Advanced Startup Expectations when Looking for Investors

In a small survey conducted by DailySocial, the track record of investors and a global investment network are the main keywords that are expected for advanced startups.

In addition to capital support, there are many needs and criteria that are sought by founder startups to investors. This is especially true for advanced startups (later stages) in Series A, B, and C. These findings were obtained DailySocial from a small survey of a number of founder startup at that stage. We also do Polling brief on this topic on Twitter and LinkedIn.

Why do we stick to Series A, B, and C startups? Startups in that phase on average have obtained traction, pocket customer base, and started to think scale up or business expansion. This means that their needs are increasingly complex as the business grows, and is no longer limited to capital support.

The hypothesis is certainly different when compared to early-stage startups (early stage), where they need capital to develop products/services. The goal is to get customers and find out whether the product / service has been accepted by the market (market fit).

Below are the survey results that we have summarized.

Global investor network

A number of startup founders participated in mini survey We, among others, operate in the fields of e-logistics, edtech, agritech, and musictech. Apart from capital, the expectations they most often seek are a global investor network (85,7%), technology guidance/guidance (42,9%), entrepreneurship guidance/guidance (28,6%), and mentoring for founder (14,3%).

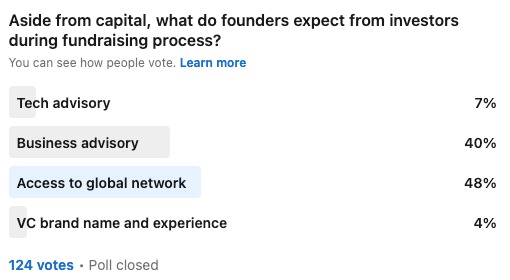

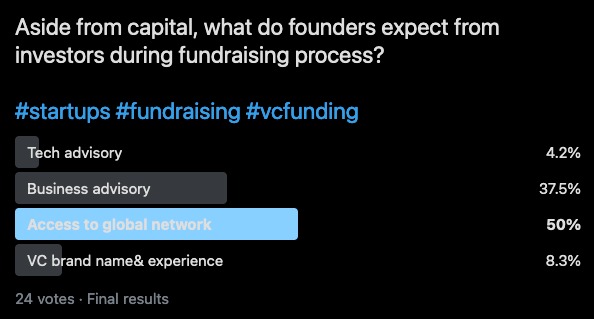

In line with the above, as many as 48% have high expectations for access to global investor networks, followed by guidance/mentoring for business (40%), guidance/mentoring for technology (7%), and VC names and experience (4%)

In this survey, Co-founder Shipper Budi Handoko said that investors already have a lot of experience in managing businesses. The role of investors is very important to provide input regarding trends and business models that can be explored in the future.

In the context of VC as investor, Founder eFisheries Gibran Huzaifah added that they can help connect to the global investor network, especially for funding in the next round with size check the greater one.

Track record is the main criteria

Next, what criteria do respondents most look for in investors? Partner track record is at the top at 85,7%, followed by personality and portfolio level at 57,1%, managed funds at 42,9%, and feedback portfolio and vision-mission similarity 14,3%.

According to Budi, it is important to know the track record and feedback positive aspects of the portfolio before accepting investment. This is because there is the potential for investors to act sweetly during the 'approach' period, then it turns out to be controlling when you invest.

This was also agreed by Gibran who added that it is important to know how investors work and how they determine funding hypotheses. These criteria can be key to seeing whether investors and startups can collaborate together.

"Another important criterion is the track record of investors' managed funds, especially matters fund cycle in what year and in total fund sizehis e. This will influence expectations exit them and how strong they can continue in the next round of funding", said Gabriel.

For the Co-founder of Zenius Sabda PS, another criteria that is no less important is finding investors who have an understanding of how to create a deep and broad impact globally. sustain. This point becomes very relevant when talking about the educational context in Indonesia which has big challenges.

Challenges in finding investors

All respondents stated that it was difficult to find investors who understand startup businesses in certain sectors, the ins and outs of the Indonesian market, and have work ethics. According to respondents, it is not easy to find investors who own it value the same thing and believe that there is something more than numbers.

"We believe that good product sells itself. Agreement regarding when to pocket return on investment (ROI) is difficult if forced. This is our origin I prefer to [seek funding] through bootstrapped just," said one respondent.

Gibran added again that his party had difficulty finding investors because there were still few who understood the business model in the agritech sector that it was running. Because of this condition, he admitted that he had difficulty convincing investors, especially appreciating progress. Benchmark There weren't many in the agritech sector at that time so it was difficult to find comparisons round size and valuation.

VC is more focused on managing business growth

Talk about sources startup funding, Venture Capital (VC) was the investor category most frequently chosen by respondents at 71,4%, followed by Corporate Venture Capital/CVC, private equity, corporations each 28,6%, and the remainder is angel funds by 14,3%.

According to one respondent, corporations are valued more mature, calm, and business-wise stable. However, there are also respondents who think that VC is more suitable for long-term investment, more light, and generic.

On the other hand, Gibran assessed VC is more focused on business growth, nothing takeover and strategic collaboration efforts such as CVC. Apart from that, VCs who have experience and a strong team can deliver insight about strategy, organizational design, and business models.

"From technology support, several VCs provide channeling ke tech talent nor best practice. Some also have internal teams that can support for Development. As a startup, technology becomes defensibility. VCs who can provide this support will bring a lot value ke company," explained Gibran.

Most of our respondents also have a strong tendency to look for foreign investors (42,9%), especially investors who have networks or specific interests in deeper industries. niche, like sustainable innovation. There are also those who are interested in trying through investment through crowdfunding (14,3%).

When you get investors, other expectations are expected by the investors founder including support to help businesses at 85,7%, then joining the next round and being connected to a global investor network at 57,1%, and investors joining the ranks of advisors at 14,3%.

“I don't think there is a 'type' of investor that is more sought after, but rather who the person is and what the strategy is funding best for startups. So there can be a better match between goals and long-term relationships as a whole. For example, SMEs enabler startups "It would be very strategic to join Sembrani and get investment from BRI Ventures," said Kuassa Co-Founder Grahadea Kusuf.

Sign up for our

newsletter

Premium

Premium