Encourage Investment Penetration, Seed Releases Mutual Fund Savings Feature

Can invite up to 10 other users to join a shared portfolio

The Bibit mutual fund investment application releases features Seeds Together to encourage users to invest in mutual funds together with friends and family in one portfolio. This latest innovation is expected to encourage everyone to start saving and achieve financial goals together.

The CEO of Bibit Sigit Kouwagam explained, this latest feature allows each user to achieve financial goals together. For example, for couples who are saving to prepare for marriage, friends who are saving together for vacation plans after the pandemic ends, or parents who are saving together to prepare for their child's education.

"Seeds launched the Bibit Bareng feature so that people can save together, fight, try, be disciplined, monitor results, and finally achieve their investment goals together," said Sigit in an official statement, Friday (10/8).

To enable this feature, users must create a new portfolio. After that, users can invite up to 10 other users to join the shared portfolio.

Explained further, there are three things to note in this feature. First, the investment activities in the shared portfolio are visible to the members involved. Second, the ownership of mutual funds remains the property of the investing party and there is no transfer of ownership. Finally, each member still has full power over the sales and proceeds from the sale of his mutual funds.

Even though it is done jointly, each mutual fund remains the property of each member in this joint portfolio. If the investment objectives have been achieved, the investment value will be divided proportionally according to the contribution of each member.

Sigit said he was optimistic that the presence of Bibit Bareng would make investing in mutual funds easy, practical, and fun, especially for novice investors who are still hesitant to invest.

“This feature is also relevant to the pandemic situation we are facing. Despite having to maintain physical distance and limited mobility, relationships with the closest people can continue to be close because they can save together and encourage each other to achieve common goals.”

Prior to releasing this latest feature, Bibit and Bank Jago worked together to enable consumers to open Jago accounts through the Bibit platform and other facilities. auto debet Jago account for mutual fund top up.

Big market share

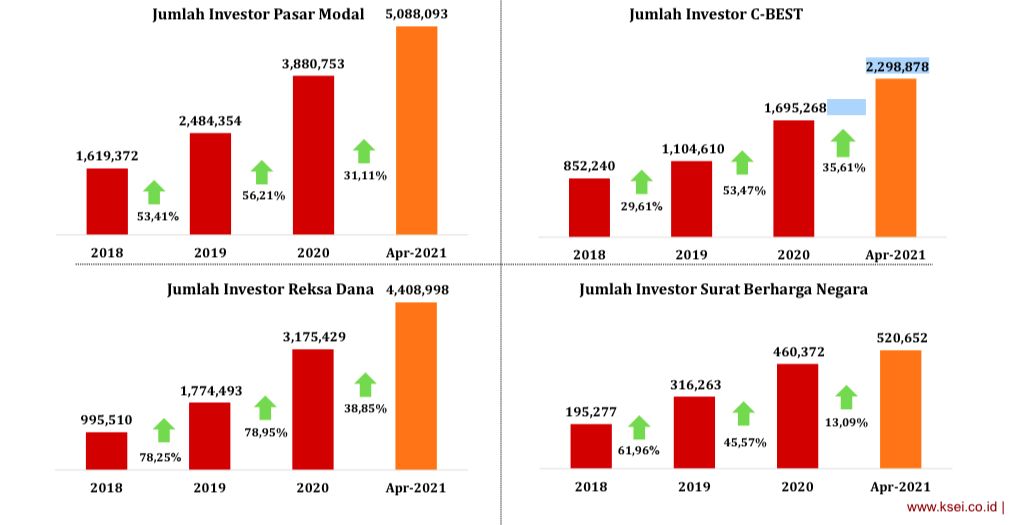

In Indonesia, only 2% of the total productive age population invest in capital market. This figure lags far behind the United States (55%), Singapore (26%), and Malaysia (9%). This great opportunity must be accompanied by solutions that are relevant to market needs.

This Seed Step can be said to be relevant to the daily problems faced by retail users and investors in Indonesia. The Seeds Together feature, with the same spirit, was only recently introduced to banking. As done by Jenius, BCA Digital, and Bank Jago, which present deposit products that are designed to be attractive and easy to encourage customers to save together.

A number of applications now also provide convenience for the public to invest in mutual funds. Seed's closest competitors are Ajaib Mutual Fund, Bareksa, Pluang, Tanamduit, etc.

Sign up for our

newsletter