Centauri Fund Receives Additional Funds Of 123 Billion Rupiah From K-Growth

K-Growth is a South Korean government-owned investment fund management agency that focuses on venture capital and private equity

The fund managed by Telkom and the KB Financial Group "Centauri Fund" has just received an injection of funds from sovereign wealth funds (state-owned investment fund management agency) from South Korea "K-Growth" amounting to KRW10 billion or equivalent to 123 billion Rupiah. K-Growth itself is a multi-manager investment company (fund-of-funds) which focuses on venture capital and private equity

As part of the MDI Ventures, Centauri targets business verticals that are not much different. But the unique value fund The funds will focus on pre-series A and series B funding. Meanwhile, MDI Ventures will focus on series B and above. The fund was launched in December 2019, with a target of raising up to $150 million.

The partnership between K-Growth and the Centauri Fund is yet another milestone. Despite the pandemic, confidence in investing in technology and interest in cross-border collaboration remains high. With an active presence in both Indonesia and South Korea, the Centauri Fund is well positioned to leverage and cross-pollinate the technology ecosystems in the two countries.

Kenneth Li, who is the managing partner of MDI Singapore added, "By joining K-Growth, MDI hopes that the Centauri Fund can help us find various innovations that will be brought to Indonesia, which will be bridged by MDI to support Telkom and BUMN initiatives."

Centauri Fund Portfolio

Since its launch, the Centauri Fund has made four leading investments in the Southeast Asia region. In April 2020, the fund led a series A financing round for platform insurtech Qoala, which closed at $13,5 million. Then, together with Wavemaker Partners, another venture capital company, Centauri Fund also supports WEBUY, a startup social commerce based in Singapore in October 2020.

The latest deal from the Centauri Fund includes an early stage investment in local logistics startup Paxel in April 2021. The Centauri Fund also participated in a series C funding round of fintech aggregators Pay attention, the deal is being led by MDI Ventures.

In January, this funding also supports RUNSystem, a SaaS platform ERP solution provider based in Yogyakarta. Currently, RUN System plans to expand its business and seek funds through an initial public offering (IPO) in Indonesia Acceleration Board.

Centauri Fund partner Steven Hong said, “Our funding acts as a working tool in the larger ecosystem. Managers at Centauri can invest from the early stages and continue to participate in later stages, as the company reaches a growth stage and beyond.”

He also added that with the support of two leading conglomerates, this funding provides strategic value for startups by connecting them to the Telkom Group and KB Financial Group for large-scale business and partnerships. This is referred to as part of the company's initiative to create value for the portfolio as well as a real return on investment for investors.

Cooperation between Indonesia and South Korea

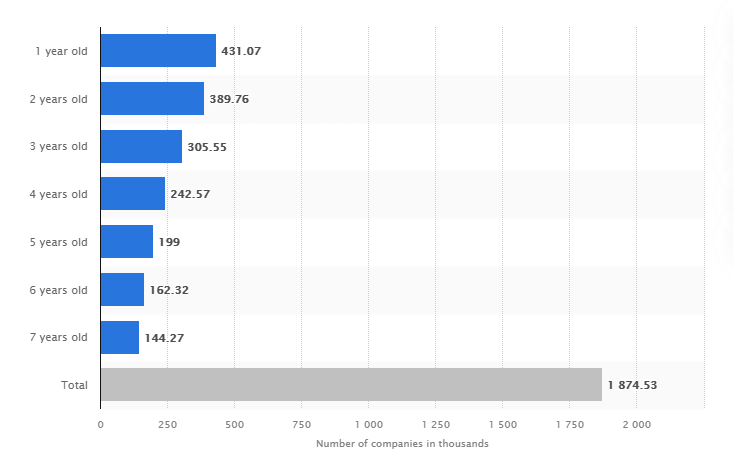

The contribution of South Korean investors to the development of the country's startup industry certainly cannot be underestimated. Some of them entered through cooperation with several managed funds to lead the funding round. According to Statista data, South Korea has around 1,8 million startups. In addition, more or less these countries are also supported by 165 venture capital.

More Coverage:

Reporting from Tirto, the South Korean government provides the highest per capita funding injection in the world. The government is setting up a budget of up to 12 trillion won or $9 billion to fund startups this year. The government is also targeting an additional 10 startups with new unicorn status in 2022.

Head of Investor Relations and Capital Raising MDI Ventures Sarah Usman added, "With our team's extensive experience and expertise in the Korean startup industry, K-Growth's latest commitment to the Centauri Fund represents another step towards building a bilateral partnership between South Korea and Indonesia. ."

Other South Korean investors who are actively investing in Southeast Asia are Yanolja, Woowa Brothers, and the GEC-KIP Fund from Korea Investment Partners (KIP) and Golden Equator Ventures (GEV). Mirae Asset-Naver also recently participated in a series D marketplace funding online groceriesHappyFresh.

Sign up for our

newsletter