Grab Officially Announce Plan "Go Public" Through SPAC

In collaboration with Altimeter, the plan will be listed in the middle of the year with a valuation of almost $40 billion

Yesterday Grab announced confirmation go public on the United States stock exchange using a Special Purpose Acquisition Company (SPAC) in partnership with a blank check company (blank check company) Altimeter Growth Corp ($AGC). It is not stated when exactly this process will be completed, but it is estimated that the company officially uses ticker $GRAB in the middle of this year.

Grab became the second Southeast Asian company to confirm SPAC flooring. Previously, Vision+, a subsidiary of MNC, had partnered with Malacca Straits Acquisition Company ($MLAC) for go public in the third quarter of this year.

Grab targeting a valuation of $ 39,6 billion (around Rp. 580 trillion) and obtaining fresh funds of $ 500 million from $ AGC and through PIPE (Private Investment in Public Equity) worth $ 4 billion. $750 million of which is the Altimeter commitment.

"Altimeter is committed to holding the shares owned by its sponsors for three years and will also make a substantial contribution of its shares to the endowment. GrabForGood. Altimeter together with other well-known investors and investment management institutions will be with us in the long term,” said the Group CEO and Co-Founder Grab Anthony Tan.

Valuation figure Grab this is equivalent to the expected valuation resulting from the merger Gojek and Tokopedia. Throughout 2020, Grab recorded sales (Gross Merchandise Value / GMV) of $12,5 billion, with business pillars consisting of Delivery, Mobility (movement of people), and Finance (financial activities). Indonesia is the biggest market Grab.

Anthony said, “It is an honor for us to be able to represent Southeast Asia in the global open market. This step is an achievement in our journey in providing access for everyone to be able to enjoy the progress of the digital economy. [..] When Southeast Asia is successful, then Grab also successful."

Brad Gerstner, Founder & CEO, Altimeter added, “As one of the world's largest and fastest growing internet companies, Grab opening digital avenues for 670 million people in Southeast Asia. We are very happy that Grab chose Altimeter Capital Markets as their IPO partner and are excited to join as long-term owners of this innovative, mission-driven company.”

Be careful with SPAC

The increasing number of companies that go public using SPAC has become a separate concern for regulators. United States regulator, SEC, urge so that the decision to invest in a SPAC is not solely supported by industry celebrities and requires investors to continue to do their own checking and research.

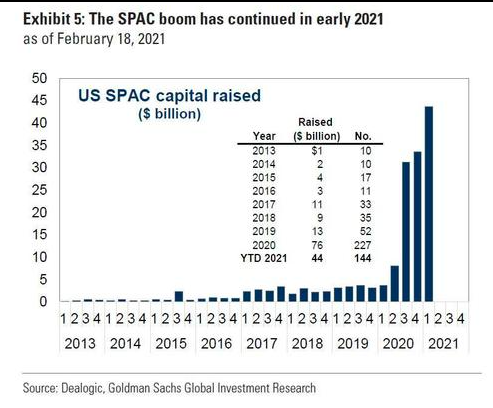

According to data compiled by Dealogic and Goldman Sachs, growth in public funding through SPAC spiked in 2020 and peaked in the first quarter of 2021. ZeroHedge report this figure dropped dramatically at the start of the second quarter. The SEC is alleged to have tightened the registration process and go public This SPAC is to protect public funds.

In general, SPAC simplifies and speeds up the process go public company because not much paper work and requirements that must be met by the company. Nevertheless, Nikola's case, which caused the founder to resign, is an example of a company that go public through SPAC it is not certain that it is free from problems.

Sign up for our

newsletter