BTPN Establishes a Sharia BTPNS Venture Company, Encouraging a Digital Ecosystem Served by the Bank

BTPNS Ventura has an authorized capital of IDR 80 billion, with issued and fully paid capital of IDR 20 billion

PT Bank BTPN Tbk (IDX: BTPN) and PT Bank BTPN Syariah Tbk (IDX: BTPS) officially established venture company BTPNS Ventura last Friday (22/10). The establishment of this venture will help the parent company to invest in the digital sector.

Based on information disclosure on the Indonesia Stock Exchange (IDX), BTPNS Ventura has an authorized capital of IDR 80 billion. Then, the issued and fully paid capital amounted to Rp20 billion.

With this establishment, BTPS becomes the controlling shareholder with 99% share ownership or equivalent to Rp19,8 billion. Meanwhile, BTPN pocketed one percent or around Rp. 200 million.

BTPN Syariah Director of Compliance and Corporate Secretary Arief Ismail said that BTPNS will carry out sharia venture capital business activities, manage venture funds, and other business activities in accordance with the approval of the Financial Services Authority (OJK).

"The purpose of establishing this subsidiary is to support BTPN Syariah's business activities and aspirations in realizing a digital ecosystem for the segments served by the bank," the statement said.

In an information disclosure released on Saturday (23/10), the company stated that there had been no material impact considering that BTPNS Ventura had not been able to effectively carry out business activities. BTPNS Ventura will only be effective after obtaining approval from the relevant authorities.

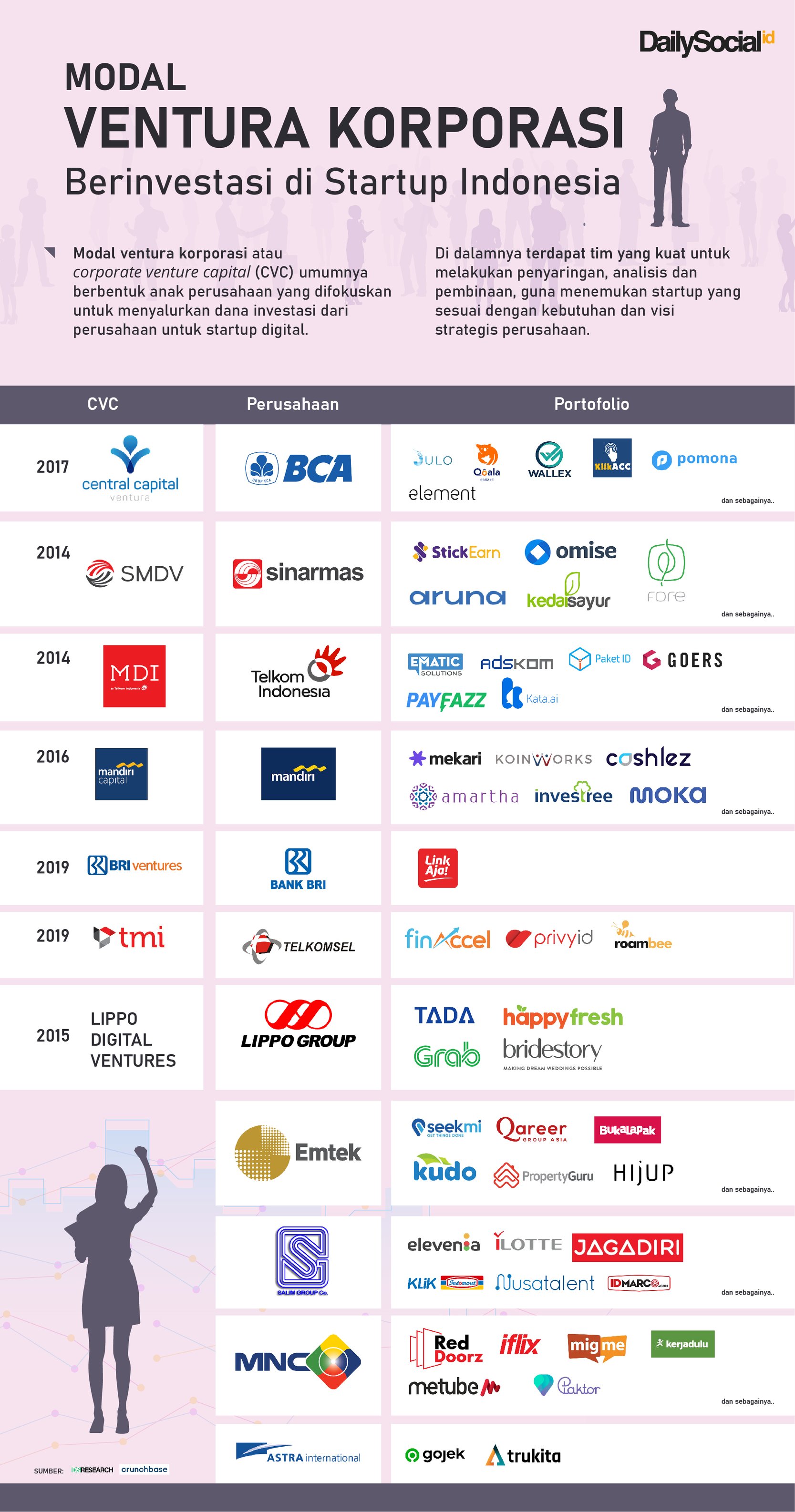

CVC in Indonesia

CVC is an extension of the company's investment to match technological innovation with the business and market access of the parent company. The end goal is to synergize digital services with company-owned businesses.

Meanwhile, several other banks have already formed CVCs to synergize their innovation portfolio with their businesses and services. Some of them are MDI Ventures, a CVC pioneer under the Telkom Group, BRI Ventures by BRI, Mandiri Capital Indonesia (MCI) by Mandiri, and Central Capital Venture (CCV) by BCA.

BTPN's steps to establish corporate venture capital (CVC) shows the direction of its new strategy to develop a financial services ecosystem, especially for digital banking genius.

More Coverage:

Moreover, during this time Jenius adopted the concept of co-create by involving the community tech savvy on every service/feature development digital banking. Currently, Jenius has 3,3 million users in the first semester of 2021.

Sign up for our

newsletter