For Risk Mitigation, Four Fintech Startups Now Connected with Dukcapil (UPDATED)

Access to population data is only for KYC process, cannot view population data freely

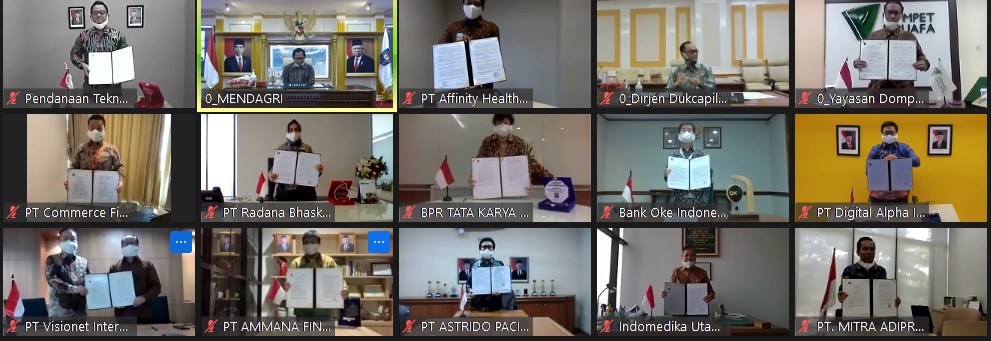

Today (11/6), the Directorate General of Population and Civil Registration (Dukcapil) of the Ministry of Home Affairs (Kemendagri) granted access to the use of population data for 13 institutions originating from financial services (consisting of banks, financial institutions, and fintech), health services, and national amil zakat services.

The 13 institutions include Pendanaan.com, UangTeman, Ammana, Ovo, Astrido Pacific Finance, Commerce Finance, MAS Finance, Bank Oke Indonesia, BPR Tata Karya, and Indo Medika Utama. In total, now the Dukcapil system has been connected by 2108 users, both from government and non-government institutions.

Companies that are connected to the Dukcapil system have the opportunity to speed up the process for the community to obtain various public services, as well as streamline the process of verifying the correctness of population data that will receive these services. All of these users take advantage of population data, NIK, and Electronic ID cards.

For startups fintechFast customer verification is needed because it has a high risk of fictitious loans, especially since this is part of the KYC (Know Your Customer) process. By utilizing population data, NIK, and Electronic ID cards, of course, it will be very helpful when the consumer identification process is carried out remotely.

"It is hoped that access to Dukcapil data can prevent fictitious borrowers so that they can advance the industry, namely strengthening its role in distributing loans to people who have not been accessed by financial service institutions," said CEO of Pendanaan.com Dino Martin in an official statement.

He further explained that access to data from the Director General of Dukcapil will provide 'appropriate' or 'incompatible' information on the registration of prospective UangTeman customers after completing a series of data checks through the technology used by the company previously, together with institutions certified at the OJK.

Separately, quoting from Kompas.com, CEO Ammana Lutfi Adhiansyah stated that access to population data was only for the KYC process. All service providers will not see all Indonesian population data.

“We match the data we already have to Dukcapil. When a match occurs, there is a message from the Dukcapil system that the user data is verified. After that, we will process it," he said.

According to him, before connecting with Dukcapil, service providers often used third party e-KYC assistance to match user data. Which one, service level with a third party is certainly different. "With Dukcapil cooperation, the user verification process can be faster," he concluded.

More Coverage:

Meanwhile, other startups that have previously been connected to Dukcapil, including LinkAja, PrivyID, nodeflux, My Taxes, Clear Veri, and My Cash.

*Note: changes in the number of fintech players listed in the article title

Sign up for our

newsletter