Multiple Securities Crypto Assets Boost Triv .'s Business Growth

To date the Triv platform has 1,35 million registered users and trades more than 60 types of crypto assets

CoFTRA noted that crypto asset investors have reach 6,5 million as of May 2021 with a transaction value of IDR370 trillion (January-May 2021). This figure has exceeded the number of capital market investors on the IDX of 5,37 million SID. These two asset class investors have continued to be loved by many people since the pandemic.

The trend of increasing investment in the auto industry is reflected in the performance of the players. One of the oldest crypto asset class players in Indonesia is Triv, which has been operating since 2015.

To DailySocial, Triv CEO Gabriel Rey explained that despite the rapid growth of crypto investors, Indonesia's market share compared to the global market is actually still very small, only 2%-3%. "Therefore, if Indonesia really becomes an Asian tiger and first world countries, I believe Indonesia can improve market shareIt's 15% -20% with our very large population," Rey said as Gabriel's greeting.

Another reason is that crypto is present in Indonesia to be part of investors' asset class portfolios. Because, starting a lot hedge funds and billionaires who have at least 5%-7% of their crypto asset portfolio in their investment allocation. "So if someone doesn't have any exposure to crypto assets in their portfolio it's a mistake."

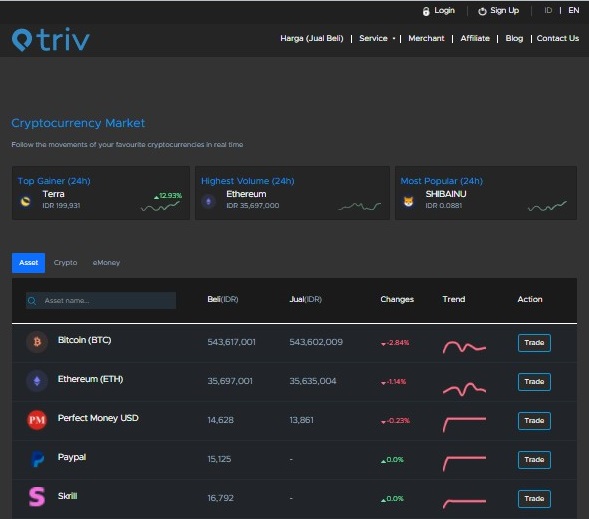

It is claimed, currently Triv has more than 1,35 million registered users in Indonesia as of July 2021, with a growth of more than 300% YOY both in terms of number of users and transaction value. There are more than 60 types of crypto assets traded on the Triv system, out of 229 assets listed with CoFTRA.

“Right now the most popular asset in Triv is the Shiba Inu coin which is predicted to be Dogecoin killer. "

As one of 13 crypto asset trading companies listed with CoFTRA, Triv has demonstrated its commitment to protecting customer funds. Currently all coldstorage Triv is insured by Bitgo & Lloyd Insurance England for $100 million.

Triv .'s pioneering journey

Rey started Triv in 2014, when she was 24 years old. It captures the potential of Bitcoin and its technology platform, blockchain, will be a big thing in Indonesia. Triv's initial journey was quite challenging due to the lack of conditions that in Indonesia at that time it was not possible to make Bitcoin transactions.

“I studied the technology, then studied the concept. I think this is good, but how come when I want to buy Bitcoin no one sells it in Indonesia.”

These difficulties eventually led to the presence of Triv. In 2015, it was still difficult to sell or buy Bitcoin quickly, so Triv was founded to make it easier to exchange Bitcoin only at that time.

"by" non-official, Triv was founded in 2014. Then in February 2015, we made it official. We started a partnership with several payment gateway too, so transactions on Triv are still running 24 hours now.”

Over time, Triv expanded its services and continued to add asset types to more than 60 crypto assets. Compared to similar players, Rey claimed that spread (difference of buying and selling) in the lowest Triv. Because, this Triv is manifold brokerage, where the buying and selling transactions are directly carried out by Triv.

This concept is more profitable from the user side because the process settlement run instantly and real-time to 61 banks in Indonesia. Compared to other players who used the concept marketplace, in which the user has to wait for the other party to reach a transaction agreement.

spread is a sensitive issue in terms of new user acquisition and retention as it is often a consideration when selecting a suitable crypto asset trader. Getting smaller spread when buying and selling assets, trader can get the best price and if the loss is not too big.

For deposits and withdrawals, Triv has collaborated with players e-money such as DANA, ShopeePay, Gopay, and OVO.

The company also has a new crypto pawn feature released earlier this year. This feature allows users to use their crypto assets to get instant loan funds with 9% fixed interest per year and cheaper than p2p lending or banks. “As for staking We are still waiting for confirmation from the regulator, so we can't make the feature yet."

The crypto assets that can be pledged are Bitcoin, Ethereum, and USD Tether. The company guarantees that a 100% mortgage application will be approved without BI Checking and within two minutes it will be immediately disbursed.

More Coverage:

This feature is present because in Indonesia there are approximately 144 thousand BTC per year traded. From there, there are around 14 BTC that is targeted to be used as collateral for a pledge.

Besides Triv, Rey also founded Veiris, tech e-KYC startup blockchain in 2015. Veiris allows verification using text recognition and facial recognition technology. These solutions are needed by industries that come from fintech, E-commerce, travel, and the financial industry.

"When customer do Sign up in a website, no need for manual verification. No need to type a name. It's all in-handle by Veiris automatically.”

Veiris' clients include Pundi, Stellar Kapital, Xfers, 8QQ8 Capital, Kioson, E2Pay.co,id, Infinetworks, and many more.

Sign up for our

newsletter