E-Commerce vs Social Commerce: Ease of Shopping Online

Seeing the readiness of e-commerce platforms to compete with social commerce

My mother is getting better at tinkering with social media from her smartphone. One time he idly consulted about a tablecloth product that he accidentally found on Instagram.

"Which tablecloth motif is good?". I'm more used to shopping through the platform E-commerce replied with a doubtful tone, "Are you sure you want to buy from here? I search where I usually buy it."

After some time, suddenly my mother called me to her room. He said, "Please transfer the money to this account, I'll give you the cash later." Suddenly I asked again, "Are you sure? The shop blessgak?” while I checked the contents of the mother's chat with the seller on WhatsApp.

There is nothing suspicious in it. Since the value of the goods that my mother bought was not too expensive, I finally complied with my request. The package arrived a few days later, the goods ordered were as described.

The daily example above can be an example of how people shop online today. Some tend to ask for details because they are afraid of buying the wrong one. There are also those who prefer to search in one application, then compare from all sides.

Besides the advantages and disadvantages, shopping through social media has its own fans. These habits eventually formed two camps, shopping through social media or e-commerce platforms. Getting here, the barrier between the two is getting grayer, thus giving birth to the concept of social commerce.

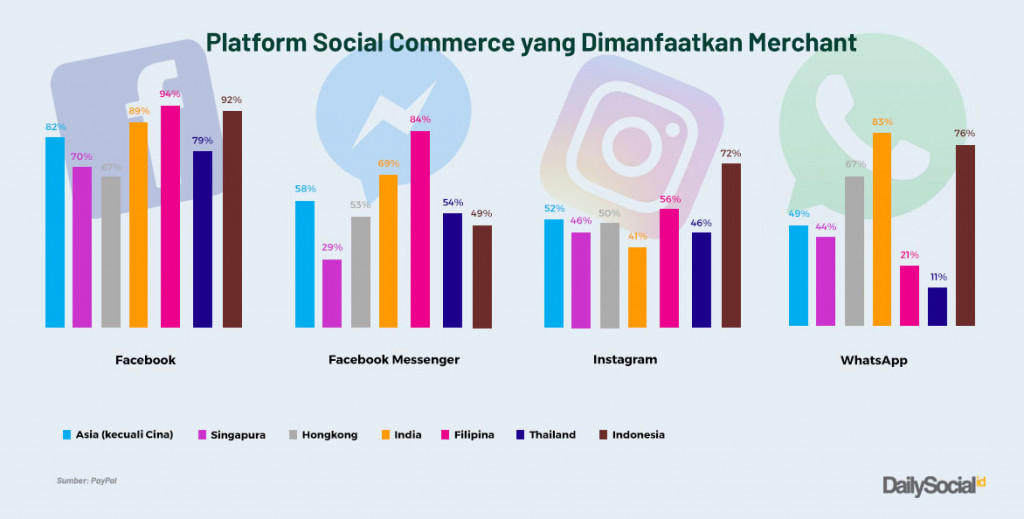

Report “Asia Social Commerce Report 2018” released by PayPal with Blackbox Research shows that Instagram and Facebook are the most used social media for sellers in Indonesia to promote their business.

This platform is growing rapidly because it is able to provide a different experience from offline shopping. Because it allows recommendations from friends or reviews from other consumers that ultimately influence the decision of potential consumers to buy it.

This study involved 4 consumers from China, India, Hong Kong, Singapore, Thailand, the Philippines, and Indonesia, as well as 1.400 SME merchants. As many as 94% of traders in the Philippines use Facebook, as well as in Indonesia (92%), and India (89%). Instagram is the most widely used by merchants from Indonesia (72%), the Philippines (56%), and Hong Kong (50%).

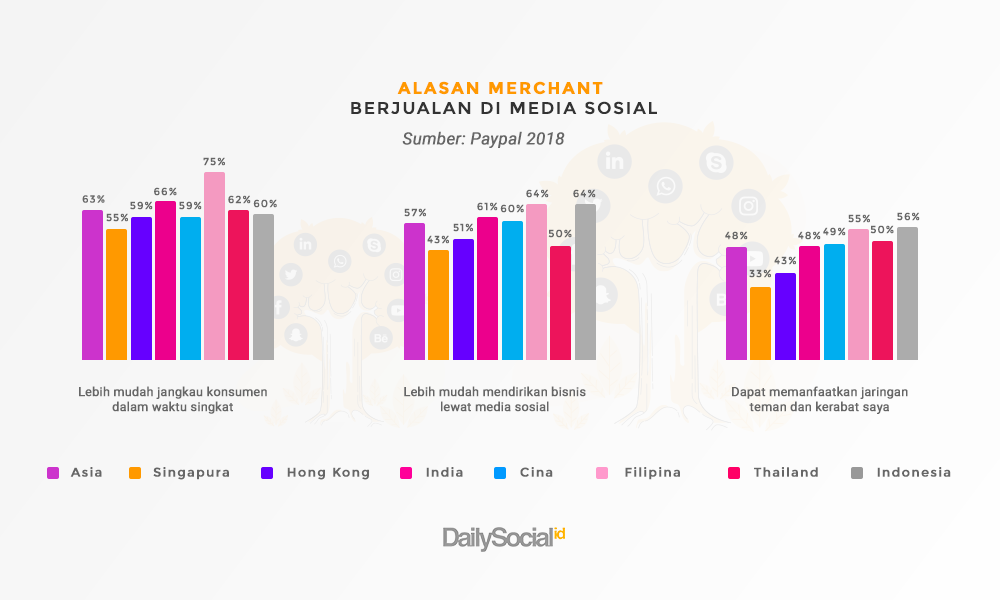

The three main reasons for trading on social media are also explained. As many as 63% of respondents considered this platform easier to reach a wider potential market; 57% of respondents rated it easier to open a business through social media; 48% of respondents said this platform can increase the network of friends and acquaintances that can drive business growth.

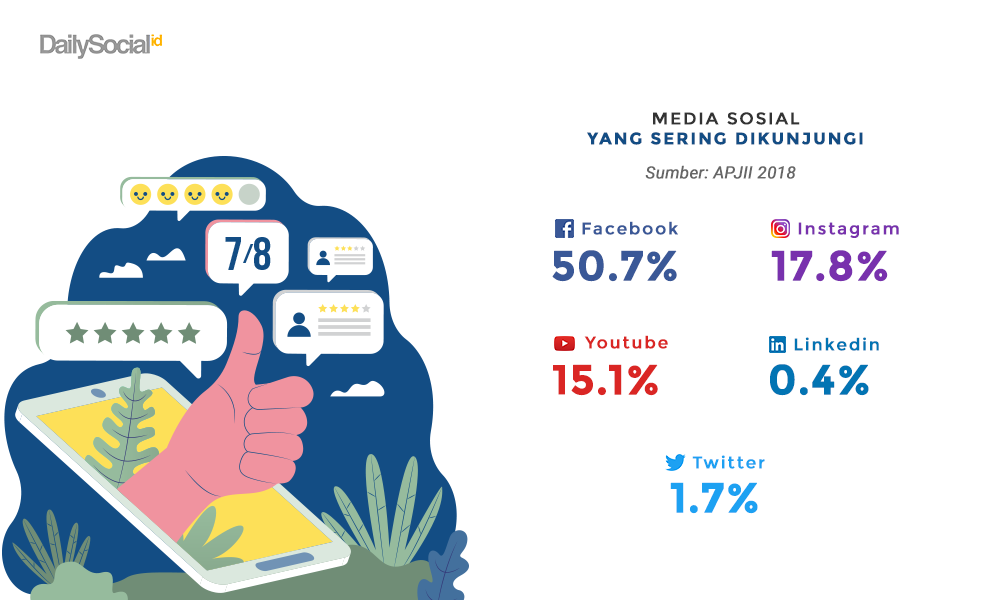

Supporting the above report, in his latest survey, APJII mentioned Facebook (50,7%) as the most visited social media by respondents. Followed by Instagram (17,8%), YouTube (15,1%), Twitter (1,7%), and LinkedIn (0,4%).

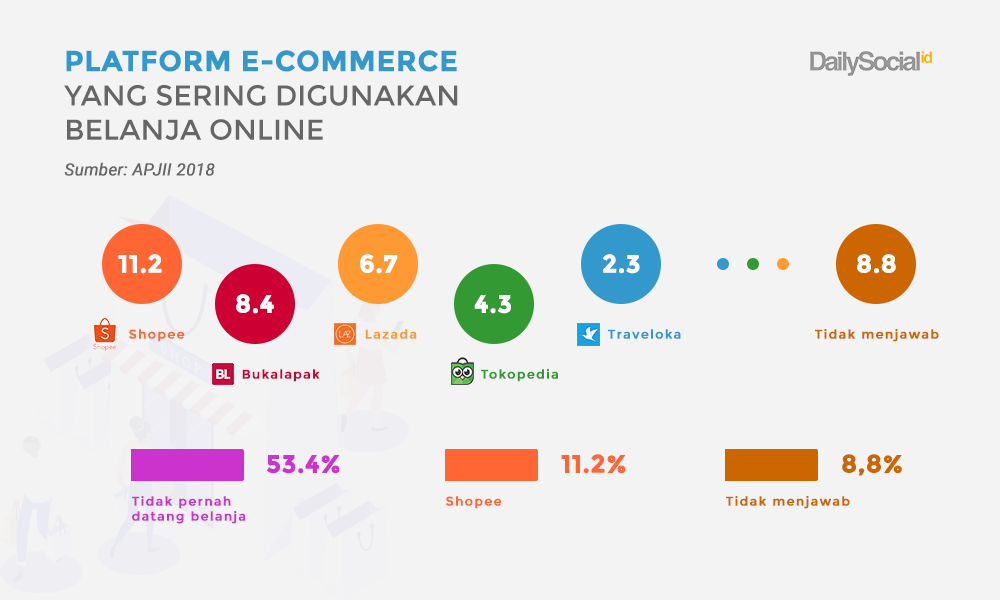

APJII also highlighted the most frequently used services for online shopping. Shopee (11,2%), Bukalapak (8,4%), Lazada (6,7%), Tokopedia (4,3%), and Traveloka (2,3%). According to the respondents, the goods purchased were clothing (14,6%), books (4%), accessories (3%), bags (2,9%), and electronic goods (3%).

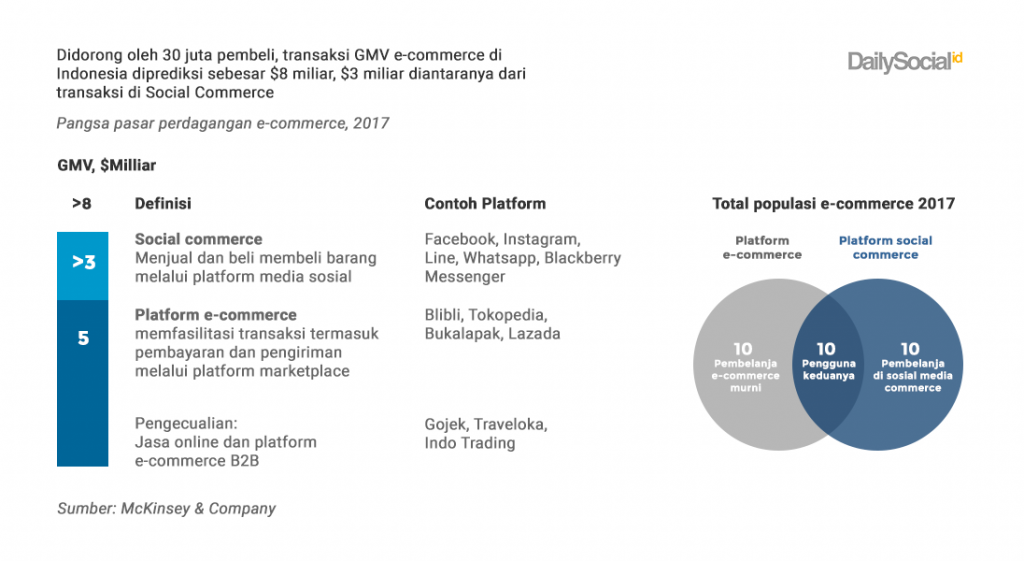

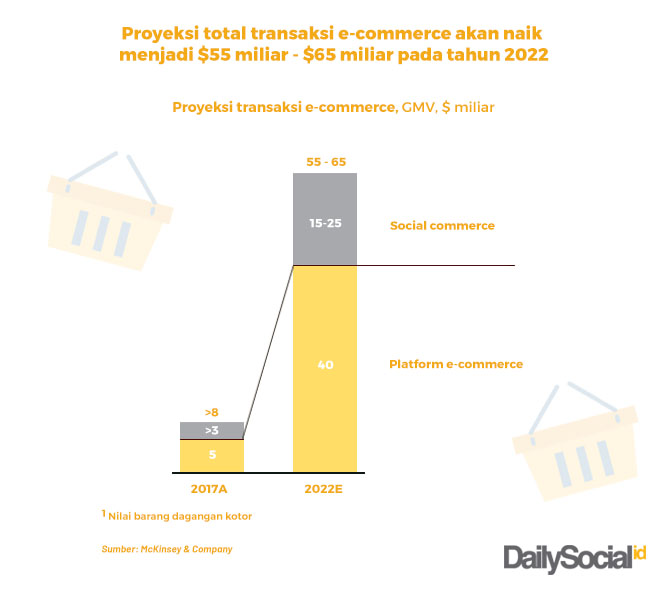

Speaking of potential, you can look at the McKinsey report “The digital archipelago: How online commerce is driving Indonesia's economic development (2018)”. The report predicts that around 30 million people have shopped through online platforms out of a total population of 260 million in 2017.

The prediction of GMV transaction value from online commerce reached $8 billion in the same period. Figures come from platform contributions E-commerce official $5 billion, and informal commerce more than $3 billion (some say up to $5 billion).

McKinsey projects the GMV figure will balloon to $55 billion-$65 billion in 2022. Informal commerce said to have contributed around $15 billion-$25 billion, the remainder being controlled by E-commerce official.

Online penetration trade will increase to 83% from 74% in the same year. In parallel, average individual spending is also growing from $260 per year to $620 in 2022.

Platform upgrade E-commerce due to increased consumer confidence in the ecosystem and the increasing number of MSMEs "go online" more variety of products sold, and reliable shipping options.

McKinsey defines E-commerce authorized as the buying and selling of physical goods through an online platform that facilitates transactions by displaying products and enabling payment and delivery. Players who fall into this category such as Tokopedia, Blibli, Bukalapak, Lazada, Shopee, and niche also include Zalora, Hijup, Zilingo.

While, informal commerce another name for social commerce, facilitate the buying and selling of physical goods through social media platforms and instant messaging, such as Facebook, Instagram, Line, and WhatsApp, but payment and delivery are handled elsewhere.

McKinsey explains social commerce plays an important role in the development of digital transactions in Indonesia. Because, this platform is used as a bridge to "go digital" also a way to avoid the exorbitant costs of traditional media advertising, before migrating to the platform E-commerce official.

Revolution of commerce features on Facebook and Instagram

Based on the report above, it can be said that Facebook and Instagram can be said to be the most loved social media by everyone. Indonesia is one of the main countries for this platform created by Mark Zuckerberg in boosting its advertising revenue.

Look Facebook financial report, total users globally grew 8% yoy during the first half of 2019. Daily active users (DAU) reached 1,59 billion with a growth of almost 1,9% per quarter. Contributors are from India, Indonesia, and the Philippines. Meanwhile, its monthly active users (MAU) reached 2,41 million with a growth of 1,3%.

The majority of Facebook's revenue comes from the advertising business. In the same period, advertising business growth reached 28% to $16,6 billion (more than 236 trillion Rupiah) with 98,4% contribution to overall revenue.

In Indonesia alone, according to We Are Social, there were more than 130 million Facebook users and 62 million Instagram accounts last year. Meanwhile, Twitter and Snapchat did not halve, respectively at 6,43 million and 3,8 million. This figure is seen based on monthly active users (MAU).

This digital advertising business cake is so delicious, it's Facebook's maneuver to strengthen its internal commerce features platformitself, as well as in its subsidiaries. However, when compared between the two, Instagram is trusted by many experts as strongest candidate to explore social commerce.

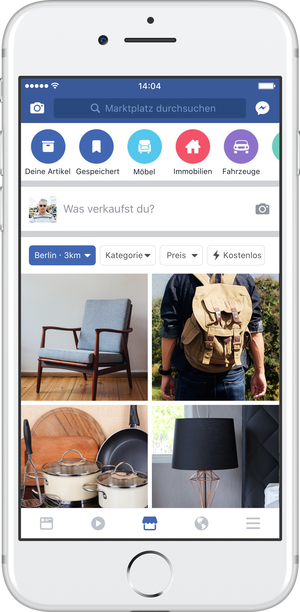

Facebook has Marketplace features officially launched in 2016, users can view products sold by merchants and contact them via Messenger. Which sold assorted, not only fashion but also beauty products, electronics to property.

In addition, there is a Buy and Sell Groups feature. The concept is like OLX, but there is a bit of Kaskus feeling because you have to be part of a community group to be able to transact. Messenger is also provided to contact the seller.

In terms of offerings, it is indeed tempting, with a local approach, sellers are offered the convenience of selling their wares as if they were surfing on Facebook. They can be tracked based on location, price, and potential buyers' interests. You can even place an ad so that it appears on the top page.

Compared to Instagram, since the beginning of the features trade introduced, Instagram looks more serious. Supported from the initial base as a photo-sharing application, visuals are the most highlighted elements. Also, visual content has become a trend for the younger generation to consume content on the internet.

After providing business profiles and advertising services, Instagram managed to beat Snapchat's dominance as a short duration video through its Stories. Then, it was even more "gahar" after adding the IG Shop as the forerunner of social commerce, allowing users to directly shop on a business account in an instant. in-app browser.

Enough tap Photos uploaded by business profiles will be visible later tag item price and button View on Website to be directed to the brand's site to complete the payment. Or enter the product into the column wishlist. This feature has a weakness because users have to exit the application to directly buy the desired item.

Finally the latest update appears, the presence of features in-app checkout. Users can save payment information on Instagram to make faster purchases. The new payment options are card-based, such as Visa, Mastercard, Amex, Discover, and PayPal.

Although only limited to 20 global brands, this decision is likely to make Instagram the strongest candidate for social commerce going forward.

In Indonesia, IG Shop has just reached the price check stage through photos uploaded and directed to the brand's website. Even then, it is still in the testing stage, only some business profiles can feel it.

“IG Shop is still an experiment in Indonesia, so not all accounts can get it. This feature has a button Shop Now to encourage consumers to make purchases or make reservations on Instagram," explained the Head of Emerging Business & SMBs Facebook & Instagram South-East Asia Ferdy Nandes when opening the Instagram Academy in Jakarta.

Instagram's position as a platform social commerce strongest

To DailySocial, Instagram spokesperson confirmed it is not a platform E-commerce, so that no transactions occur. What is being done is actually helping all online traders, one of which is the platform E-commerce, to find, connect and interact with potential buyers through photos, videos, and business tools available on Instagram.

“When shoppers find a product they like on their Instagram business account, they will click on the product and then be taken to the store's website or platform E-commerce where the transaction took place," he said.

They added, “Our role here is to help E-commerce or online shop find customers. If likened to a car, we are the car that brings potential buyers to their shop. We are not the shop.”

This Instagram claim is quite understandable because of its features trade that is currently true, transactions do occur outside the platform. The conditions will be different when the features in-app checkout brought to Indonesia. Every business profile from anywhere can receive transactions from customers anywhere because borderless.

This will be a very interesting topic in itself, for sure all players E-commerce I'm nervous because so far Instagram has only been used for channel marketing only.

The huge potential for micro-enterprises was born through social media platforms, which convinced Facebook and Instagram to be more serious in working with micro-entrepreneurs to use their platforms for advertising. Innovations for business profiles continue to be carried out, interestingly, they are available for free.

Micro-entrepreneurs can access free business profiles to get data insights regarding which uploads performed best, their audience demographics, best posting times, and more.

“They can study the results data insights to understand the characteristics of their audience, so that they can make the right strategy to reach those audiences.”

The company's seriousness, continued the spokesperson for Instagram, was motivated by the IPSOS study in Indonesia entitled “Impact of Instagram on Business in Indonesia (2018)”. It was found that 90% of respondents had used Instagram to communicate with businesses; 76% of respondents have purchased a product from a business after finding the business on Instagram.

Finally, 66% of respondents are considering buying a product or service they see on Instagram. Next, 81% of respondents use Instagram to seek more information when they are interested in a product; More than 80% of young entrepreneurs under the age of 35 said Instagram helped them achieve their business targets.

It is not stated how many MSME sellers have taken advantage of this business profile.

This year, Instagram began the initiation of the Instagram Academy program which was launched for the first time in Indonesia. This is a global training program for entrepreneurs who want to improve their digital skills in enhancing their business by tools from Instagram. In its debut, this program targets more than 1.000 entrepreneurs under the age of 35 located in Jakarta, Bandung and Yogyakarta.

Beyond that, Instagram helped Tokopedia for digital marketing collaboration for the Surprise Shopping Profit (KEBUT) campaign last year. Claimed for the first time in the world, Instagram innovated IG Live for Tokopedia so they could create something like this infomercials to invite consumers to buy merchant products.

"Last year we also held program with GoFood called InstaMarket to provide training for GoFood merchants to be able to hone their skills in digital marketing.”

How about Facebook Indonesia? Unfortunately they refuse to respond to all the questions asked DailySocial.

Actually, features trade This is not only owned by Instagram and Facebook. There's also Snapchat and Pinterest. However, both of them do not yet have enough echoes to be used by SMEs to sell.

But this is all just a matter of time. Pinterest just announced opening regional office in Singapore to serve consumers in Southeast Asia and India. Globally, Pinterest's monthly active users reach 300 million people. More than 200 billion Pins stored, serving billions of personal recommendations every day.

APAC is one of the fastest growing regions, with millions of Pinterest users every month. This number has increased by more than 50% over the past year. In Indonesia alone, almost two million ideas are saved every day.

is social commerce so a threat to e-commerce players?

The movement of the IG Shop and Facebook Marketplace, of course, needs to be watched out for. But don't be antipathy or even anticipatory with the biggest social media platform. Because that's where the consumer prospects have not been touched by the players E-commerce.

The most important key is to continue to innovate and be willing to adapt. At least this is the conclusion of the answer DailySocial receive from player E-commerce.

SVP Merchant Sales, Operation & Development Blibli Geoffrey L Dermawan explained, competition E-commerce and social commerce of course it is unavoidable. Shopping choices, of course, fall back into the hands of consumers when they see the goods they want.

However, the company is not antipathy to it. Instead, use them to market goods, along with the positive trend of strategies like this. “But a business cannot completely depend on social media alone. The sales process must be carried out thoroughly or known as omni-channel, said Geoffrey.

Agree with Geoffrey, Shopee also uses social media and toolsfor marketing needs aimed at providing a different shopping experience to Shopee consumers.

“We saw that social commerce as part of the E-commerce, it's proven with features social commerce that we use on Shopee's Instagram account," said Country Brand Manager Shopee Rezky Yanuar.

Because there is a high dependency, that's why players E-commerce need to outsmart. For example, as done by Tokopedia. From his observations, in the era social commerceThere is a change in consumer behavior where they seek inspiration and shop at the same time.

Influencers are considered to have an important role in a campaign process. This strategy was finally adopted by Tokopedia in various types of campaigns, such as brands and sales at various sites channel social media.

"This is our effort to stay relevant to our target audience, one of which is the millennial generation, where they consume social media every day with influencers as their inspiration," added VP of Corporate Communications Tokopedia Nuraini Razak.

The strategy is then translated more deeply into a new feature "Tokopedia by Me," opens new interaction space between buyers and role models or confidants who recommend their favorite products.

Utilizing influencers on social media is also used by zalora. The reason is, for Zalora as a site, E-commerce which focuses on fashion products, thick with visual elements that must always be emphasized.

“We are present in platforms where our target audience is, for example on social media such as Instagram, Facebook, and YouTube. The three are medium which we not only use to give Update, but also make commits with our customers," said Zalora Indonesia's Head of Marketing Dwi Ajeng.

Hijup is also quite active in utilizing social media platforms to increase business. Head of Creative Content Hijup Anastasia Gretti said the company used social media not only to provide inspirational content, but also to make it easier for consumers to interact with the team. customer service.

For example, taking advantage of the Facebook Live feature, providing a means of two-way communication, and making purchases easier via WhatsApp. Although, the essence of the transaction process at Hijup is through the site and application

"In business, Hijup believes that we must continue to be able to adapt to the birth of various innovations and developments in technology and social media," explained Anastasia.

Selling practical, security and comprehensive service

As the McKinsey report says, online shopping at informal commerce not integrated for payment and delivery. The whole process must be done manually by the seller which in the end takes time. This experience does not have to be felt when consumers shop through the platform E-commerce.

Geoffrey L Dermawan explained the advantages offered by the platform E-commerce is a more comprehensive system. Starting from the ease of finding products on one platform, safe and varied payment options, product availability and sorting, and more structured after-sales services.

All of this is a clearer form of transaction accountability in order to gain the trust of consumers. This trust in transactions must always be maintained with services to ensure customer satisfaction is met.

Likewise Shopee. Rezky Yanuar explained that his party emphasized the importance of the security that consumers get when transacting through their platform. To reach all aspects of society, various payment options are available. It can be through m-banking, ATMs, the nearest minimarket, even on other platforms with installments without a credit card.

"Because we are in the middle, between sellers and buyers, consumers can calmly make transactions."

Not only a more integrated system, Dwi Ajeng added, the advantages of the platform E-commerce also in the credibility of the product which is 100% original. Every item received from the distributor, the Zalora team performs quality control to ensure the goods are safe before being sent to consumers. If there is a complaint, there is a team customer service ready to be contacted from various lines.

"We also have a policy, consumers can return products if they do not match within 30 days."

Another advantage is that all consumer transaction data is recorded. Data is the most important asset in the industry E-commerce, good and strategic data management can support a business E-commerce The.

"alive focus on digital potential in promoting the products and brands that join. We read changing trends, consumer habits, and more through social commerce. However, as validation, we always refer to the data we have on the Hijup site,” said Anastasia.

Competing is more than just a place to buy and sell goods

In order to stay ahead, of course, innovation must continue. At least the focus of the players E-commerce, to compete with competitors both in the same domain and with social commerce, currently leads to how consumers feel at home in their applications to perform various activities.

That's why the development of features has now varied, not only selling physical products, but also selling virtual and service products. Shopee, Bukalapak and Tokopedia can be examples, which take part as super-marketplace.

Rezky Yanuar explained that Shopee released various products in-app games, including Goyang Shopee and Quiz Shopee, so that consumers feel at home for long in the application. Since its introduction, in-app games continue to innovate and receive positive feedback from consumers.

In relation to e-commerce, Shopee presents the Shopee24 feature, a platform that helps consumers to receive goods on its platform within 24 hours. Apart from that, the company supports national football to be better by placing itself as a sponsor of Shopee Liga 1.

The company also adopted the concept of social media by releasing product recommendation features and Shopee Live. Both are like opening Instagram with a touch trade inside it.

Bukalapak active in developing services outside the marketplace, such as financial products for gold (BukaEmas), digital mutual funds (BukaReksa), and insurance (BukaAsuransi), tax payments, vehicles and PBB (BukaJabar, e-Samsat). Also, reaching segments online to offline (O2O) by inviting warungs as partners (Paltra Bukalapak).

With regard to e-commerce, some of the features developed are service same-day delivery together with Paxel, BukaMart to offer products for daily needs, as well as trial delivery of goods via drones so that goods reach consumers' homes faster.

"From the side engineeringIn fact, Bukalapak has released 31 new products and carried out more than 4.500 feature developments during the first half of 2019," explained Head of Corporate Communications Bukalapak Intan Wibisono.

Tokopedia is not much different, super-marketplace it is not only filled with virtual products, but has also reached the logistics stage (TokoCabang), fintech products to make it easier for merchants to get business capital and consumers to make credit payments (Ovo PayLater). The newest one, Tokopedia acquire Bridestory to present wedding related products on its platform.

On the one hand, e-commerce players niche also not to be outdone, they continue to strive to be a leading player by strengthening related services. Blibli, positioning as an online mall With the omni channel strategy, there are three features that are expected to answer consumer needs.

They are Click & Collect, Swap Add and Blibli InStore. All of these features are completely online, making it more flexible. Everything is already released in the app. For Add-ons, currently only available for smartphone products. The trick is to select the smartphone they are looking for and perform a number of diagnostic checks via the application. After that, the price given for the diagnostic will be listed.

When the payment has been made, the Blibli Express Service (BES) courier will come to pick up and recheck the product to be exchanged, while delivering the new product to the consumer's address. In the future, this feature will be implemented in other categories, such as automotive to trade cars and motorcycles.

Next is Zalora releasing the Zalora Now feature, a subscription program for consumers with various offers. Contains free service express shipping for a year, and other deals offered by Zalora partners, such as Traveloka, Zomato, Sayurbox, and others.

“The key to staying gradual in the world E-commerce is that Zalora continues to review demand or consumer behavior. We will always follow the dynamics of shopping trends, then we will implement several strategies to create relevance to customers," said Dwi Ajeng.

Hijup is a little different, the company applies the O2O business model by opening offline outlets in several cities. The hope is that this strategy can increase awareness and trust in “offline customers” which will turn them into “future online customers.”

Zilingo didn't want to lose. VP and Head of B2C Marketing Zilingo Sarah Humaira also added, Zilingo has transformed from a B2C platform in 2015, to a centralized service in B2B to connect every highly fragmented fashion supply chain landscape.

While most e-commerce companies focus on B2C and C2C trading, companies adopt a different approach to provide added value for fashion merchants. Putting them and the factories operating in the fashion industry at the center of everything Zilingo does, all through technology.

This initiation was born because of the direct experience of entrepreneurs. They find it difficult to increase profits or to grow due to lack of access to technology and working capital. Meanwhile, international brands continue to grow aggressively.

Zilingo connects manufacturers/manufacturers across Asia, from design, product development, fabric procurement, manufacturing, cataloging, marketing, inventory management, distribution, billing, customer service, working capital, to trend forecasting.

“Our vision is to generalize the opportunities that exist so that every business, big or small in size, can use our technology to grow their business and become successful,” explained Sarah.

He continued, “This service has not always generated high revenue for us, but a one-stop platform (full stack) is built on the premise that our B2B and B2C businesses have strong synergies and help us unlock tremendous potential across the fashion supply chain for both merchants and customers.”

Why social commerce many fans?

Quoting from a McKinsey report, the contribution of e-commerce to retail transactions in Indonesia is only 3% of total sales in 2017. Compared to Singapore, there it has reached 10% in the same year. That is, the room for growth is still very wide.

Moreover, citing an idEA survey regarding the use of online shopping platforms on social media (2017), transactions through Facebook and Instagram reached 66%. The top position was taken by Facebook 43%. Only 16% of sellers and buyers use the platform marketplace and 7% create their own site. This survey was conducted on about 2 MSMEs in 10 cities in 2017.

It should be noted that buyers and sellers, who are mostly micro-entrepreneurs, use social media more as a place for transactions E-commerce compared marketplace available or through the site itself.

This means that social media platforms can be a starting point for traders "go online." To explore this, DailySocial contact some platform support players social commerce.

One of them is TokoTalk. director of Operations ShopTalk Nesya Vanessa explained that the high interest in shopping on social media is none other than because there are very abundant potential users. Salespeople want to make these people their potential customers.

Moreover, the instantaneous nature of social media and real-time, can be a weapon for sellers to get closer to consumers and make them loyal customers.

“Another reason is that these sellers want to have their own online store so they don't have to compete with other sellers. In marketplace, they compete fiercely with other sellers who have similar products, and the only way to excel is to cut prices against each other,” said Nesya.

He continued, if they wanted to be exposed and appear at the top of the list, they had to advertise on marketplace. Finally, having an account on the marketplace does not support Branding their own brand because it can not be customized and personalized accordingly tone and manners brand.

This can be detrimental to sellers who want to have a sustainable business, definitely care about Branding. That's why they continue to use social media or create their own sites.

"That way, they can build their own brand and display content related to their own products."

CEO and Co-Founder Qiscus Delta Purna Widyangga also added that selling on social media does not require any effort to migrate users. It's different, for example, when they create their own site, they have to acquire user from the beginning. Then, introduce the brand, introduce the technology/product used, to the buying and selling itself.

Leveraging existing platforms, such as social media, sellers can hitch a ride. Making use of base user which are already large and then selected and adjusted based on the segment.

“They also don't need to teach technology from the start because the user base on social media itself is familiar with platform which they usually use. For small and medium-sized businesses, this method is more effective, yes, than having to build an online store from scratch,” explained Delta.

Adding to Delta's response, Halosis Co-Founder and CEO Andrew Darmadi explained that selling on social media might be easier to get recommendations from people closest to consumers who have shopped at the place. For the seller of course this marketing costs cheapest way to acquire new customers.

This is supported by the social media base itself, which is more personal and people can share what information they like. Judging from the type of consumer, people who shop on social media with platforms E-commerce also different.

Andrew believes that consumers on social media are usually spoiled because they want to be more personal in contacting the seller directly. Many of the questions that were asked could not be accommodated by chatbot because they also ask for recommendations, which products are good according to their posture or face.

“They are not immediately sure that they want to buy the product for fear of buying the wrong one. That's why consumers here are very chatty, want flexibility for payment and delivery method. Different from di marketplace, consumers already know what they want to buy and are independent,” he said.

Both TokoTalk, Qiscus, and Halosis is a player who focuses on simplifying online store management, both from customer service, payment methods, and delivery in one link. Their consumers are online sellers who don't actually sell on social media platforms but also on social media platforms marketplace.

“TokoTalk doesn't compete with marketplace, instead creating a platform E-commerce for sellers to facilitate their sales activities, for example managing orders and inventory," said Nesya.

Speaking of achievements, TokoTalk has been used by 155 thousand sellers to manage their online stores on various online platforms. Scored a total of $2 million in transactions per month (as of July 2019), based on a 30% MoM increase in value.

Qiscus, as a provider platform in-app chat, released the Multichannel Chat feature for entrepreneurs managing consumers who contact via the platform mainstream chat such as WhatsApp, Telegram, Line, and Messenger handled in one dashboards. As well as managing tools others, such as CRM, payment gateway and chatbot. Without going into details, this feature has been released since early 2019 and is growing 50%-100% for the whole business.

Meanwhile, Halosis has attracted 10 thousand micro sellers who sell on social media platforms and E-commerce. The latest data shows that Halosis handled 199.200 thousand chats last year, which included 40.235 transactions worth $1 million.

DailySocial meet one of the online sellers who fully utilize social media platforms to sell. This is Jessica Yamada, the owner of the DapurFit healthy eating menu which was pioneered in 2012. As a form of her seriousness in this segment, the installation of equipment in her kitchen has even been completed. hospital grade.

According to him, Instagram is the main marketing channel for his online business. Branding DapurFit is quite strong as a healthy menu catering pioneer, with more than 80 thousand follower on Instagram. Like other online businesses, Jessica also takes advantage of the role of influencers to Branding-New.

Consumers must contact via WhatsApp to subscribe to the menu with available package options. Delivery will be made via own courier and courier on demand GrabExpress if outside the service range of DapurFit. In a day, DapurFit sends 600 boxes.

“Nearly 90% of orders come from Instagram which are forwarded via WhatsApp. The site itself actually exists, but it's still in beta, unable to accept orders," said Jessica.

Grab realizing the potential of the courier business from online sellers by releasing Grabexpress. So to take this business seriously, there are regular feature updates to make it easier for them to deliver packages to consumers.

Up to now, the service area GrabExpress is available in 150 cities. Without specific data, over the past year, the number of daily shipments in GrabExpress increased by more than 20 times, the accuracy of orders arriving according to estimates also increased by more than 90%.

In terms of users, more than 50% of users GrabExpress are micro-entrepreneurs by their definition who sell online with any platform, from social media or other platforms E-commerce.

"We serve all micro-entrepreneurs who sell online, such as WhatsApp, Instagram and Facebook. Also for those who sell on e-commerce platforms, we have collaborated with Tokopedia, Bukalapak, and Shopee," explained the Head of Logistics Grab Indonesia Tyas Widyastuti.

There are a number of features designed Grab to serve online sellers, including delivery between cities on the island of Java with Ninja Xpress, newly introduced early July 2019; frugal package subscription GrabExpress; instant delivery and same days; proof of delivery & live tracking; Send to multiple destinations and multiple messages at once.

It boils down to empowering online merchants to be competitive

All of the above players have continuity with each other in order to capture the huge opportunities in digital platform transactions, because it all boils down to local traders themselves, how they can be empowered and willing to grow by utilizing online platforms.

From the quoted data Grab, there are 62 million MSME actors which cover 99,92% of the total domestic business units. However, only around 23 million MSMEs have knowledge of selling online, and even then it is still very basic.

However, in order to be competitive, Grab sees that MSME actors need to have products that can answer the needs of the community, have good and sustainable management, digital marketing knowledge, be able to create a good brand image, and have an easy-to-use logistics process.

From all these challenges, it is natural that many parties hold training programs for young entrepreneurs, from global scale companies such as Facebook and Instagram, to local companies from various lines that are directly related.

The noble ambition to be achieved is to encourage sellers not only to be famous in the country but also abroad.

There are still many traders who are not online yet, but there are also those who have tried to expand the market beyond Indonesia. Multiple platforms E-commerce already provided the service. Likewise with Instagram.

When you open the IG Shop tab, the catalog presented is a mix of local and foreign sellers. You can directly select the product and complete the payment by credit card or PayPal.

Readiness of e-commerce players

Bukalapak, for example, has released OpenGlobal to answer the challenges of limited logistics, access, and infrastructure that have been hampering the steps of SME players to the global stage. BukaGlobal is present in Singapore, Malaysia, Hong Kong, Taiwan, and Brunei Darussalam who have an interest in Indonesian products.

"We are still monitoring its progress in order to expand the reach of BukaGlobal's features to other countries," said Intan Wibisono.

Shopee releases Kreasi Nusantara export program from Local to Global, takes the form of a special page dedicated to highlighting local products. This program has curated about 25 thousand local products every week, there has been an 8-fold increase in transactions since it was first launched.

"From this program, MSMEs can maximize the potential for selling local products overseas via Shopee. In addition, they can also learn how to develop export strategies through the Shopee Campus class," said Rezky Yanuar.

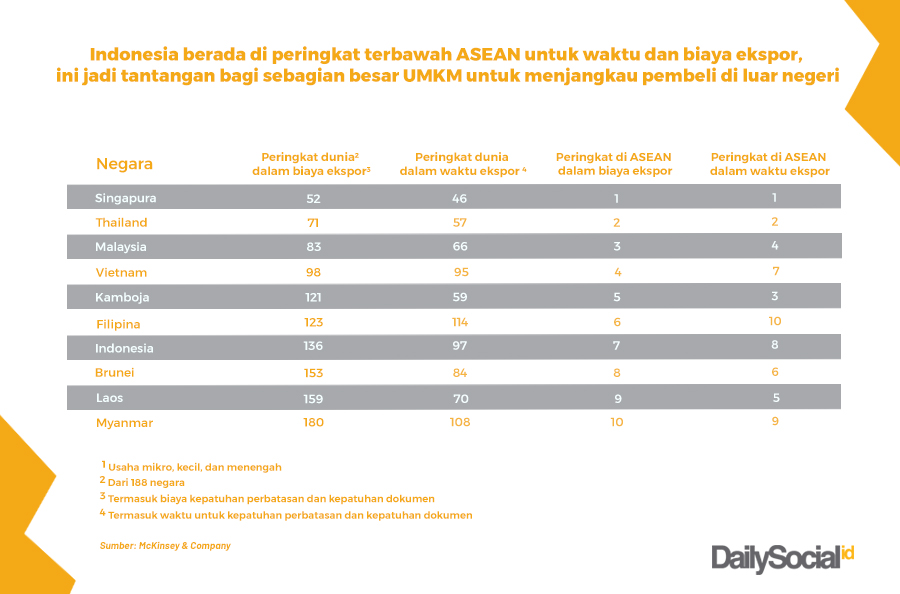

The challenge when exporting for SMEs is quite large. They must master regulations, logistics, and payment methods. These three are quite crucial if they are missed, so it is necessary to make sure they understand the details through training sessions.

Blibli has its own way of encouraging exports. Geoffrey explained that the company is preparing local SMEs through The Big Start competition, seeking talented talents to develop their business. Starting this year, The Big Start in collaboration with several ministries will debut sending creativepreneur best local to attend international festivals.

During the program, talents will be prepared and educated on how to make products that meet demand in the global market. And, what are the requirements so that it can be marketed abroad.

"So there is a key word for exporting is intensive assistance and education. The role of the government is also very much needed to help local SMEs not only focus on domestic economic resilience, but also ease and clear policies for exports.”

Not only opening storefronts at international festivals, the Blibli platform will also be prepared to accept orders from abroad for SME merchants in Blibli.

"Actually, the platform can [accept orders from abroad], but it's not a priority. For example, when we sell tickets for the Asian Games, we buy those from abroad. Now we are still preparing from the beginning of this year. I'll share it later when it's ready," added Blibli CEO Kusumo Martanto.

Tokopedia does not yet provide export facilities. Nuraini Razak emphasized that Tokopedia is a company marketplace domestic ones that do not facilitate transactions between countries. The company only accepts sellers from Indonesia and facilitates transactions from Indonesia to Indonesia.

The reason is that encouraging local products to be hosted in their own country is a very complex joint homework. Through online, local products can have the space and stage to develop creative ideas, market products to a wider market, so that one day they can become global national brands.

“We have many programs that cover upstream to downstream, for example Markerfest, encouraging local creators to improve production quality, the packagingand Branding so that they can compete with imported products, open MEA, and have access to capital from banks.”

Government and stakeholder assistance is urgently needed to support SMEs to go global. Anastasia Gretti explained that Indonesian fashion products, in this case Muslim clothing, have superior and innovative creativity when compared to other countries.

But that's not enough, it needs a lot of improvements from upstream to downstream, such as procurement of raw materials, increasing the scale of production, capital assistance, and others where this is a shared responsibility.

"So according to Hijup, the export challenge is not only limited to regulations and shipping costs, but also the readiness of local product competitiveness in terms of quality and quantity to also be considered," he said.

Still a polemic in taxation

Without compromising the potential of each online shopping platform, keep in mind that until now the Government is still in a dilemma on how to do it tax e-commerce. The implementation of taxes through PMK No 210 of 2018 has finally been officially postponed.

E-commerce players still want equality in taxation with social commerce platforms. The reason is, Indef Economist Bhima Yudhistira assesses that this rule is not fair because it is still aimed at one party. In fact, according to him, the portion is in social media.

"If you want to make tax rules, ideally there should be no discrimination. All online sellers are required to pay 10% VAT and PPh. If the rules are stricter on the platform E-commerce, there will be a shift in consumption to social media," said Bhima.

Representatives from the Indonesian E-Commerce Association (idEA) agree. It remains firm on the principle of equality in rules and regulations (equal playing field). "Various rules enforced E-commerceWe hope that it will also be applied equally in social media transactions," said Bima Laga, Head of the Digital Economy Division at idEA.

He also believes that in the future consumers will prioritize a sense of security and comfort in shopping online. Platforms E-commerce have guaranteed security, both in transactions and delivery.

"Even the government will eventually find it easier to supervise the platform E-commerce compared to trading on social media," Bima concluded.

Sign up for our

newsletter