Glancing at the Great Potential of the "Gaming" Industry in Indonesia

Seeing conditions from various sides, including the efforts made by various parties to encourage a better ecosystem

"Gamal! When did you learn?! Don't keep playing!," said Mary, Gamal's parent, a 12th grade high school student in Bekasi.

Mrs. Mary has repeatedly expressed her frustration to her child. Gamal too often neglects to do his homework from school and just enjoys playing games on his smartphone all night. That bad habit is not once or twice, but Gamal does almost every day, which includes kids nowadays.

Mary meant that Gamal could relax for a while, but don't overdo it. However, in reality, more often than not, they play with gadgets, rather than study. As a result, Gamal's school grades fell into free fall, even though he is now at the final level.

Mary didn't know what game Gamal was so addicted to. Initially Gamal was not a child who liked to play games. But, because of the influence of friends at school, or maybe from his friends in cyberspace, finally making him a dark eye gamer.

MOBA trend

Gamal, like most children of today's generation, seems to be addicted to playing the game Mobile Legends: Bang Bang. This mobile game is very popular and continues to occupy the top positions in the Top Charts in the Play Store and App Store. On the Play Store alone, it has been downloaded by more than 50 million times worldwide.

Mobile Legends is multiplayer online battle games (MOBA), five against five in a simple way of playing. There is a tutorial provided for gamers who are trying it for the first time. Players can compete with known players or unknown people from all over the world. They can work together to win matches, even features are provided in-game chat to stay in touch during the game.

Graphic design and visuals are laid out quite nicely. Both characters, maps, items, skill effects, and others are quite pleasing to the eye, almost perfect to be categorized as a mobile game.

Actors who 'play' in the game are deliberately made from various countries. There's Bruno from Brazil, Yin Shun Shin from Korea, Kagura from Japan, Chou from China, there's even a character from Indonesia, Gatot Kaca. All of these characters have various skill different ones to play with.

The prestige of this game is quite high in Indonesia. The proof is that the Mobile Legends South East Asia Cup (MSC) 2017 competition was held in Indonesia in the middle of this year. According to Mobile Legends, Indonesia was chosen because it has 3,5 million daily active players. This is the highest number compared to other countries such as Malaysia, the Philippines, Singapore, and Thailand. The game company behind Mobile Legends is Shanghai Moonton Technology from China.

Mobile Legends (game) competitor in Indonesia is Arena of Valor who entered Indonesia through the company publisher Singapore, Garena, in July 2017. The company is a subsidiary of Tencent Games.

Tencent is one of the biggest technology companies, competing with Alibaba and Baidu. Through its subsidiary, Tencent Games is known for its products mobile game they issue, such as Mobile Area, Strike of Kings, and King of Glory.

Although the two are currently arguing in the United States court regarding the issue of intellectual property and copyright infringement allegedly committed by Mobile Legends, it turns out that their prestige in Indonesia is quite strong. They competed to attract teenagers of Gamal's age to the workers to be avid to play the game. Users are willing to pay additional fees to buy item which is sold in the game. For the sake of increasing the chances of winning matches and prestige. The price also varies from Rp. 3 thousand to Rp. 1,5 million.

Business potential in the industry Gaming Indonesia

Sales item become one of Mobile Legends' income pockets. Citing statistical data revealed by Prioridata.com, until March 2017 Mobile Legends has been downloaded by 31,6 million times worldwide. Its total revenue has reached US$5,3 million since it was first launched in November 2016.

Indonesia's population, which is almost 260 million, is a surplus value for anyone who does business here. According to the research results of the gaming firm Newzoo, in 2016 demographically the number of mobile game players was dominated by men aged 21-35 years with a percentage of 27%. The second position is occupied by people aged 10-20 years by 24%, and the rest are aged 36-50 years.

For women, the largest portion is also held by those aged 21-35 with a percentage of 18%. Age 10-20 years by 14% and 36-50 years by 7%. So it can be concluded, the age group of 21-35 years is the main land for game companies because they are workers who are willing to spend extra money for their favorite games.

Industrially, the potential for the game business in Indonesia is more 'green' than other countries in the Southeast Asia region due to its fast growth. Still referring to the same source, the total revenue of the gaming industry in Indonesia is predicted to reach US$879,7 million in 2017. This figure is higher than Malaysia's US$586,6 million and Singapore's US$317,6 million.

The size of the game industry cake makes Indonesia the 16th country with the largest business potential out of 100 countries researched by Newzoo. The largest countries occupying the number 1 and 2 positions are China and the United States, with potential revenues of US$27,55 billion and US$25 billion, respectively.

This figure is quite amazing, according to the Chairman of the Indonesian Game Association (AGI) Narenda Wicaksono, the portion that is enjoyed locally is less than 10%.

"Hmm.. if you trace the problem, it will be long and not finished [the discussion]," explained Narenda with a sigh and a small laugh, (9/10).

Narenda describes one by one the problems that still haunt local gamers.

First is a distribution channel that is already too dominated by the Google Play Store and the App Store. As for PC-type games, it is controlled by the Steam platform, a digital game distributor that can be purchased directly there. For consoles, they must use their respective principals currently circulating, including PlayStation, Nintendo, and Xbox.

Of all the distribution channels above, the most suitable for the Indonesian market are mobile game. Most Indonesians are new users of using smartphones (mobile-first). However, because it is dominated by two big players (Google and Apple), the stage for small players is getting thinner due to the intense level of competition with other applications.

"Finally to get exposure have to advertise. Again, advertising is not cheap. If you want to put [advertisements] on TV, you already know how much it will cost. There are still many game companies that revenueIt's still under Rp. 200 million."

Secondly,, the problem is the uneven quality of game developers. Some are very good, some are lacking. As a result, the quality of games created on average is still inferior to Vietnam.

Third, the level of willingness of Indonesians to buy premium games and their items is still very minimal. Even though this step is one of the coffers of game companies doing monetization.

Finally, making quality games can apparently be a long-term source of income for the company. Unfortunately, there is no exact formula to make a quality game. Game developers have to keep producing new products and keep learning how they are going.

"To hone skills coding it can study anywhere. But to hone how to make a good game, you need to make products continuously and study the results until you get to the point where the game becomes a jackpot. This will be a problem if there are no investors. Because this will make run away so short, finally switch to advergame."

Support from various parties

All of the above problems, according to Narenda, make the entrepreneurial mentality of game developers less resilient. Especially for young people who have just graduated from college and have an interest in being a game developer. They finally decided to stop halfway, switching to another profession because they were unable to survive the initial process.

The cycle of talent reproduction in this industry has become less varied because at the end it is filled by veteran players and idealists who are able to survive.

"So it's like a chicken and an egg. Because no one wants to fund it, the breath can't be long. There are many stories that we can finally change professions. It's not a bad thing either because no one dares to give funding until their product becomes a hit."

Based on the results of research conducted by Dicoding, the company where Narenda belongs, to make a decent mobile game it takes at least 6 months to a maximum of a year. The decent definition at least meets all the minimum criteria, including gameplay, storyline, characters, and more.

Unlike other industries, in the game the X factor applies which can be the biggest stepping point for a game product.

One example of a game that became a hit because of the X factor is Angry Birds by Rovio. The game emerged, partly because of the momentum of the swine flu epidemic that spread globally in 2009. The epidemic gave birth to the idea to make pigs as characters and enemies for birds, because the virus spreads through pigs.

Angry Birds itself is not the first game made by Rovio, but the 52nd game produced by Rovio since its establishment in 2003. The X factor has brought Rovio's glory to this day. Initially Angry Birds was made exclusively for the iOS platform as a premium game, the cost of making it was around US $ 136 thousand with 8 months of processing time.

"Because of this X factor, the game in the eyes of investors is less attractive. The fluctuations are very high and less sustainable. In fact, this industry has a clear formula: good games, maximum promotion, money must be there."

To foster an entrepreneurial spirit in the gaming industry, AGI diligently conducts training programs in collaboration with campuses to produce young seeds. The purpose of this activity is that AGI wants to give them the experience of pioneering a game from scratch long before they graduate from college.

The enthusiasm is that when they graduate, they already have the ability to make games and set up their own business. Thus, being able to improve the reproductive cycle of gamers is no longer filled by veterans only.

Google Indonesia's Head of Corporate Communications Jason Tedjasukmana said that his party had witnessed the growth of the local game industry which was of high quality and acceptable to the public. Examples are Round Tofu, Guess the Picture, and Warung Chain.

"They are growing tremendously with strong growth figures in terms of revenue and downloads," Jason said without specifying the figures.

To continue to support the local game ecosystem, Google Indonesia actively continues to carry out local initiatives by creating activities such as the Indonesia Games Contest, Made in Indonesia Collection, Ramadan Collection, Independence Day Collection, and other collections with local content.

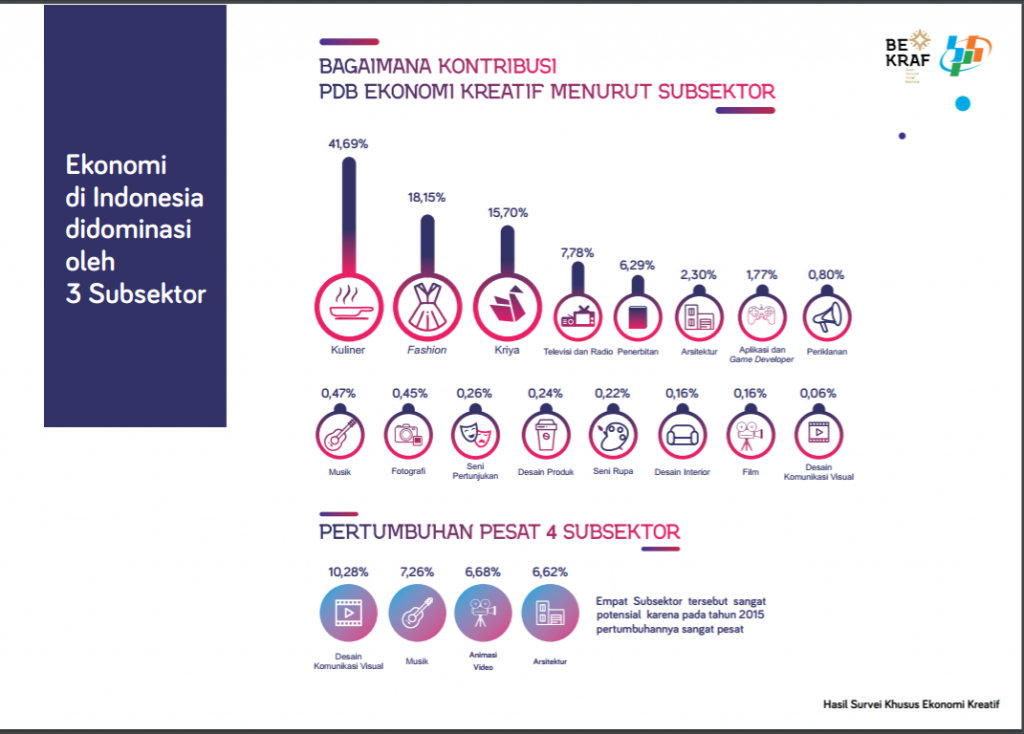

Seeing the considerable potential of this creative industry, application and game developers (AGD) are one of the three priority sub-sectors appointed by the Creative Economy Agency (Bekraf). After that there is the film sector, and music.

"These three priority sub-sectors suffer the most because the ecosystem has not yet been formed," said Head of Creative Economy Agency Triawan Munaf in his remarks at the event held by Samsung, (9/10).

Bekraf raised these three sub-sectors because they have something in common, namely that there is no standard formula that makes every product released always sells well in the market. This is what makes the fluctuations high and the business continuity less visible in the eyes of investors.

In addition, its contribution to the total gross domestic product (GDP) for the creative economy was below 1% last year. In fact, GDP growth in each sector grew by around 7% per year.

As an illustration, the contribution of application and game developers is 1,77%, music is 0,47%, and films are 0,16%.

Another reason, Bekraf raised applications and game developers because this industry is considered to be a motor to lift other sub-sectors of the creative economy. For example, games can be used in the world of entertainment, advertising media, education, and so on.

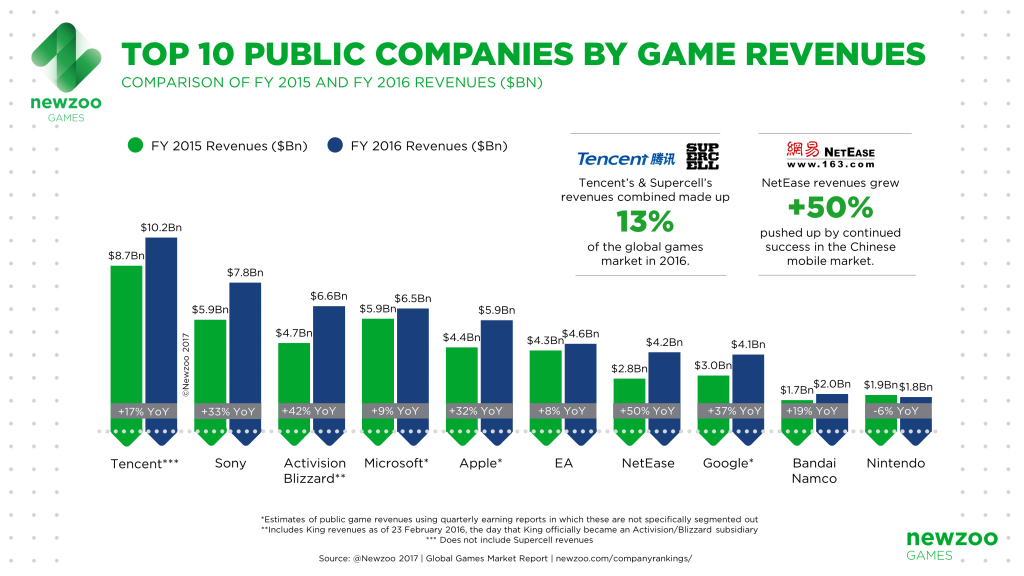

Even in terms of revenue growth, the game industry continues to show quite a drastic increase [see Newzoo chart]. However, the portion enjoyed locally is very minimal.

"For these reasons, Bekraf decided to elevate application and game developers, as well as music, and films to the priority sub-sectors since last year. We actively participate in every activity involving the three sub-sectors," said Bekraf Deputy Infrastructure Hari Sungkari, (17/10).

Several programs initiated by Bekraf to advance the game industry, ranging from printing natural resources, building infrastructure, to funding assistance. To produce quality talent, Bekraf held a Bekraf Developer Day (BDD) in collaboration with global scale companies. The aim is none other than to bring together business actors and companies so that business collaboration occurs.

Within two years, BDD has been present in 14 cities, attended by more than 10 thousand developers and produced more than 1.300 applications. Of the total, about 338 applications are games. Other programs Bekraf also participates through the Samsung Developer Academy Indonesia. There it has educated 5 thousand people and produced 900 local applications.

In order to support the development of the creative economy ecosystem, Bekraf encourages all cities in Indonesia to take part in the Indonesian Creative Regency/City Self Assessment (PMK3I) program. This program is intended to encourage an increase in the contribution of creative economy GDP which is carried out directly by local governments.

Each city is required to choose one of the 16 sub-sectors it relies on. Later Bekraf will conduct its own assessment and verification and provide a number of incentives to support these sub-sector activities. For example, assistance in the procurement of offices and activity centers.

The city that has decided to focus on the AGD sub-sector is Malang. Bekraf's assessment was to choose AGD for Malang because this sub-sector has grown and continues to grow since 2011.

There, the number of AGD actors reaches more than 2.200 actors, 6 communities, 96 entrepreneurs, 4.800 academic graduates, with annual national-scale activities and international-scale business operations. It is estimated that the number of workers currently absorbed is around 2.200 people with a growth of 20% per year.

Economically, the AGD sector has indications forward linkage in business activities in other leading sub-sectors, namely culinary and animation, film & video. Also, backward linkage to the absorption of skilled and educated workers from universities and vocational schools.

"We also challenge them, after focusing on the AGD sub-sector, how much GDP contribution can they provide to Malang, how many workers can be created. Instead, we provide incentives in the form of financial assistance for infrastructure development to support the AGD sector."

Other cities that have set a focus on the creative economy are Semarang, which chooses fashion, Banda Aceh and Pekalongan chooses crafts. Sleman, according to Hari, although not yet decided, will most likely become the second city after Malang to focus on AGD.

With various positive efforts from Bekraf, AGI, and Google to advance local game players, it means that there is still a glimmer of hope for Tahu Bulat and his friends to continue to exist in the country, facing the brunt of Mobile Legends and the like.

Sign up for our

newsletter