A Number of Local Startup Founders Participate in Debut of Forge Ventures Managed Fund

Prepare investments ranging from $500 to $1 million to lead pre-start funding rounds and early-stage startups in Indonesia and Singapore

Venture capital company Forge Ventures announced the first closing of its $21,88 million debut managed fund (over 313 billion Rupiah). In this round, Alto Partners, one of the multi-family offices as LP (Limited Partner); as well as a number of founder startups such as Airbnb, Carousell, Fabelio, Facebook, Funding Societies, GajiGesa, Grab, Kopi Kenangan, Qoala, Stripe, and others.

In a separate interview with DailySocial.id, Co-founder & Partner of Forge Ventures Kaspar Hidayat explained, his party wants to build an LP base that can provide support and guidance to the founder in his portfolio. According to him, the development is increasing founder startup involved as LP or angel investors signifies that the technology ecosystem is maturing and that startup founders have produced something of value.

"We are very happy with this development and welcome it. We are very grateful to the founders who have collaborated and supported us with the launch of Forge Ventures,” said Kaspar.

Forge Ventures was founded by Kaspar and Tiang Lim Foo, both veterans of the startup ecosystem. Kaspar previously held investment roles at 500 Startups, Venturra Capital, Koru Partners, and Maloekoe Ventures, with various startup portfolios, including Grab, Bukalapak, Zilingo, Carsome and Carro. He has also served as VP Pomelo with the task of launching and managing the business in Indonesia, as well as overseeing marketing and business intelligence regionally.

Meanwhile, Foo has more than a decade of experience building, operating and investing in startup ecosystems. He is a venture partner at Next Billion Ventures, and serves as a partner at Singapore-based early-stage investment fund SeedPlus. Its portfolio includes initial investments in companies in Southeast Asia, including Qoala, Rukita, Homage and CardUp.

In an official statement, Foo said that the startup ecosystem in the region is at a turning point with an abundance of capital, so founders are demanding more from their early investors. “We are operators, so we know what it takes to go from zero to one. This is why we were able to build confidence early and become the first institutional capital to support a startup,” he said.

Through this debut, Forge targets to build a concentrated portfolio of 15 companies over the next three years with a focus on Singapore and Indonesia. Noted, Forge has invested in three startups. First, Vorge, a Singapore-based digital concierge SaaS platform for the hospitality industry. Second, Dropezy, startups online groceries from Indonesia, and Marathon, a startup EdTech K-12 tutoring from Vietnam that democratizes access to select tutors.

Kaspar said that Forge's hypothesis in investing is not tied to just one sector. Sector fintech and EdTech is a consideration that Forge will target because it sees a lot of high activity in the industry. The investment size Forge is setting up ranges from $500 to $1 million (Rp7 billion - Rp14 billion) for the pre-start and early round lead.

He admitted, when investing, his party did not carry out special metrics in assessing startups, even though it was known that investments in the early stages tended to have higher risks. “Sometimes we invest in pre-products, so we don't have to base our decisions on metrics. Every company is unique, so our process will be different.”

Qoala Co-founder & CEO Harshet Lunani added, Foo was one of the early investors in Qoala, even before the product was launched in the market. Foo played an important role in terms of GTM and strategy and was very helpful in acquiring key employees and investors.

“I am very pleased to have had the opportunity to support Tiang and Kaspar in building Forge Ventures. I believe the operator-led approach of Forge Ventures will change the game for early-stage founders,” said Lunani.

Last year's early-stage funding trend

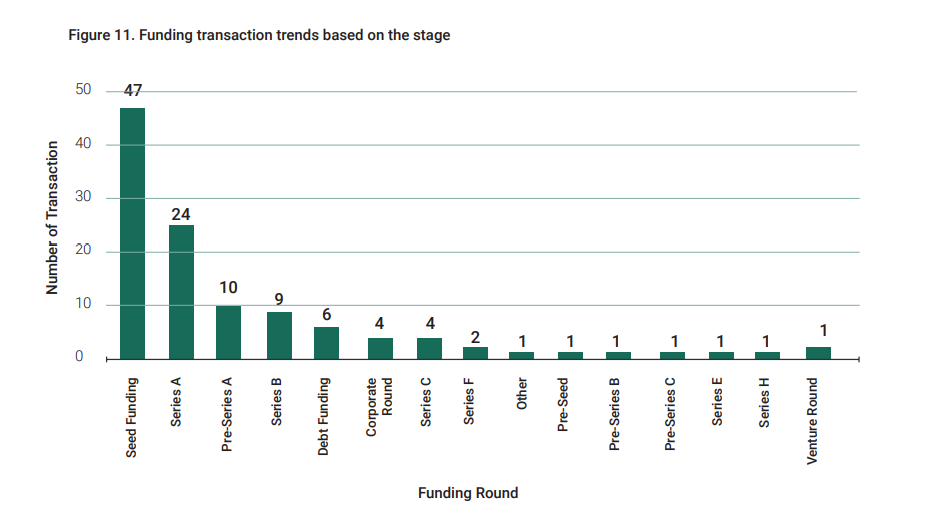

According to records Startup Report 2020, there were 113 publicly announced funding transactions totaling $3,3 billion. The nominal was obtained from 50 funding transactions that were disclosed to the public. A total of $2,43 billion of which goes to unicorn startups.

More Coverage:

Based on the stages, early-stage funding dominated transactions with a total of 47 transactions, with details of 11 funding for SaaS startups, five each for startups. E-commerce and EdTech, and four funding each for startups new retail and online media.

As for the VCs who are most actively investing in the early stages, East Ventures has 14 investments, the majority of which are intended for startups.

Sign up for our

newsletter