OCBC NISP Venture Prepares 400 Billion Rupiah to Invest in Fintech Startups, Proptech to Edutech

Darryl Ratulangi appointed as Managing Director

The challenge of digital disruption has inspired Bank OCBC NISP to launch a strategy beyond banking through formation corporate venture capital (CVC). Named “OCBC NISP Ventura”, the investment unit debuted with the acquisition of an operating license from OJK as of January 2020.

To DailySocialOCBC NISP's Head of Strategy & Innovation Ka Jit explained, the purpose of establishing this CVC is to create a digital ecosystem that is able to drive the transformation of the banking sector.

"We established OCBC NISP Ventura to create transformative value by harnessing the potential of the entrepreneurial spirit and startups in Indonesia with an extensive banking network to respond to the growing needs of society," said Ka Jit.

Current site ocbcnispventura.com is in preparation, as a centralized information channel of the venture unit. Meanwhile, the internal team has started working, including conducting an analysis of potential startups that will be invested.

"Comrades founder can send proposal (pitch deck) via email investment@ocbcnispventura.com," he explained.

Prepare 400 billion Rupiah

The company has also appointed Darryl Ratulangi as Managing Director who will be responsible for carrying out the vision of OCBC NISP Ventura. Bank management will participate in the function of supervising the running of the company by placing several members of management as commissioners.

"In line with the commitment to develop a digital ecosystem in Indonesia, OCBC NISP Ventura will focus on SMEs and technology startups engaged in the business financing industry, fintech, property (proptech), logistics, media, health (healthtech), education (edutech), data analysis, E-commerce and on-demand"explained Ka Jit.

Funds worth 400 billion Rupiah have also been prepared as authorized capital, with 99,9% ownership by Bank OCBC NISP. In addition to investing, several programs that will be run include startup incubation and strategic partnerships. In the initial phase, the company is targeting to be able to foster digital solution developers who are able to increase financial literacy and inclusion in Indonesia.

CVC Development in Indonesia

The term disruption that has been widely echoed since the middle of the last decade has made the development of CVC in Indonesia quite fast. It becomes multi-purpose strategy. In addition to providing profit opportunities through venture business models such as: "Exit", also opens up corporate opportunities to forge strategic partnerships with innovative digital platform developer startups.

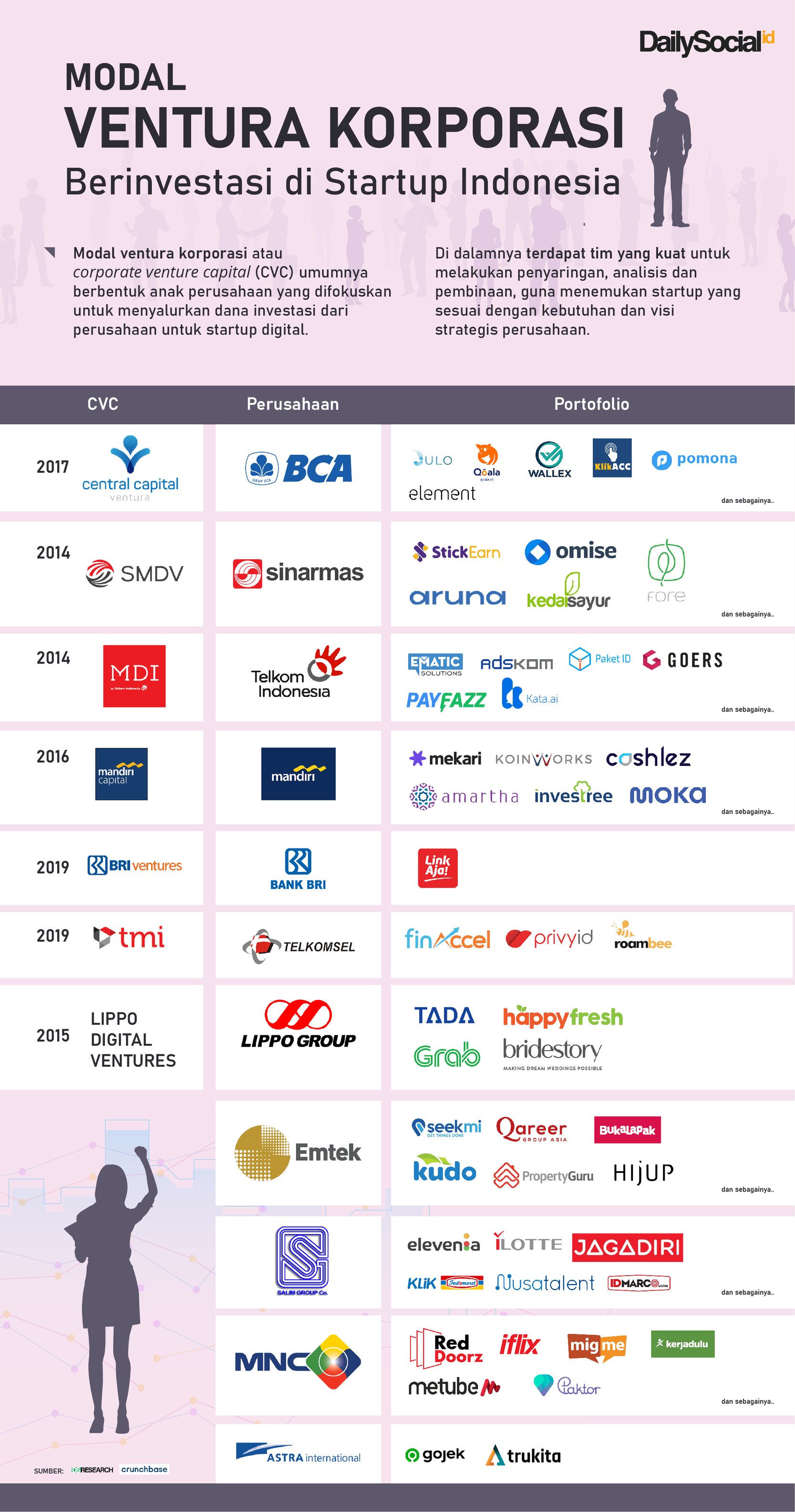

Based on team records DSResearch As of December 2019, the following is a list of CVCs in Indonesia and their fostered startups:

And here is a list of nicks "Exit" local venture capitalists throughout 2019. Telkom Group's CVC led the acquisition, through corporate acquisitions and IPOs:

Sign up for our

newsletter