Encouraging the Implementation of "Open API" Banking in Indonesia

The path to an integrated financial, banking and fintech industry is increasingly promising

With the proliferation of digital channels and applications in the financial sector, the modern generation now rarely visits local bank branches to meet their financial needs. People want to access banking services not where the bank is, but where they are. Banking is now innovating with customer journey and multi-channel increasingly modern.

This emerging new demand, combined with the emergence of increasingly innovative software technologies, is creating a new form of finance embedded through application programming interfaces (API) that enables banking services and consumer data to be integrated into third-party applications.

INDEF economic observer Nailul Huda said that open API is actually not a new thing in the global financial ecosystem but is still new in the financial ecosystem in Indonesia. So, why is open API important in the evolution of the banking sector?

Implementation of banking open API

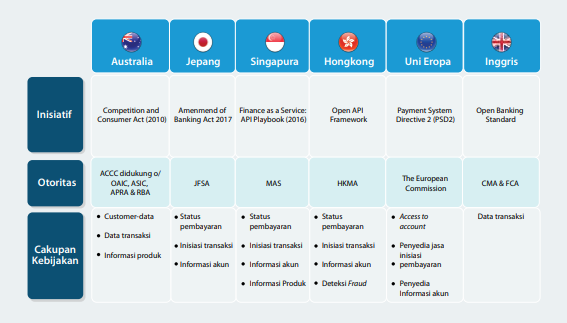

In 2010, UK and European policymakers passed regulations requiring banks to securely disclose data and services to third parties to encourage innovation that will transform and create better financial products for consumers. This results in greater investment in the fintech ecosystem, as many entrepreneurs and investors take the opportunity to revolutionize banking with the support of existing infrastructure.

This initiative is also called open bankg or open banking, issued in the UK under UK Open Banking regulations and in continental Europe under Payment Services Directive 2 (PSD2). Some industry leaders understand the attractive business potential, but not a few choose to keep it status quo.

In Indonesia itself, the development of open banking through API has been implemented by several banks, including BCA, BRI, Bank Gems, BNI, CIMB Niaga, and Mandiri.

2016 was the first moment for banking to open up to the ecosystem in the form of API. At that time, BCA, through Finhacks 2016, an effort to accelerate Indonesia's digital innovation in the field of financial technology (fintech). It aims to introduce API availability to the developer community in Indonesia.

Furthermore, BRIAPI allows business consumers to make transactions and access information about BRI products directly from the application, ranging from the payment feature via virtual accounts and Direct Debit, the BRIZZI balance refill feature, to the feature of checking the location of Branch Offices and BRI E-Channel locations. On the internal side of the company, BRI's open API also facilitates the process of checking balances and business account mutations, as well as making transfers to either BRI accounts or other banks.

One of the SOEs, namely Bank Mandiri, recently introduced services Mandiri Application Programming Interface (API) which targets the digital business market, such as financial technology (fintech) and e-commerce, which are growing in Indonesia. Mandiri API has 13 sandboxing features and 3 by call features for e-money top up, direct debit, and seller financing. This platform can be accessed by digital businesses to find product information, develop and test, as well as integrate Bank Mandiri banking products and services directly through their website or application.

In addition, the open API can also speed up the process interlink between banks and other financial services such as payment fintech, p2p lending fintech, or other types of fintech.

A number of banks are also progressively collaborating with fintech. Since 2018, BRI has started cooperation by channeling funding through the Investree fintech platform and People's Capital. Fintech startups my capital has also collaborated with Bank Sinarmas as the custodian bank that will be authorized to accommodate lenders' funds in order to improve the security and transparency of funds.

Basically, the implementation of open API in Indonesia has the same goal. Welcoming the era of the digital economy and financial inclusion. It is hoped that the availability of these various features will encourage major changes in the national banking ecosystem.

Pandemic triggers digital acceleration and openness

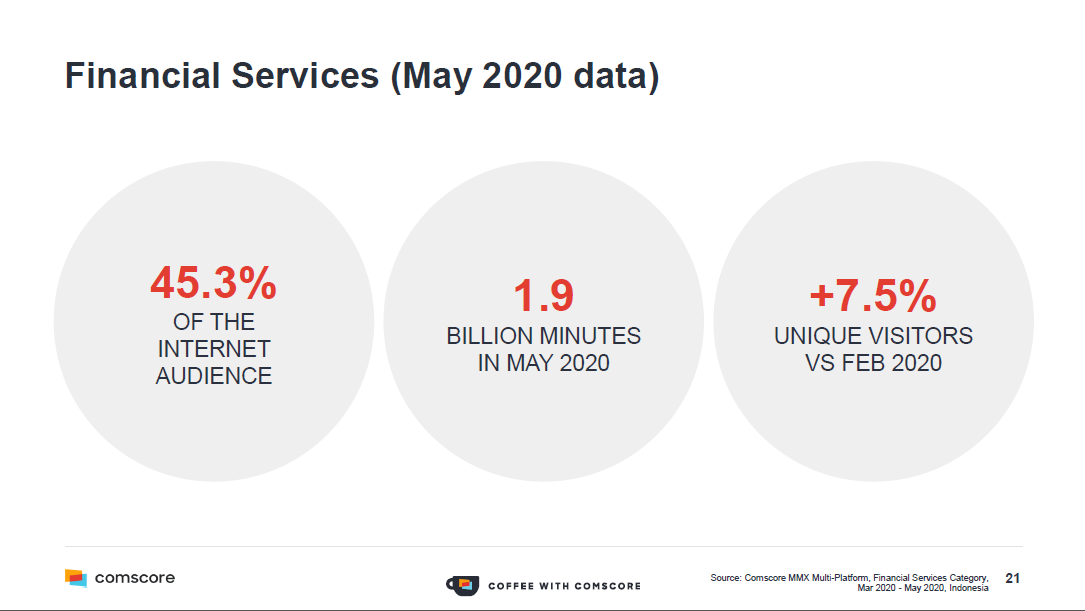

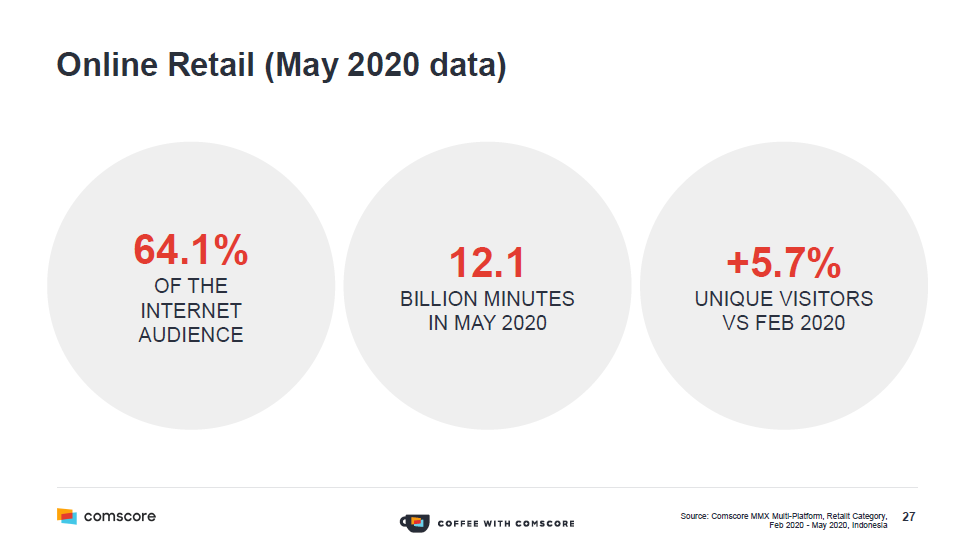

According to a survey conducted by Comscore entitled "COVID-19 and its impact on Digital Media Consumption in Indonesia", there are data about number of internet users which is increasing during the pandemic. People are starting to reduce direct interactions and transactions, and prefer to fulfill all their needs online.

The growing e-commerce sector which is the locomotive of the digital industry in Indonesia has triggered banks to encourage more massive Open API adoption.

With the API, consumers who buy products in the market place will be able to choose payment channel options from virtual account transfers. Market places that work with payment gateways provide payment options, which will exchange data from both parties and connect to banks as providers of electronic money.

With a beautiful future projected through the implementation of the open API, in reality there are still many banks that have not yet cleaned up in the face of the digitalization era and the disruption caused by financial service actors. innovative like fintech. As a result, the open API development process is still hampered.

Challenges faced

In its development, open banking technology in Indonesia has often received pessimistic views from several parties. Because this technology allows actions to take place moral hazard which can threaten aspects of consumer protection. This aspect is a guideline that must be prioritized for the financial services industry in doing business.

It is natural for banks to be very careful about data governance issues, this is often the reason they are not ready to face the digital era of banking and information disclosure. One of the reasons is that the data security system owned by banks [especially small banks and regional banks] is inadequate. There is great concern about the misuse of data.

In this regard, regulators have a key role to play that must be immediately staged - API standardization is likely to be a key condition for success. On the other hand, a lack of common standards will hinder progress and add to the burden.

Anton Himawan, Head of Digital Business Development Bank CIMB Niaga, said, "Among the challenges faced by banks is that there are no standard rules regarding the implementation of Open Banking, thus making Banks obliged to refer to the rules that have been applied previously which may no longer be suitable. "

So we need a regulation that is equivalent to the law that regulates the protection of personal data. Until now, Indonesia does not yet have a Personal Data Protection Law that can be used as a guide.

"If the Personal Data Protection Law is passed, I believe that national banking will be heading for a new era of information disclosure. I think the opportunity to implement open banking will be even greater if the Personal Data Protection Law is passed," added Nailul.

The future of open APIs

At the end of last July, Bank Indonesia (BI) announce will issue a standard Open Application Programming Interface (API) to encourage collaboration between banking and financial technology companies (fintech). Banking and fintech collaboration through the Open API standard is expected to create an inclusive financial services ecosystem.

Open API standards are needed to encourage the adoption of open banking that supports the achievement of efficient, secure, and reliable payment services; increase innovation and competition; encourage financial inclusion, including financing to MSMEs; reduce risk shadow banking; and encourage the creation of an Open API ecosystem with integrity.

The implementation of this open API standard will be carried out in stages considering the diversity in the payment system industry in Indonesia. It is stated that these stages will be carried out both in terms of actors and implementation time, taking into account aspects of the size and complexity of the business.

"We see that in the end Open Banking will become a necessity for the banking industry. In the future, competition related to Open Banking is not only related to features and technology availability, what is more important is how collaborating parties can take full advantage of Open Banking both in terms of services as well as the right business model for the community," said Anton.

Sign up for our

newsletter