Observing BaaS Product Expansion, Working on the "Unbanked" Segment in Indonesia

BaaS allows Cermati to expand its financial product offerings, from account opening, paylater, insurance across all types of platforms

Pay close attention to the Fintech Group (CFG) starting to work on the product Banking-as-a-Service (BaaS), characterized by a strategic partnership with BCA Digital and Blibli. CFG sees potential unbanked and underbanked which is still so large in Indonesia can be solved through this technology.

To DailySocial, Co-Founder & CEO of CFG Andhy Koesnandar said BaaS allows his company to expand its financial product offerings, from account opening, paylater, insurance, and more on all types of platforms virtually to third parties, so they can have banking capabilities on their non-bank platforms.

“BaaS is the latest technology product offering from Pay attention to Fintech Group, where we provide technology stack to connect banks with digital platforms,” he said.

In this case, Cermati developed a strategy embedded finance, open banking services can be embedded in the application ecosystem enabling super application capabilities through Open API and BaaS capabilities. Cermati's BaaS offering enables the ecosystem online and offline to invest in banking services, other than insurance and paylater used as service models in their ecosystem.

The presence of financial products can increase users fintech, reduce user friction, and increase loyalty. As for banking, BaaS technology offers a new way to partner with the ecosystem by providing banking services tailored to these customers.

Andy said, BaaS and embedded finance In general, it has enormous potential. From the data he cites, as many as 66% of Indonesia's 275 million population are still in the group unbanked and underbanked.

The group does not yet have access to financial services, which the solution can be by introducing financial products through platforms that Indonesians use on a daily basis. "Process it is completely digital, without them having to go to a physical branch of a bank or other financial institution.”

With the integration of Blu BCA Digital in Blibli, Blibli users can enjoy a complete range of Blu banking services. Starting from opening accounts, transferring funds, in-app payments, and more without the need to download or switch to other applications.

Andhy continued, his party still prioritizes the security element as a very crucial aspect in building partnerships with financial institutions. For this reason, the company always reviews and strengthens the system so that it is of the same level as banking security. “Earlier this year we were certified to ISO 27001, the international standard for information security.”

After BCA Digital and Blibli, Andhy said that the next partnership would be announced at the end of this year. However, he is still keeping a close eye on this matter.

BaaS service opportunities

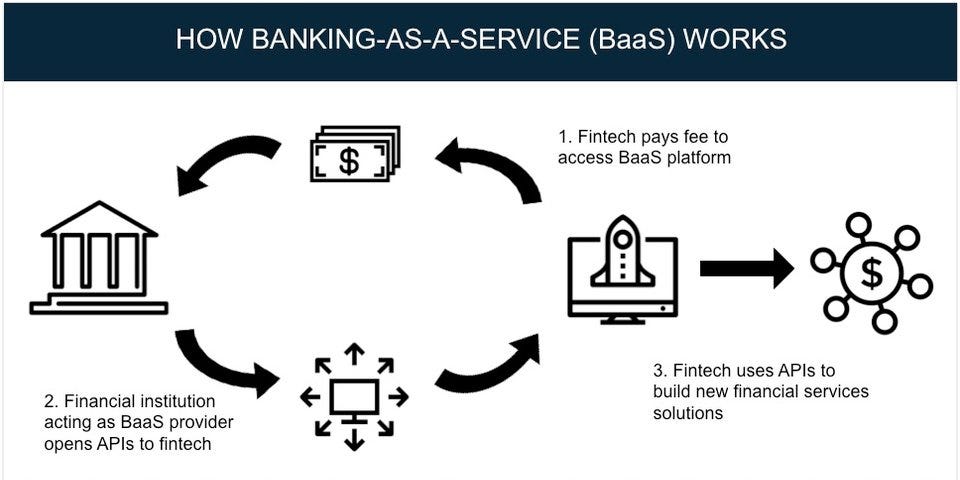

BaaS has now become one of the key strategies in the concept open banking. The model allows digital banks and third parties to connect with the banking system directly via an API. That way, both parties can build services on the provider's infrastructure while opening opportunities to develop products open banking other.

This model has also begun to be applied by many banks in the world because it is considered more efficient. In global spades, citing a report by research firm Oliver Wyman, implementing BaaS can reach more new users and reduce customer acquisition costs from $100-$200 per customer to $5-$35.

More Coverage:

In Indonesia itself, BaaS players besides Cermati have nexus introduced by Standard Chartered Bank. In the near future, banking solutions from Nexus will be available in the Bukalapak application.

Finantier Co-Founder and CEO Diego Rojas argues that BaaS is different from other API concepts because it provides a licensed and regulated infrastructure for core banking services. By out of the box, almost all companies can now become fintech companies without having to go through this long process thanks to the presence of open finance companies such as Finantier.

Finantier is a startup that provides an ecosystem open finance to support collaboration between various types of companies in providing financial products designed specifically for their customers.

Sign up for our

newsletter