Mitigating Risk, Reaping Investment: Cultivation Crowdfunding Platform in the Spotlight

After the problem of managing public funds, it is necessary to strengthen regulations and risk management in the aquaculture investment sector

Not to mention the negative news about the rise of online loans, the Indonesian fintech industry has again been marred by the alleged "mismanagement" of billions of Rupiah worth of investor money by the digital-based crowdfunding platform Tanijoy. This case adds to the row of fintech startups that have stumbled upon the same case in the cultivation sector.

Before Tanijoy, in the last two years, similar cases hit Angon and Vestifarm. Both are demanded by investors to return the funds. Angon and Vestifarm use the model through crowdfunding or crowdfunding to channel financing to farmers or ranchers.

Of course, this polemic cannot be left alone because it could potentially reoccur in the future. Investors may lose confidence to invest in the aquaculture sector. In fact, breeders and farmers in Indonesia still really need access to capital.

DailySocial trying to understand what actually happened and what mitigation efforts can be made in the future. There are three sides that we want to discuss, namely the cultivation business actors, the industry, and the efforts of the government and related sectors to handle this case.

Cultivation investment risks

From various sources of information that we collected, the three cases were both caused by internal and external factors. For example Free-range. This startup, which was founded in 2016, is considered negligent in managing public funds. Angon allegedly used a lot of these funds for operational expenses and necessities founder which is not too urgent.

While Tanjoy admitted that the project had been completed, but was hampered by the withdrawal of funds. According to his clarification, the funds from the project are still in the hands of the farmers and have not been fully returned to Tanijoy. PSBB is considered to make communication with farmers difficult and makes it difficult for companies to earn income because there are no projects.

In the Vestifarm case, we found it difficult to find detailed reports regarding alleged delays in refunds. From the uploads of a number of Vestifarm investors, businesses funded by Vestifarm have failed to pay. Vestifarm did not specify the failed projects, but they admitted that they had made every effort to collect payments through third parties.

Apart from the Covid-19 pandemic situation that has occurred since last year, Cultivation is a business sector that has quite high risks. The risk of crop failure can occur due to a combination of various factors, ranging from weather, natural disasters, lack of care, to farming skills.

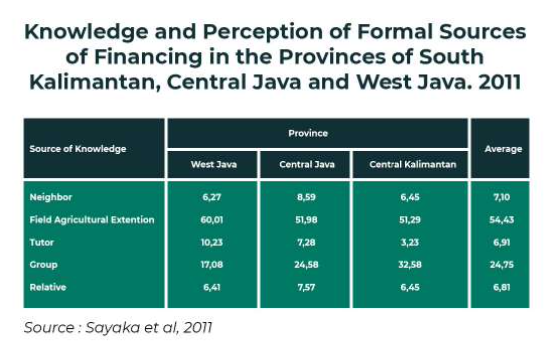

Report DSResearch and Crowde titled "Driving the Growth of Agriculture-Technology Ecosystem in Indonesia" stated that business development in the cultivation sector was hampered a number of challenges, such as access to capital, financial literacy, as well as farmers' cultivation abilities and knowledge.

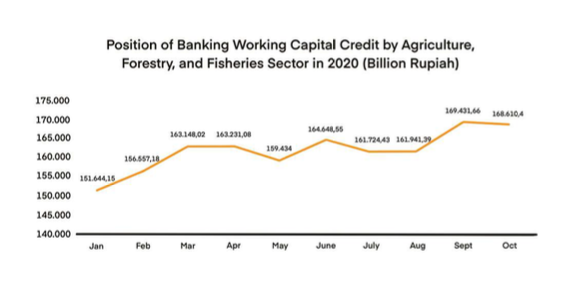

Banks that have strong access to capital are not the main choice for farmers. The requirements are very difficult to fulfill because the average farmer does not have a land certificate as collateral. Not to mention the crop production cycle which is sometimes hampered by weather and pests, making their income unstable. The complexity of the application procedure encourages farmers to borrow from unofficial institutions with easier terms.

| Status | Total Indonesian Farmers | Male Farmer | Women Farmers |

| Didn't graduate from elementary school | 8.247.112 | 5.679.847 (68,9%) | 2.567.265 (31,1%) |

| Graduated from elementary school | 13.994.725 | 10.638.485 (76%) | 3.356.240 (24%) |

| Graduated from middle school | 5.400.834 | 4.255.020 (78,8%) | 1.145.814 (21,2%) |

| Graduated from high school | 4.799.070 | 3.992.383 (83,2%) | 806.687 (16,8%) |

| Graduated from S1 | 754.814 | 633.414% (83,9%) | 121.400 (16,1%) |

Education level of Indonesian farmers / DSResearch & Crowde

This report also states that the low educational background and financial literacy of farmers is one of the factors inhibiting cultivation businesses. Likewise with internet penetration. Based on BPS data in 2018, only 4,5 million people were connected to the internet out of a total of 27 million business actors in agriculture.

Returning to the issue above, the explanation just now actually explains why these factors contribute greatly to the potential for crop failure and payment failure in the cultivation sector. It is true that there is no data that can show the level of potential failure in platforms that provide financing to the cultivation sector, but this potential can be reduced with better risk management.

What can platforms do as providers of facilities? If the mission is to encourage the cultivation industry, assistance should not just stop at access to capital. Platforms can increase their role by providing assistance to farmers so they can maximize their business capital within the limitations they have.

Apart from mentoring, it is important to place people who are experts or capable of managing finances in the company. After all, these are public funds that need to be accounted for.

Founder should prepare a backup scheme/model if there is a potential for the project to fail. If farmers fail to harvest, they will definitely fail to pay. If this happens, refunds will be difficult.

Take TaniFund for example. TaniHub CEO Pamitra Eka revealed that collection efforts still refer to the scheme that the company has created. This scheme is also designed in accordance with the provisions regulated by the OJK. In the first step, TaniFund will carry out credit rescue efforts, such as restructuring and negotiations, if there is a delay in the first 60 days.

"However, if up to 90 days there is no resolution of the remaining late payments from borrowers, we prepare the claim process to insurance companies that have become TaniFund partners. We are making this effort so that Actioncalendar get a principal return of up to 80%," said the man who is familiarly called Eka DailySocial.

Meanwhile, he continued, TaniFund has implemented it advanced credit scoring with a 100 data points model to measure profiles borrowers, trace the track record of commodity cultivation, and access to markets. Thus, this system can generate profiles borrowers and quality projects as well as reducing the potential for crop failure/payment failure.

"We also monitoring periodically by field team or agronomist to ensure each project runs well and the timeline can be in accordance with the initial RAB submission. Mentoring is also carried out continuously so that borrowers gain access to information and renewable technology in managing business and achieving appropriate targets."

Regulator protection

DailySocial try to contact representatives of the Financial Services Authority (OJK) regarding this matter. However, there was no response until this news was published. Regardless of the status of this illegal platform, OJK can actually strengthen policies to protect consumers, in this case investors. For example, providing platforms with strict rules in terms of risk management.

In fact, these three "problematic" startups do not have registered or licensed status from the OJK. However, they can still operate and manage public funds without further supervision or audit.

| Startups | OJK status |

| Angon | Not listed |

| Tanjoy | Not listed |

| Vestifarm | Not listed |

Of course, not all cultivation investment platforms are "naughty". The following are the names of cultivation investment platforms registered with the OJK and information about the Payment Success Rate on each platform (which tends to still be healthy).

| Startups | OJK status | Investor | TKB90 |

| Crowde | Registered | Mandiri Capital Indonesia, STRIVE, Crevisse | Present in several = 97,12% |

| iGrow | Registered | Google Launchpad Accelerator, 500 Startups, East Ventures | Present in several = 96,54% |

| iLivestock | Registered | Unknown | Present in several = 98,57% |

| TaniFund (Part of TaniHub) | Registered | MDI Ventures, Openspace Ventures, Intudo Ventures, BRI Ventures, Telkomsel Innovation Partners, etc. | Present in several = 100% |

Contacted separately, Executive Director of the Indonesian Joint Funding Fintech Association (AFPI) Kuseryansyah commented that the issue is very simple, but the matter needs accurate verification. If Tanijoy continues to operate without obtaining a registered certificate, the reasons remain unjustified.

He emphasized that his party continues to urge the public to carefully choose fintech that has been registered and supervised by the OJK.

"We admit that the potential of platforms in the cultivation sector is very large, but the challenges are also large. For example, efforts to build a supply chain for farmers, breeders and fishermen so that they are integrated in the ecosystem. We hope that information related to the production, harvest and marketing processes can be monitored. We are confident that this will slowly "But definitely, this ecosystem will become more mature with the support of technology," he said.

Sign up for our

newsletter

Premium

Premium