GoCement Takes Disruptive Steps to Streamline Construction Business

Exclusive interview with GoCement Founder & CEO Djonny Suwanto, pioneer of construction tech business in Indonesia

According to research Global Data, the market size of the construction business in Indonesia has reached $234,6 billion or the equivalent of IDR 3,591 trillion in 2021. It is projected that this sector will find average annual growth rate (AAGR) of more than 4% in the upcoming 2023-2026 period. This growth is directly correlated with a number of economic metrics, including the national GDP which in 2022 has managed to grow 5,31%.

In addition, investment in the construction business has also increased. In 2018 the value reached $72 billion, indicating an AAGR of 5% since 2010. BPS data also stated that in 2018 there were more than 131 thousand companies of various scales (small-medium-large) working on this business in Indonesia. So there is no doubt that this is indeed an industry that has great value and opportunity.

However, this industry is still faced with a number of inefficiencies that impact productivity in this sector. Among the existing issues, supply chain leaders which is less than optimal is one of the fundamental issues that has more urgency to be resolved. Most of the existing business processes are still manual, relying on the workings of traditional companies that have been in business for decades.

According to data McKinsey20% of construction projects take longer to complete and 80% of projects experience cost overruns. From there, ideas emerged about efforts that could make the existing work system in construction more efficient, so that it had implications for better construction projects - one of which was through digital transformation.

Efforts to digitize the construction sector

Seeing the huge opportunities for digitalization in the construction sector, Djonny Suwanto and two other co-founders Asanga Abhayawardhana and Tarun Kakkar initiated GoCement. The mission becomes one stop platform for cheaper construction materials and tools, while increasing the efficiency of the supply process. Currently the GoCement platform is B2B trade, bridging the needs of suppliers and contractors.

In its debut, a number of investors gave funding support, starting from BEENEXT, MDI Ventures (through funds managed by Arise), and Ideosource. And now the company is continuing with the next stage of funding (pre-series A) through the support of Foundation, DS/X Ventures, and a number of other investors.

"Construction is one of the industries that was the last to be disrupted. And I think we are here at the right time in 2021. If it had been 2-3 years earlier, perhaps [ed: investors and the market] would not have been able to see this (business model) workable or acceptable in our country," said Djonny.

In the local startup landscape, since 2022, solutions similar to GoCement have also emerged. Some of the other players in attendance included BRIK (supported by initial funding by AC Ventures and a number of investors), JuraganMaterial, Proglix (supported by Y Combinator and a number of angel investors), to BukaBangunan (a business unit of Bukalapak). Each of them is working on a strategy to achieve this product-market fit with its unique value proposition.

Not only that, a number of local investors also said they were starting to work on it thesis investment for construction-tech. One of them Mandiri Capital Indonesia which has prepared a special managed fund to enter this new sector.

Construction-tech This is also increasingly validated by the number of startups that have become unicorn, including one Infra.Market from India which managed to soar its valuation to $2,5 million after their series D round in 2021. Even in India, there are also other players who have become unicorn namely Moglix and Ofbusiness.

Comes with model vertical marketplaces

Djonny said that in the initial phase, GoCement provided services vertical marketplaces to serve the market in East Java. This concept is considered relevant to be applied in the construction industry, because in their business processes they also curate and manage stock of goods in-house. At the tactical level, GoCement even helped establish infrastructure (warehousing, fulfillment and logistics) to ensure availability and affordable distribution.

"Now everyone is running away horizontal marketplace [ed: such as Shopee, Tokopedia etc] become vertical marketplaces. The difference is, this model provides customers with a system curated-managed marketplace. "This selection and curation process is important for those of us who play in B2B, to ensure a better user experience," explained Djonny.

Further explanation regarding the concept vertical marketplaces This. Djonny said that at the beginning of the emergence of marketplace services such as Tokopedia, most of the merchants in it were drop shipper — they sell without having to physically have stock of the goods. If applied to B2B marketplaces, something like that is considered to be profitable user experiences the bad one. Business consumers, in this case property developers, carry out projects with planning (including costs, timeline) which is ripe.

This management and curation process ensures that in addition to accuracy, business consumers get it value others by ordering digitally. Value This can be anything, including a more affordable price.

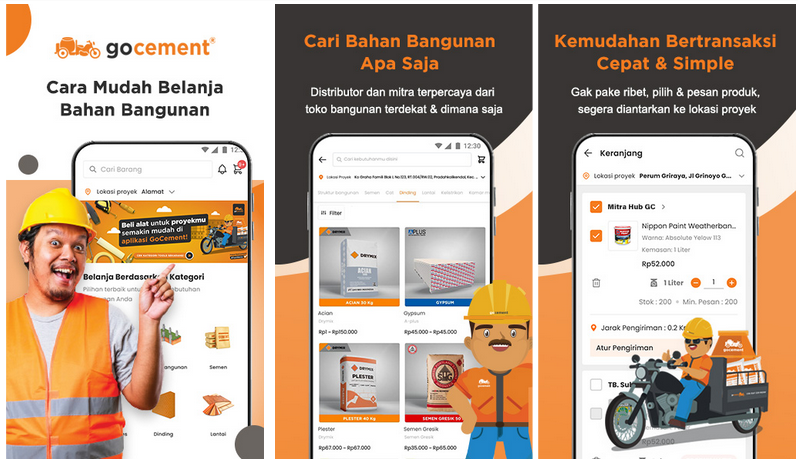

Through its website and application, GoCement makes it easier for project managers to shop for various construction needs and rent various supporting equipment. GoCement also ensures that the quality of the products sold meets SNI, ISO standards and passes product tests; plus guarantees transparency and price stability.

The delivery management model is also considered to solve problems often faced by construction workers. Often to get competitive prices they have to buy certain materials in large quantities, unfortunately sometimes there is no place to put the goods. GoCement can make it easier with a scheduled delivery process, according to the needs of the project. In operational areas there is also a delivery guarantee on the same day when the order is completed.

Introduce constructiontech

At the start, Djonny admitted that he had difficulty finding the right terminology to explain his business, especially to investors. "April 2021, I'm confused about what to say, here we are E-commerce huh, marketplace huh [...] finally said as supply chain leaders and logistic solutions (for construction), because of that time last-mile logistics still hot in industry. Until we finally met seed our investor, BEENEXT, who provided that understanding construction tech (contech) This already exists in other regions and many have already done so unicorn."

Like a tit for tat, from that point on, interest in this business model in Indonesia became high. And what is most interesting, a number of strategic VCs have joined the ranks of GoCement investors, one of them Fundamental. For Djonny, Foundation is a strategic partner, because this venture capitalist has thesis and special experience in construction tech.

Fundamental also invests in startups contech others, including Tül and Infra.Market. Tül's position in the Colombian market is also interesting, the startup has managed to raise $181 million in follow-on funding at a valuation of $800 million since 20 months of their existence -- making the startup the fastest growing technology company in Latin America.

Tül and Infra.Market have different approaches. On the consumer segment side, Infra.Market focuses on developing large-scale construction projects, while Tül focuses on fulfilling small-medium scale building stores.

This is not without reason, even though the construction industry market value in Latin America is worth more than $120 billion, the distribution structure is still based on building shops (at least 50% of the total distribution currently available). However, most of these shops do not have an efficient supply chain, because some of them are run at the MSME level.

Meanwhile in India, the construction market is currently driven by large-scale infrastructure projects and housing. Contractors are expected to face the challenge of providing building materials more efficiently and cheaply.

GoCement comes with a more holistic approach, combining the business models of Tül and Infra.Market. This is because in terms of service GoCemenet places its platform more as one stop shop, selling thousands of product SKUs in one place. This divergence is also wrapped up to serve business clients, retailers and end consumers. On the other hand, GoCement also provides fulfillment infrastructure and supporting operating systems.

GoCement business model

GoCement saw a number paint points The main thing that often disrupts the smooth running of construction projects. Starting from the availability of material stock, uncontrolled service/delivery, and an unfavorable financing system (including for material shop owners). Through its platform, the company is trying to solve this problem while trying to apply a number of business models.

"Almost all marketplace akan have income generation, one of which is from a private label. Then with the infrastructure we have, we will also enter 3PL & 4PL (logistics). And of course fintech. Fintech this will unlocking all the bottlenecks, including in construction, here it will make it easier for contractors to carry out financing. "Apart from that, we have local wisdom and experience from working in this industry," said Djonny.

Product manufacturing private-label this is an interesting one. Considering that GoCement has a strong business legacy and network from its founder, they claim to have a mature distribution chain to be able to present a number of their own material products. Apart from producing a more profitable net margin on the business side, there is "cloud manufacturing" spread across distribution areas can make stock fulfillment more efficient.

On the transaction side, apart from getting gross margin from purchasing materials through its B2B commerce, GoCement also provides rental services for various construction tools such as molens, stampers, vibros, and cast lofts. Meanwhile, for financing, the company is also continuing to expand cooperation with a number of partners, including fintech and banks.

"What is clear is that the market is very large and we are currently still in Sidoarjo and Surabaya, East Java. Of course we will soon expand to other areas such as Central Java, but what must be certain is that we want to tidy up the supplyfirst, then search (or form) demand in the new market," added Djonny.

Sebagai tech-enabler, GoCement has three pillars that will always be ensured to be the main value proposition provided to its users, namely convenience, reliability, and fair pricing.

"Fair pricing We always emphasize this. We never claim to have the cheapest prices, because we play with bulky item products, most of which are low value. So fair pricing This is more important, because everything has many dependencies, for example due to factors demand-supply and geographic location," he explained.

Construction business disruption

As an industry that contributes 11% of total national GDP (4th place), construction clearly plays a significant role in the economy. If you delve deeper, the construction business also has quite a lot of derivatives based on the type/scale of projects carried out. Meanwhile, GoCement is currently choosing to take the small-medium segment, facilitating the need for construction materials/equipment for projects in areas that are small in size, but have large quantities.

"Large construction businesses, such as building skyscrapers or national strategic projects, are usually carried out by large class contractors who already have a mature network and distribution due to decades of experience. We don't play there, GoCement serves small-medium construction. "The big ones will take longer to disrupt, while the small ones have more interesting potential," he said.

Djonny said that one of his company's distribution partners is Jawa Berkat, which has served Gresik cement purchases for around 2 thousand customers. It is acknowledged that it is difficult to digitize a construction company of that scale --- although on the other hand, parties such as Semen Indonesia have actually developed an integrated system that makes it easier for shops to place orders with distributors. For decades, the supply chain flow of the construction business has been from factories, to distributors, to wholesale stores, to small shops, then to final consumers.

"If you look at this flow, GoCement has disrupted its distribution side. However, what needs to be noted is that the distributor's role does not necessarily disappear, but instead changes its function, one of which is as a stock point. The role of the stock point cannot possibly be eliminated, especially considering the geographical conditions in Indonesia "We did this by disrupting ourselves (ed: Djonny previously had a conventional construction business)," said Djonny.

Meanwhile, one of the most basic problems in the construction industry, especially on a small-medium scale, comes down to financing. "Games at this level are complained about on terms of payment, some are 30 days, 45 days, even up to half a year. There have been incidents where house projects have been completed, but the seller has not received payment for the materials purchased. Apart from that, it cannot be denied that there are many contractors who 'gemplang' and pay late."

"GoCement continues to accommodate this 'culture', but by providing additional value in the form of transparency, for example through features tracking and guarantee on-time delivery. From here we begin to provide an understanding of its importance decentralized procurement for this construction," explained Donny.

With a solid business model and consistent business growth, GoCement is confident enough to step up and spread its wings. From the trip, Djonny admitted that this market still requires a large educational effort. There are differences in the adoption process between users in cities tier-1, 2, and 3, which makes GoCement have to readjust its strategy to penetrate each market area.

"On the funding side, we are still opening the pre-series A round with the main focus on finding strategic partners. The company's main focus in the next one or two years is increasing growth and operations, strengthening the team, and product development," concluded Djonny.

-

Disclosure: DS/X Ventures (part of DailySocial Group) is one of GoCement's investors

Sign up for our

newsletter