GMO Payment Gateway Gives Funds to Investree, Local Fintech Lending is Increasingly Interested by Institutional Lenders

Previously, Investree also received debt funding from Accial Capital

Investree again adds to the line institutional lenders in the ecosystem. This time it was GMO Payment Gateway's turn to join, a payment technology company from Japan. No mention of nominal debt funds which is given.

Previously, Accial Capital was also included as Actioncalendar institutions at Investree, announced together with funding C2 series worth 213 billion Rupiah that Investree just got. Investree Co-Founder & CEO Adrian Gunadi said that the cooperation between the two companies had existed since 2017.

Although it did not explain in detail, it was also conveyed that at this time Investree had recorded funds from Actioncalendar local institutions, namely from state-owned and private banks.

The practice of cooperating with institutional partners to provide funding is increasingly being adopted by players p2p loans. The goal is clear, accelerating their loan growth and penetration. Moreover, services such as Investree focus on productive sectors, such as MSME financing.

The concept is that the loan funds will be fully managed by the platform, to be channeled through the loan mechanism they have. With its technology, the platform is also responsible for conducting credit selection and assessment, including taking into account various risks that may occur.

At Investree itself, funds are channeled through several mechanisms, including: invoice financing, buyer financing, working capital term loan, online seller financing, and supply chain financing.

Multiple players p2p loans also announced that it has received investment funds from institutions. Among them People's Capital from BRI and BRI Agro, UangTeman from Bank Sahabat Sampoerna, KoinWorks from Bank CIMB Niaga and Sampoerna.

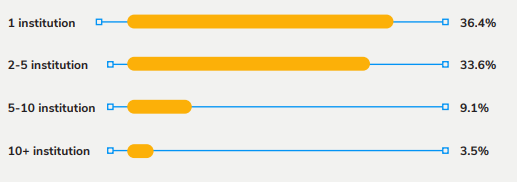

According to the latest report released DSResearch and AFPI, based on a survey conducted on C-levels in companies local, currently most have Actioncalendar various institutions.

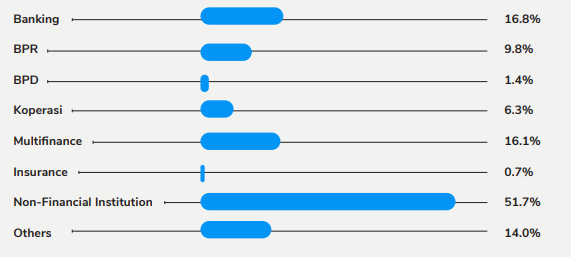

Interestingly, 51% of Actioncalendar Most of the existing institutions are not from financial companies. However, banking finance, and BRP also gets a share in the percentage. Most of the loan funds from institutions have a very significant value, 56,2% of respondents admitted that the value distributed has reached over 50 billion Rupiah.

More Coverage:

"Currently there are several international players who have joined as Actioncalendar Investree institutions and GMOs are one of them. We hope this can further strengthen funding support for SMEs so that they can be more empowered and accelerated during the recovery period of the Covid-19 pandemic," said Adrian.

Head of Asia Strategic Investment & Lending GMO-PG Kohei Nakajima said, "We first met with Investree in 2018 and our cooperation began in 2019. Through the fruitful collaboration over the past one year, we firmly believe that Investree is the right partner for support the empowerment of SMEs in Indonesia."

According to the report submitted, as of October 2020 Investree has facilitated loans of 7,3 trillion Rupiah to 1429 borrowers and recorded around 120 thousand lenders on its platform. In addition to adding a series of strategic collaborations, Investree also strengthens its regional presence by expand to Thailand and Philippines this year.

Sign up for our

newsletter