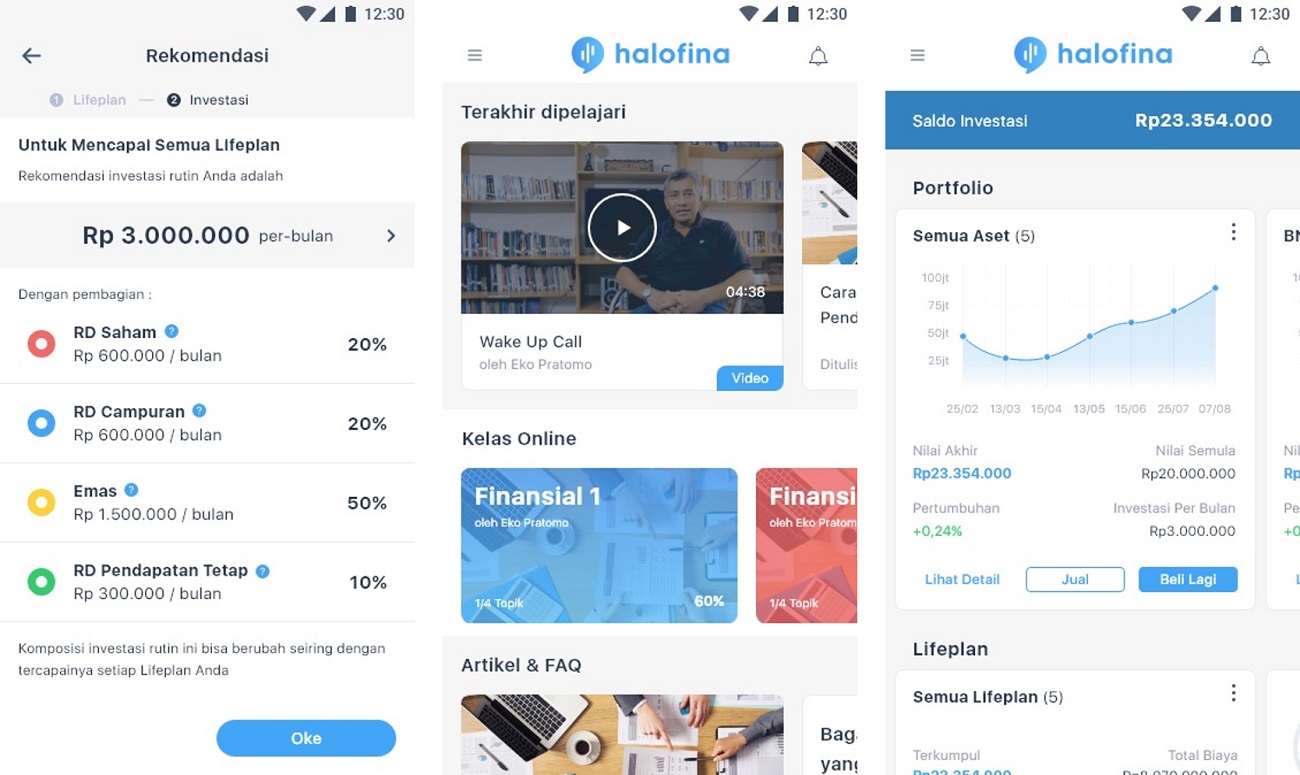

Halofina is a personal financial planner application. The concept of work is made as a virtual assistant. This is based on the tendency of the community to consider financial management to be a complicated activity. The hope is that when there are (virtual) friends who provide knowledge about finance, these management activities become more comfortable.

In the digital landscape, products chatbot it is mushrooming. One thing I try to emphasize in Halofina, chatbot called "Robo Advisor" will do the personal assistant. The Halofina team stated that their products have followed global standardization and are supported by experts in the financial industry.

Experts are engaged in discussions with product and technical teams to build algorithms that will provide intelligent recommendations. The recommendations given by Halofina are based on financial preferences (sharia/conventional), risk profile, financial condition, and users' financial goals.

"When the user first accesses Halofina, the user will perform a series of personal assessment which is intended so that the system learns the user's character and provides the best recommendations according to conditions," said Halofina Co-Founder & CEO Adjie Wicaksana.

Halofina's mission is to provide financial management education and recommendations. Halofina will be a free application for the community. From a business model perspective, Halofina will benefit through the system commission fees and subscription fees from online financial education and consulting features in the application.

Soff launch the end of this month

Currently, the new application can be accessed by a limited number of people, but through the official website, Halofina has opened registration for early access. The plan will be done soft launch on August 28, 2018. So far, Halofina is running its operational bootstrapped.

Adjie said that his party was intensively talking to venture capital for initial funding. Recently, Halofina was also selected to be one of the participants in the Batch 3 Plug and Play accelerator program along with 16 other startups.

This Bandung-based startup was founded by two people founder. Besides Adjie, there is a colleague named Eko Pratomo. Adjie is a graduate of the University of Southern California. Her passion to produce social impact businesses, especially to encourage the level of financial literacy and inclusion in Indonesia, gave birth to the idea of Halofina.

Meanwhile, Eko Pratomo has 20 years of experience in the financial industry and mutual fund investment. He was awarded as "Indonesia's Asset Manager CEO of the Year 2008" from Asia Asset Management.

"Halofina's vision is to be the leading robo advisory apps in Indonesia. To support this vision, we divided our achievements into 3 big rounds, namely product development, customer development, and strategic partnership," said Adjie.

Adjie continued, "This year, we are targeting to work with various Fintech, Banks, Fund Managers, and other financial institutions to strengthen services. On the product side, we will continue to strengthen the Halofina platform with components artificial intelligence to provide the best recommendations.”

Leading users to investment goals

LifePlan is the main feature of Halofina which will provide investment recommendations according to the user's life goals. Through LifePlan, Halofina groups a person's life cycle into four financial phases. The first phase, when a person has not earned and is still dependent on their parents. The second phase, when a person begins to earn, is financially independent, and various needs arise. The third phase, when a person is at the peak of his career and needs increase. And the fourth phase, when entering old age, may not even earn.

Based on these four phases, it is understood that a person has various financial needs in the future that need to be prepared early, for example the cost of education, house ownership, worship, vacation to retirement.

"The LifePlan feature will make it easier for users to realize their financial goals. Halofina provides full assistance from start to finish. Starting from the planning process, calculating investment needs, choosing the right investment, investing regularly, to investment progress reports," concluded Adjie.

Sign up for our

newsletter