Discussing the Rules of Fintech Lending

Explore fintech lending billing schemes, interest rules, news about foreign entities, and financial literacy that must be paid attention to

In recent times, industry in Indonesia is back in the spotlight. Because of the failure to pay case that went viral on social media, names were dragged out one of the platforms registered with the OJK namely AdaKami (PT Indonesian Digital Financing). Both AdaKami, OJK, and AFPI are associations that oversee businesses in Indonesia have provided information, the essence of which is that each of them is currently investigating this case.

Amidst its popularity, the industry indeed faced with a number of chronic issues. Starting from the existence of illegal platforms [which are constantly being eradicated, but also keep coming], violations of business process SOPs stated in the regulations [billing by intimidation, etc.], to the most sad thing, namely the low financial literacy of consumers.

According to the OJK's latest release, as of March 9 2023 there were 102 players licensed. In accumulation, as of July 2023, players have disbursed IDR 657.854,73 billion in loans through more than 435 million funding transactions, both consumptive and productive. Currently there are more than 117 million registered loan accounts.

The background to its emergence due to funding gap in the midst of society. According to IMF data, in total there is a need for credit worth IDR 1.600 trillion every year. Meanwhile, conventional financial institutions (banks/multi-finance companies) can only serve around IDR 600 trillion.

A busy issue on social media

Of those widely discussed on social media, there are three main cases that are highlighted: the alleged suicide of the victim due to failure to pay, the terror of collection, and high interest/loan costs. Despite AdaWe his party avoided doing this, however netizen who shared this information also included evidence in the form of screenshots of the application and several recordings of the uncivil billing process.

Regarding suicide cases, this is actually not the first time this has happened. Several cases of suicide were motivated by failure to pay loans online It started being reported several years ago. For example, in February 2019, a taxi driver with the initials Z (35 years old) was found dead in his boarding house room. From a letter found by the police, the victim asked the OJK or the authorities to eradicate pinjol which he said was like a 'devil's trap'.

Similar cases also occurred in subsequent years. More than 10 similar suicide cases were reported in the media over the last 3 years.

The motive for committing suicide was because the victims felt pressured and humiliated by the billing process which was carried out in an intimidating manner --- not only to themselves, but to the people around them. Considering that many applications [especially illegal ones] also request access to the perpetrator's cell phone contacts.

Even though the OJK and AFPI already have very detailed regulations regarding this billing scheme, both when carried out online in-house or via a third party. It cannot be denied that due to limited operational areas, there are many players hire third party services for the process collection, to carry out billing via cellphone or mediate directly with its customers.

Defined billing scheme

In OJK Regulation no. 10 of 2022, it states that loan organizers can only collect within 90 days and the rest is forfeited. The mechanism is then detailed in provisions of AFPI (Indonesian Joint Funding Fintech Association).

Regarding billing procedures regulated by AFPI, the points are as follows:

- Companies are required to have and submit collection procedures in the event of payment failure.

- Recommended steps: warning, restructuring scheduling, long-distance correspondence via telephone/email/other, visit/communication with collection team, and loan write-off.

- Internal billing employees from the company required to obtain Collection Agent certification from AFPI/OJK.

- Company fintech must inform the loan recipient in detail about the risks of not making repayment.

- Don't do it collection by intimidation, physical and mental violence or methods that offend SARA or degrade the dignity and self-respect of the loan recipient -- whether in person or via cyberspace for the borrower, their property, relatives, friends and family.

Even if billing is handed over to a third party, AFPI also has special provisions, as follows:

- Third parties must be registered with AFPI and have a certificate to collect loans online.

- All billing employees from billing implementation service companies are required to obtain Collection Agent certification.

- Company fintech Funding uses a third party for bills that have passed the late limit, namely more than 90 days calculated from the loan due date.

- In addition to using third parties to collect loans over 90 days, the company You can also do several things, namely:

- Appointing a legal representative and submitting available legal remedies on behalf of the lender to the loan recipient must of course be in accordance with applicable law.

- To provide loans to borrowers with cooperation schemes (eg cooperation supply chain leaders or distributor financing), billing can be done by business partner

- Company It is prohibited to use third party billing service companies that are on the OJK/AFPI blacklist.

Provisions regarding interest

The highlighted cases also involve very large service fees, approaching 100% of the loan value. In fact, this practice is illegal, in fact the OJK says that the interest rate limit includes other costs for set by AFPI is a maximum of 0,4 percent per day and is intended more for short-term loans. This figure has decreased, the previous regulation indicated a maximum interest of 0,8 percent per day.

Previously flowers it could be said to be relatively high when compared to banking credit products. According to AFPI there are several factors, first because has a fairly high level of risk of bad credit from customers. Second, related to the various conveniences offered through digitization of the process until funds are disbursed. And third, loan tenor online it's relatively short.

News is run by outside entities

Another issue that was also discussed virally was the involvement of outside entities in the loan business online outside, because the agreement states that there is a non-local company that will be the fund provider. According to POJK regulations, to obtain permission from the authorities must be an entity and have local ownership, so it must be a legal entity (PT) in Indonesia. And currently 100% of entities registered with the OJK have a registered PT.

Regarding the involvement of this external entity, DailySocial.id try to trace it, ask directly to the parties involved. Our source, former CEO of the company OJK licensed to tell stories. Most loan distribution it does come from super banker abroad --- for the most consumptive consumers from China or Hong Kong who are legal entities in Singapore.

However, this practice is considered to be common and does not violate the rules. In its debut, one of the company's KPIs is to distribute as many loan funds as possible. To achieve this, large funding is required. If you only rely on retail funders, the value will be very less. For this reason, companies are raising loans (debt/loan channeling) ke super banker institution.

Our source also explained that usually the working scheme is: super banker This will create an entity locally or in Singapore, with the aim of being able to directly monitor the company's business processes fintech who he helped. Regarding the distribution of funds, super banker first transfer to the company fintech, then fintech which is passed on to the final consumer. If in a loan agreement, usually super banker involved as a second party as the owner of the funds.

For your information, in a fund lending agreement, there are three parties involved: the borrower/consumer, the funder, and the platform/distributor.

On the other hand, there are quite a few companies local which becomes an extension (expansion) of companies from outside.

As quoted from Katadata, Digital Economy Researcher Ignatius Untung Surapati said that he was not sure that fintech it's 90% local. He gave the example of platforms such as OVO, Gopay, ShopeePay, and others which dominate the market, most of their funds come from investors from India, China and other countries.

Our source also did not deny this condition. Because there are many local whose business (mainly) is also operated from abroad.

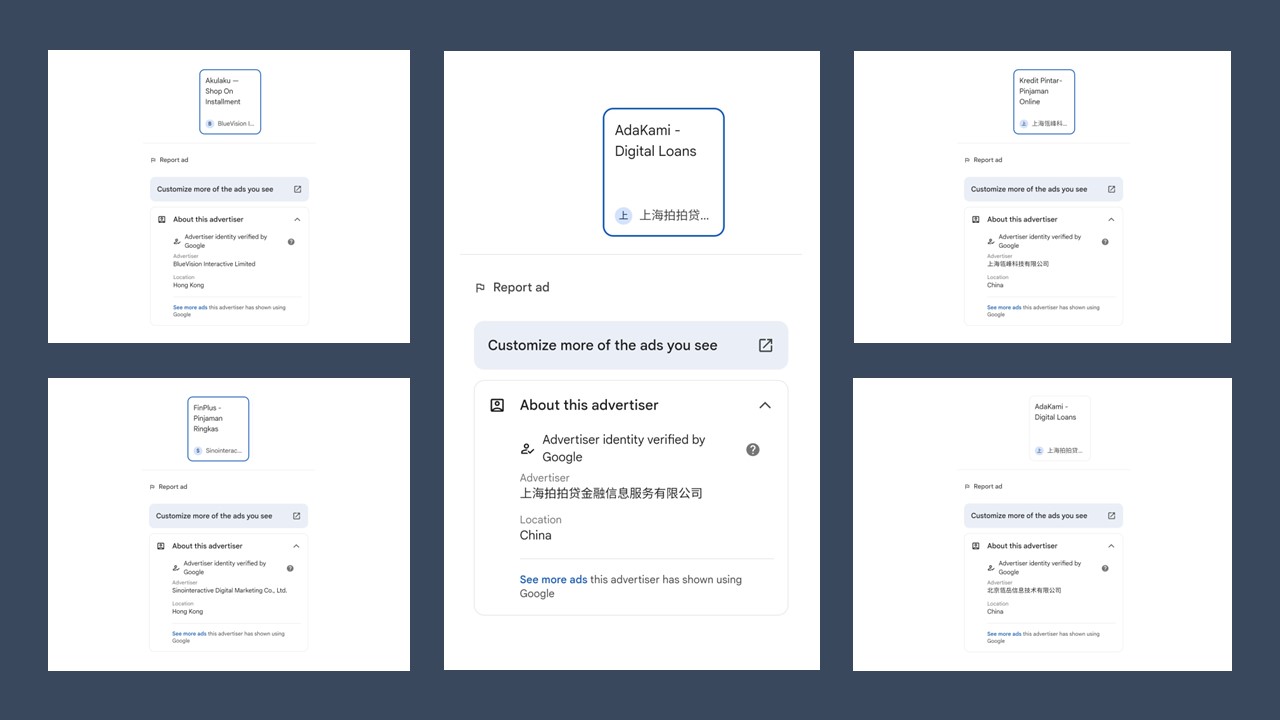

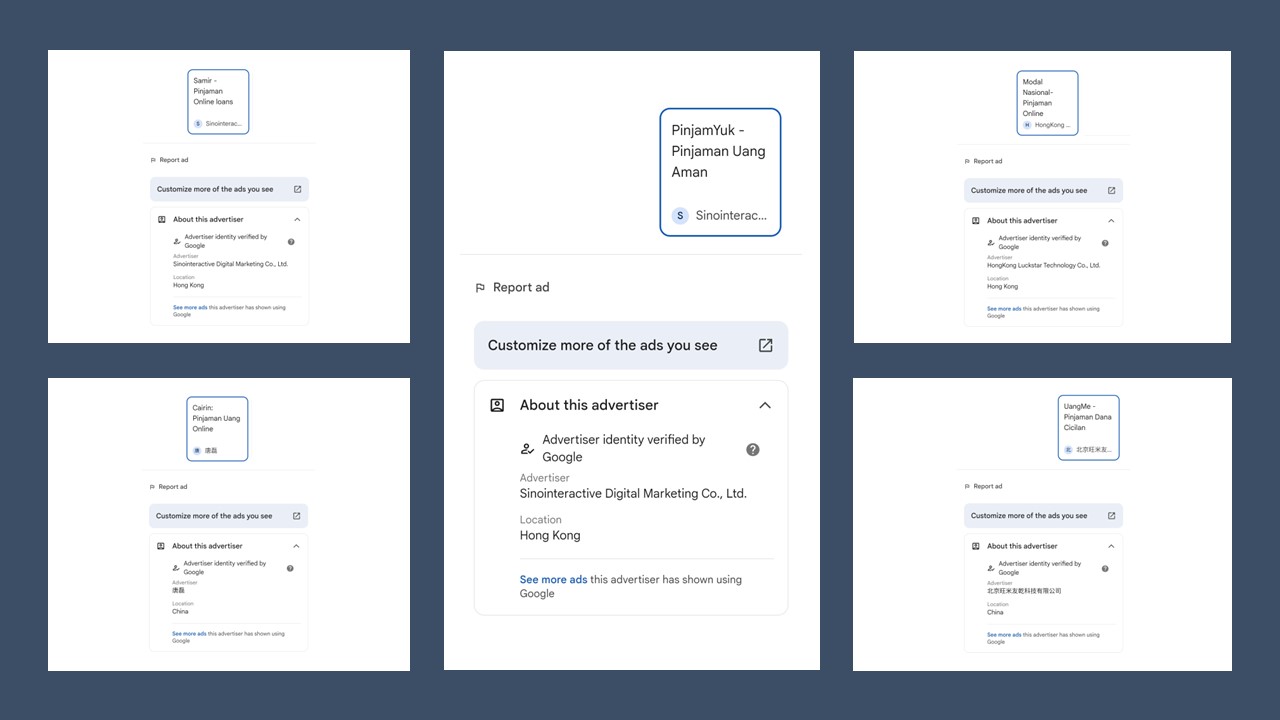

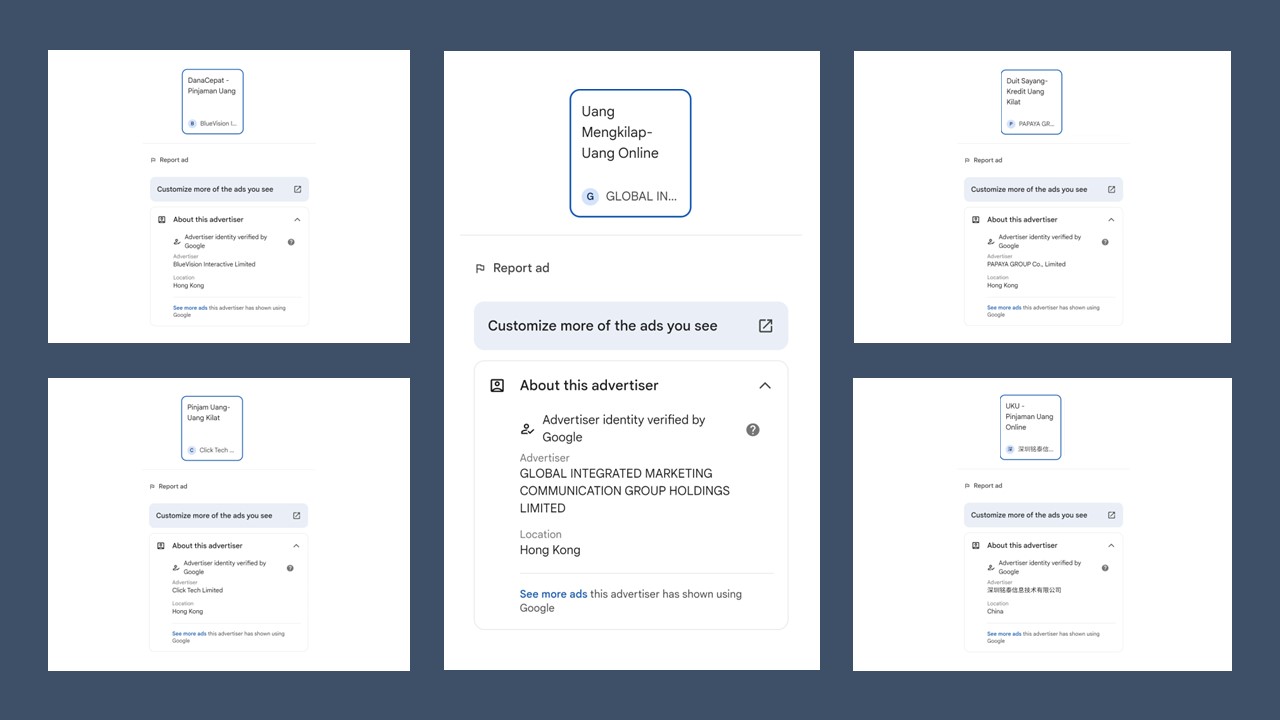

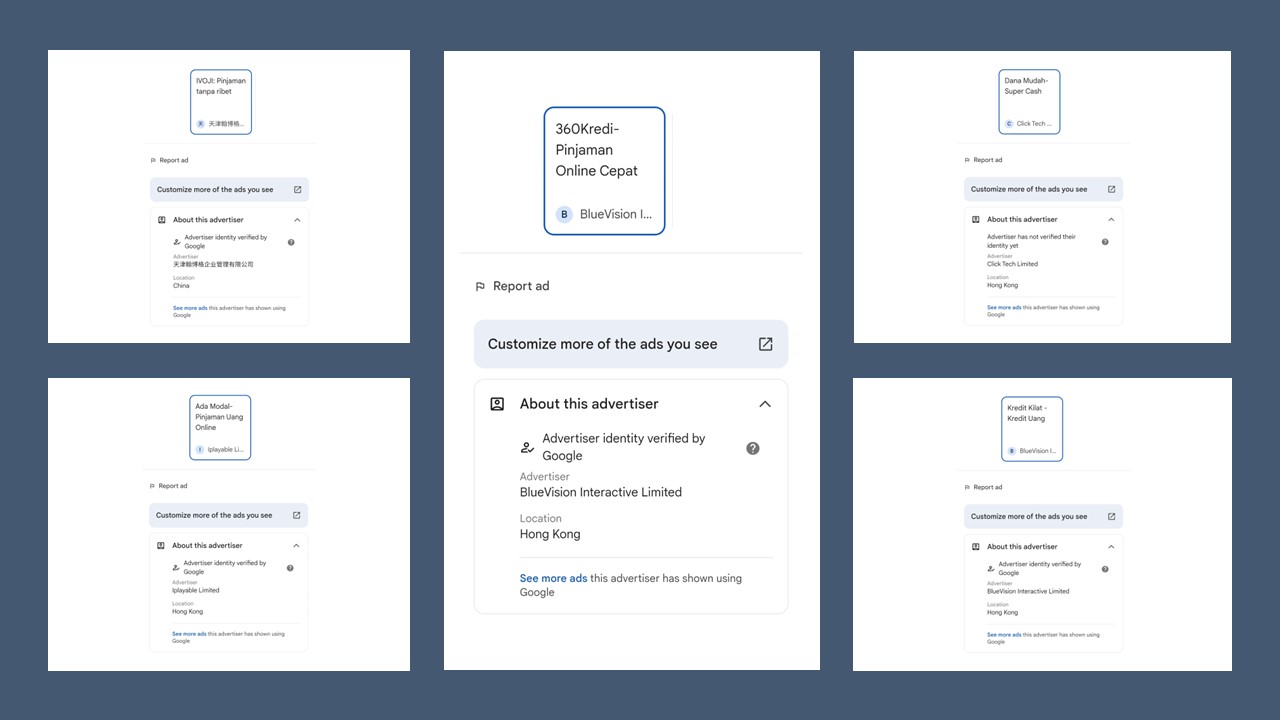

We also tried to carry out searches, one of which was by identifying the operator company behind the application circulating in Indonesia. This is done by identifying companies that advertise certain applications through AdSense. It was found that quite a few external entities --- although many were also operated by PTs from Indonesia --- were trying to market these services.

Community financial literacy

Based on the results of the 2022 National Survey of Financial Literacy and Inclusion (SNLIK), the financial literacy index of Indonesian society is 49,68 percent and financial inclusion is 85,10 percent. This value has increased compared to the 2019 SNLIK results, namely a financial literacy index of 38,03 percent and financial inclusion of 76,19 percent.

This proposition means that access to financial services is currently easier, compared to competence related to the financial product itself.

Financial literacy is a person's knowledge of financial products. Meanwhile, financial inclusion refers to the condition of ownership of a bank account or other financial institution by the productive age population.

As an illustration, from OJK statistics, the majority are loan account holders online are in the age range 19-34 years with an equal distribution between men and women. Meanwhile, 81% of distribution is still in the Java area. On this basis, the new POJK rules are starting to encourage players to provide more portion to borrowers outside Java. This is a noble mission, although homework for user education will also be relatively more challenging.

Regulation finetch lending it should be made very strict and disciplined. Including efforts to eradicate illegal players and sanctions against violations. After all, it has always been the financial sector high-regulated. However, what is no less important is efforts to educate the public regarding financial products and risks in depth. Because in the end, this viral case would not have happened if from the start the people concerned had fully understood the provisions of the loan product they were subscribing to.

In POJK, the obligation for industry players to provide education to the public is also regulated. In the old regulation, article 33 POJK 77/2016 stated that organizers support the implementation of activities in order to increase financial literacy and inclusion.

This form of support is expressed in the form of outreach and education. Organizers who have registered are required to carry out 12 outreach events in 12 different cities and provinces with a proportion of 6 on Java Island and 6 outside Java Island. Meanwhile, the Organizer has regular permits 3 times a year with a proportion of 1 time on Java Island and 2 times outside Java Island.

In essence, all over stakeholder involved in industry must support each other. The government monitors the industrial ecosystem; the giving industry provides good services and education to the community; The public must also be careful in becoming customers and play an active role in helping regulators monitor it.

Sign up for our

newsletter