VC Gives Fundraising Tips During Tech Winter

Investors are increasingly observant in providing business validation, rather than just narrative

Techwinter What happened recently [and still today] has a direct impact on the startup ecosystem in Indonesia. Global economic turmoil causes investment to flow to venture capital slowed down, as a result the allocation of funding to startups also decreased. This makes founder have to work extra hard when doing it fundraising or raising investment funds.

Based on interviews with a number of venture capitalists who are quite active in Indonesia, most of them said that the selection process (due diligence) when assessing startups become tighter lately. On the other hand, investors are starting to think more conservatively by prioritizing metrics revenue or profitability as milestone what a startup must achieve at a certain stage.

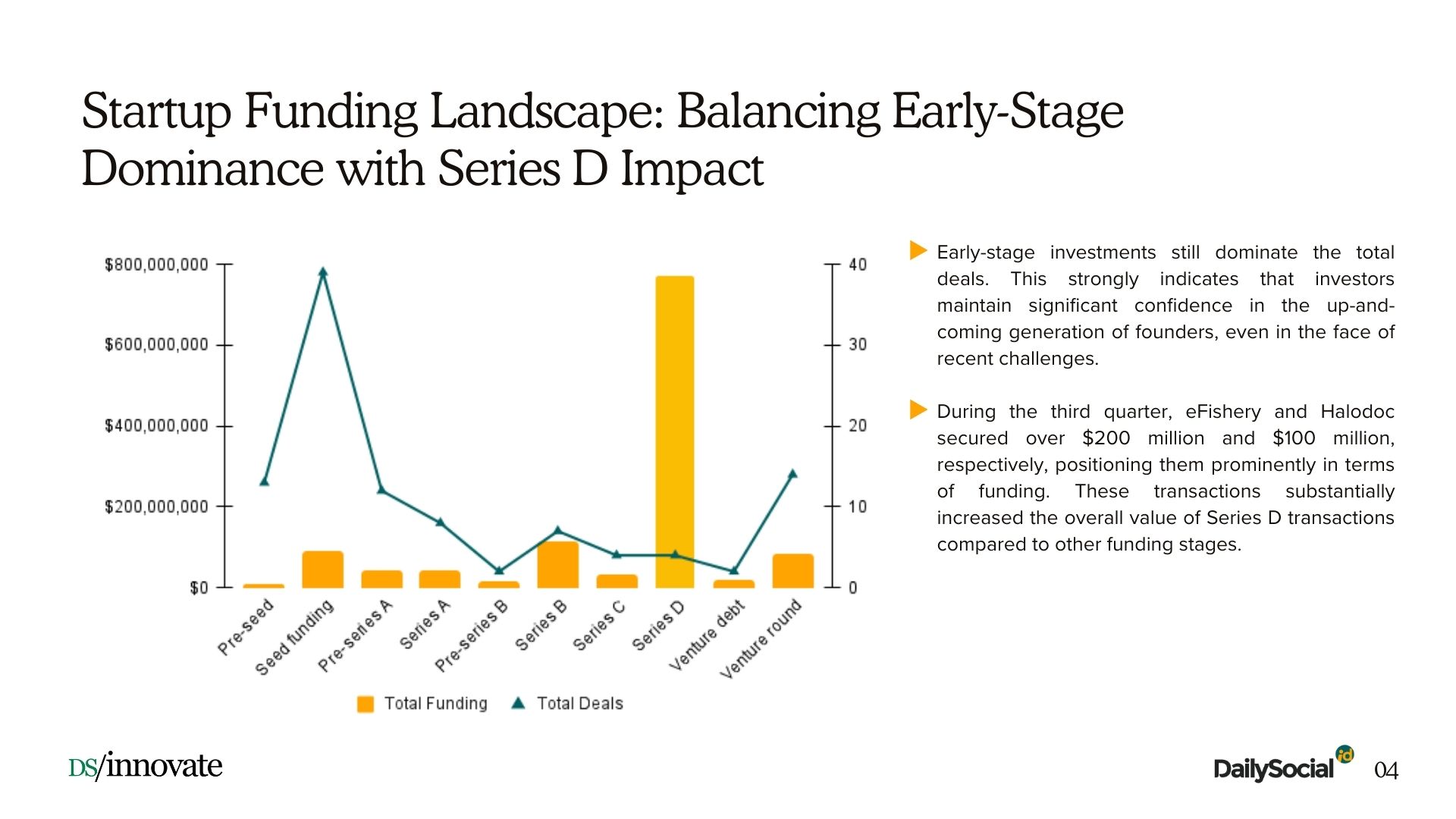

However, this does not mean that funding for startups has stagnated. In fact, this year more than 10 venture capitalists announced new managed funds whose allocation will be mostly to Indonesian startups. This means that the funds are available, all you have to do is find a strategy so that the startup gets a decent assessment from VC analysts. This is illustrated in a recently published report DSInnovate, the number of initial funding transactions was still high [dominating] until Q3 this year, even in the third quarter there was a significant upward trend in terms of value.

This article tries to compile a number of tips given by 4 well-known and most active venture capitalists in Indonesia for... founder an early stage startup that is planning to raise funds for its startup.

Focuses on the startup's key capabilities

Before raising funds, the East Ventures team advises: founders to be able to focus on his main abilities (core competencies), in order to achieve financial sustainability (financial sustainability). For founder it is also necessary to be truly wise (careful) in regulating their use and paying more attention to economic units. Moreover, the era of aggressive expansion and testing new products should be put on hold.

“Our message remains the same, we advise para startup not to do fundraising when your company needs money," said Co-Founder & Managing Partner of East Ventures Willson Cuaca.

This is in line with what the AC Ventures team suggested. They think that founder [early stage startups] should do it bootstrapped first and do it fundraising when a startup already has a proven business model [achieves product-market fit]. Founder You also need to be more selective in choosing investors, make sure you partner with investors who have long term conviction in Indonesia.

"We have a preference for investing in an existing business revenue, even though it's still small," added AC Ventures VP of Investment Alvin Cahyadi.

Have a clear plan

There are several approaches to developing an investment raising strategy, one of the most important factors is that the startup must have a clear business plan. The following questions can be asked by: founder to himself, to judge how much clear Achievable plans and projections:

- What do I want to achieve in the next X months and how much money [investment] is needed?

- How much funding can I raise and what can I achieve with it?

- Can I detail the use of these funds, such as by presenting examples or case studies of their use?

The first question aims to provide a big picture of the short/medium term achievements that the startup will achieve. Ideally, you can provide a plan for the next 12-18 months by providing detailed financial projections and fundraising targets.

Meanwhile for the second question, founder You can answer by trying to provide an assessment of the business currently being run by considering projections for the next 12-18 months. Also include the corresponding dilution range founder reasonable, investment potential that can be completed, and realistic targets that can be achieved within that period.

"Investing in businesses with solid unit economics is a wise practice. It is important to understand how the business/startup can generate profits and back it up with data. I think today, as investors, we should pay more attention to business validation than mere narrative, " said Head of Investment MDI Ventures Gani Putra Lie.

Frugal living mindset; reinforce the value of collaboration

CIO Mandiri Capital Indonesia (MCI) Dennis Pratistha also gave his views. According to him, investors now have expectations early stage startup to apply frugal living mindset; namely a way of thinking that emphasizes wise financial management and reducing unnecessary expenses. In addition, investors want to see a startup's ability to maintain healthy growth, carrying out initiatives that have a positive impact on the company Bottom line, manage company finances well, and carry out fundraising at the right time so have runway sufficient.

"What is no less important for investors is access to data transparency so that investors can do things assessment, monitoring, and provide support if necessary to founder," he added.

More Coverage:

He also stated that as a CVC, although MCI's investment thesis is agnostic, they have a strategy to invest in startups that they believe can provide benefits. value through business development. MCI is looking for founder which is collaborative and has products that suit needs and can bring new innovations to the parent company.

Specifically in terms of criteria, apart from the metrics that investors usually assess, MCI emphasizes focusing on the following things:

- Growth revenue healthy by ensuring a positive impact on bottom line.

- Speed cash conversion cycle or account receivable turnover.

- Business power to approach operating cash flow positive ones.

- Expenses startup up to burn rate relative to

- Effectiveness and efficiency of all business operational activities.

"MCI always helps startups to accelerate integration and collaboration with the Mandiri Group ecosystem so that startups can develop, especially in this winter. One of the ways we do this is via the Xponent program which is an event semi-annual matchmaking business to bring together startups with business units Mandiri Group. Apart from that, MCI has a Zenith accelerator program whose aim is to accelerate the integration process into the Mandiri Group ecosystem through mentoring, workshops, and synergy creation," said Dennis.

As CVC, MDI also has the same view regarding collaboration. Gani said, "Regarding collaboration among portfolios, I think this is important in any business. Collaborating and partnering with others to fill gaps that you cannot fill yourself is the key to success. At MDI Ventures, we have a 'synergy' division whose goal is is to create partnerships between our stakeholders, which include the Telkom Group, BUMN, other companies, and also the MDI Ventures portfolio."

Sign up for our

newsletter

Premium

Premium