Bukalapak is ready to be listed on the IDX on 6 August

It is estimated that a maximum of IDR 21,9 trillion will be obtained; the majority will be used for working capital

PT Bukalapak.com Tbk has finally publicly announced that it will soon be listed on the Indonesia Stock Exchange (IDX). Companies that will use the issuer code OPEN, will listing on the IDX on August 6, 2021.

Aksi unicorn it definitely attracts attention for being the first technology company in the industry E-commerce Indonesia which took the floor to the stock exchange.

Based on the prospectus submitted by the company today (9/7), Bukalapak issued 25.765.504 shares of common stock on behalf of which all were new shares, representing a maximum of 25% of the issued and paid-up capital of the company after the Initial Public Offering.

Of this total, the allotment for centralized retail investors is 2,5% or Rp75 billion. However, it will be readjusted if it is oversubscribed during the period bookbuilding.

The share offering price ranges from Rp. 750 to Rp. 850 per share. Thus, the value of this IPO transaction is as much as IDR 21,9 trillion. This action will be the largest IPO in the history of Indonesia.

The company will soon carry out roadshow attract large investors abroad and at home to participate in this corporate action.

Approximately 66% of the funds raised will be allocated for working capital purposes. The rest is used for working capital of subsidiaries, of which around 15% is allocated for Open Mitra Indonesia, around 15% for Indonesian Open Business. Then, about 1% for Open Joint Investment, about 1% for Open Procurement Indonesia, about 1% for Bukalapak Pte. Ltd., and about 1% for Five Jack (my item).

The initial offering period will be held on July 9-19 July 2021. Then, the initial public offering period will be on July 28-30 July 2021. If the process goes well, the listing of Bukalapak's initial shares on the IDX will take place on August 6, 2021.

Of the total shares released to the public, the company will apply 0,1% for the program allocation of shares to employees (employee stock allocation/ESA) or a maximum of 25,76 million with the same ESA exercise price as the offering price.

The company's initial public offering does not use an electronic system or e-IPO. Management stated the procedure for ordering shares based on Regulation No.IX.A.2 and Regulation No.IX.A.7 with certain adjustments based on the letter of the Financial Services Authority (OJK) No. S-108/D.04/2021 dated 7 July 2021.

Bukalapak provides special link to make it easier for investors to obtain information on how to order. There were 4 information submitted, namely information on Bukalapak's share issuance, share price, purchase order form or FPPS, as well as initial prospectus and prospectus.

The order for Bukalapak shares is carried out specifically. Investors are required to have Single Investor Identification (SID), Sub Securities Account (SRE), and Customer Fund Account (RDN).

Next plan

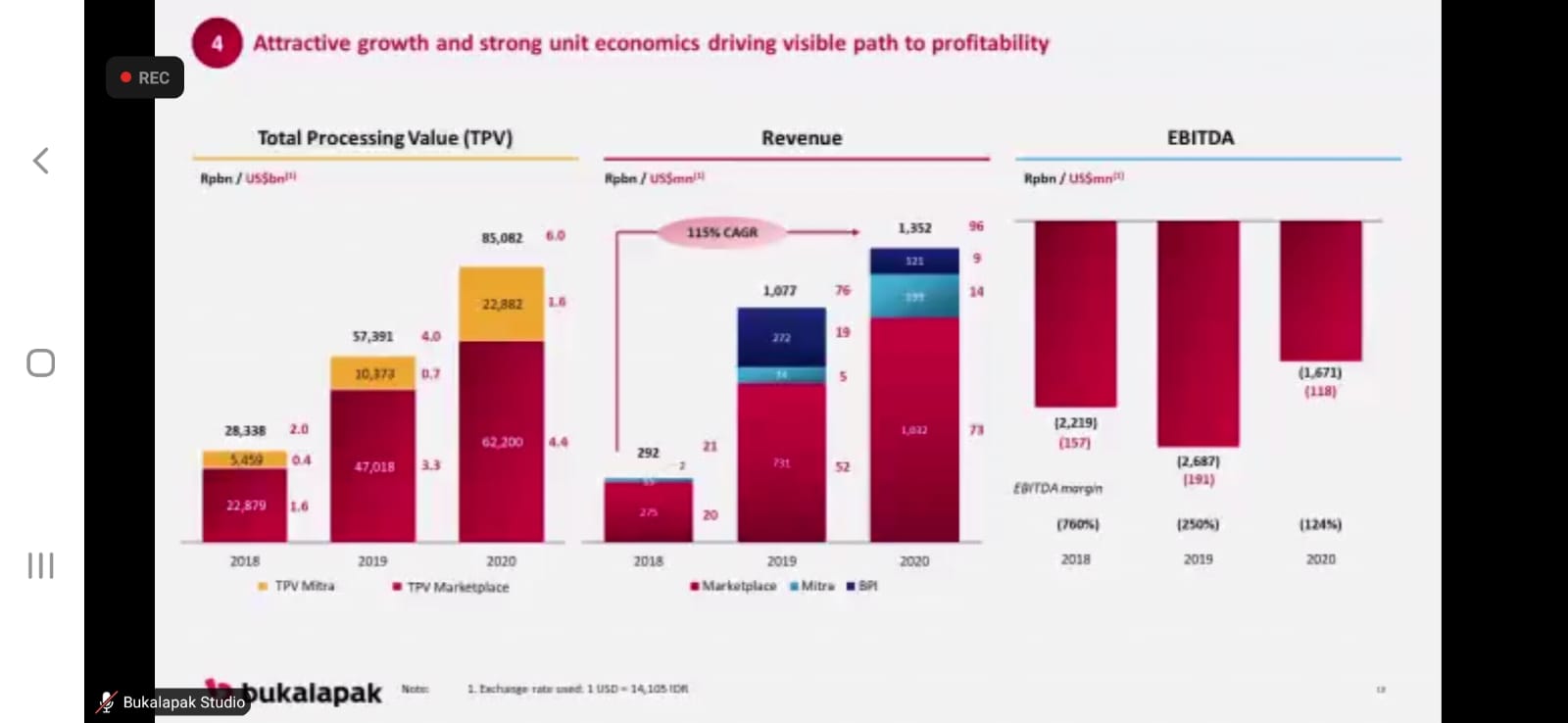

From the prospectus, the company posted a transaction value of IDR 85 trillion per year, an increase from the previous IDR 28 trillion. This upgrade make Bukalapak income increased 4,6 times to Rp1,35 trillion from Rp290 billion per year.

“Growing 115% on average per year. Many technology companies have to burn money to grow, but our way of thinking is different. We want to grow and improve our profitability. We are improving EBITDA and continue to strive so that this trend can continue and can become a profitable company in the future," said President Director of Bukalapak Rachmat Kaimudin in a statement. public expose, today (9/7).

He also said that this IPO is a milestone in the technology industry and the capital market because of the company's shares unicorn already available to the general public. Previously, Bukalapak was only an application that had been around for 11 years.

"With big dreams, starting with boarding houses and capital of IDR 80 thousand but having a big goal of advancing MSMEs."

According to him, the problems faced by MSMEs in Indonesia are quite complex and have not been touched by technology, so their business processes are still carried out traditionally. Technology is a solution that can be used to serve underserved communities.

Service presence E-commerce on the one hand is also not evenly distributed. 70% of the transactions came from five major cities in Indonesia, namely Jakarta, Surabaya, Bandung, Medan and Semarang. The population in the city is only 10% of the total population in Indonesia.

More Coverage:

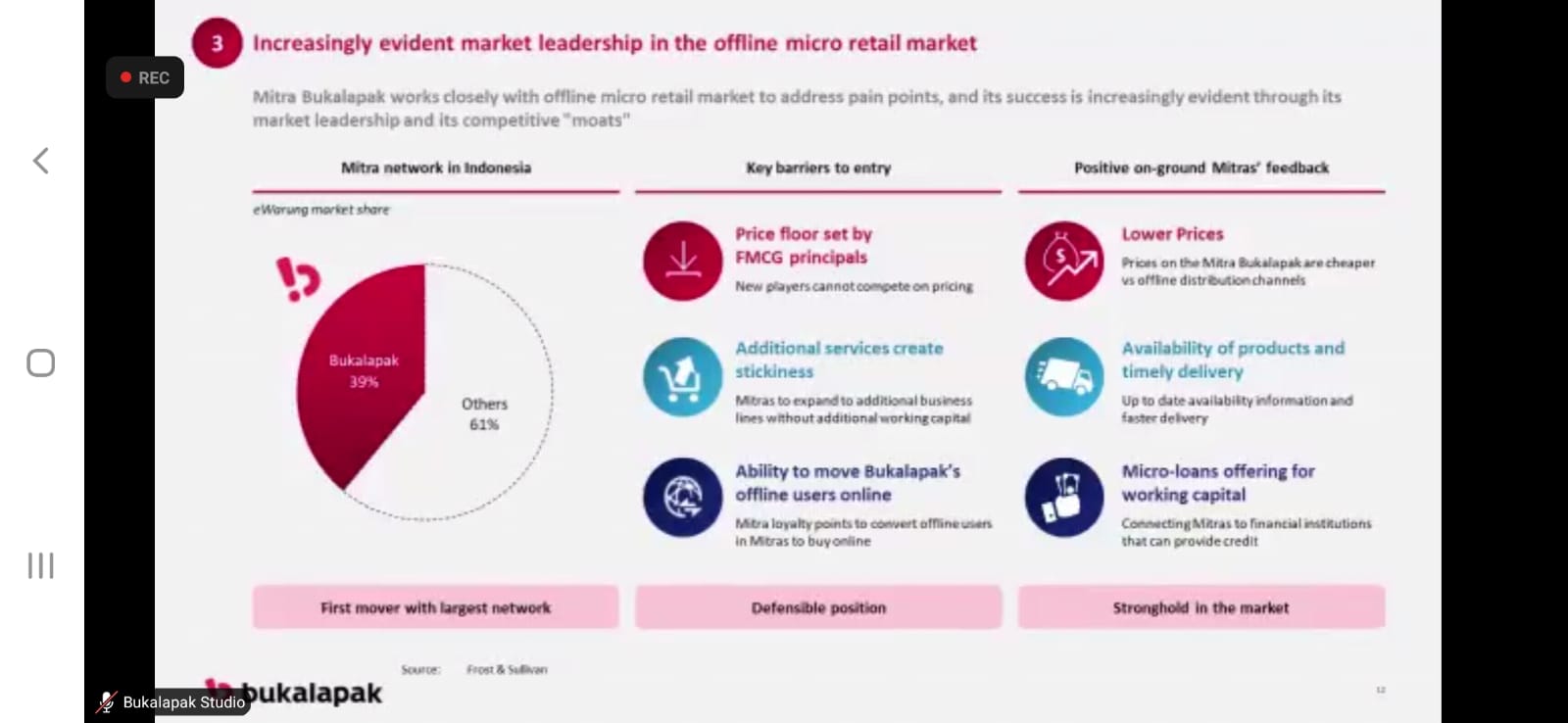

Meanwhile, 90% of the Indonesian population who came outside the five cities only made transactions in e-commerce services for 30% of the transaction value. "So the ratio is 20:1 in terms of the Indonesian population. Our strategy is to open an O2O network through the digitization of warungs which can be an additional infrastructure.”

After the IPO, continued Rahmat, the company will continue its all-commerce business strategy, through the Bukalapak application and Bukalapak Partners (along with their applications), to add products and services for partners so that more people are digitized and have many additional sources of income.

Bukapalak Director Teddy Oetomo also added that the revenue contributed by Bukalapak Partners is likely to be more dominant in the future from services. E-commerce. He reasoned because of the recent fantastic growth and innovation that the company has always carried out.

“Bukalapak will get a commission if our pelapak business grows, so our business goes hand in hand. The more their business grows, the more loyal they will be to Bukalapak," he concluded.

Sign up for our

newsletter