Seeing how BTPN Syariah Empowers Inclusive Women from Aceh to Kupang

Get to know the Right Sharia Financing product and meet Ita Risna and other BTPN Syariah financing customers from Aceh

Bank BTPN Syariah has a unique business model that is different from most banks. One of its business segments is to provide collateral-free financing to women from productive underprivileged families.

Why did BTPN Syariah enter this segment? Quoting data from the Central Bureau of Statistics, there are 45 million productive poor people and as many as 23 million of them are women. The criteria for this productive underprivileged group are daily expenditures below $2 and 78% are in Java and Sumatra.

According to internal research BTPN Syariah, this business group works daily as traders, producing goods, and raising livestock. They work to meet their daily needs, educate their children, and repair their homes.

"The productive underprivileged class, namely people who have tried but are not fit to do banking transactions. We will help them so they can get banking services and become people who deserve to enter the world of banking in the future," explained BTPN Syariah Business Director Dwiyono Bayu Winantio, who is fondly called Iin .

Customers who come from this group have now spread all over the country, one of which is in Aceh since 2013. One of the customers who DailySocial.id met in the city of Serambi Mecca is Ita Risna who is now an inspiring customer. At her shop located in North Aceh, Ita produces and sells traditional dodol cakes, as well as Acehnese souvenirs, such as meusekat, peunajoh, keukarah and halua breuh.

Before meeting with BTPN Syariah, Ita admitted that she had to borrow money here and there from relatives and friends in order to continue to support her business. Then in 2016 he met a BTPN Syariah field officer after receiving information from a friend.

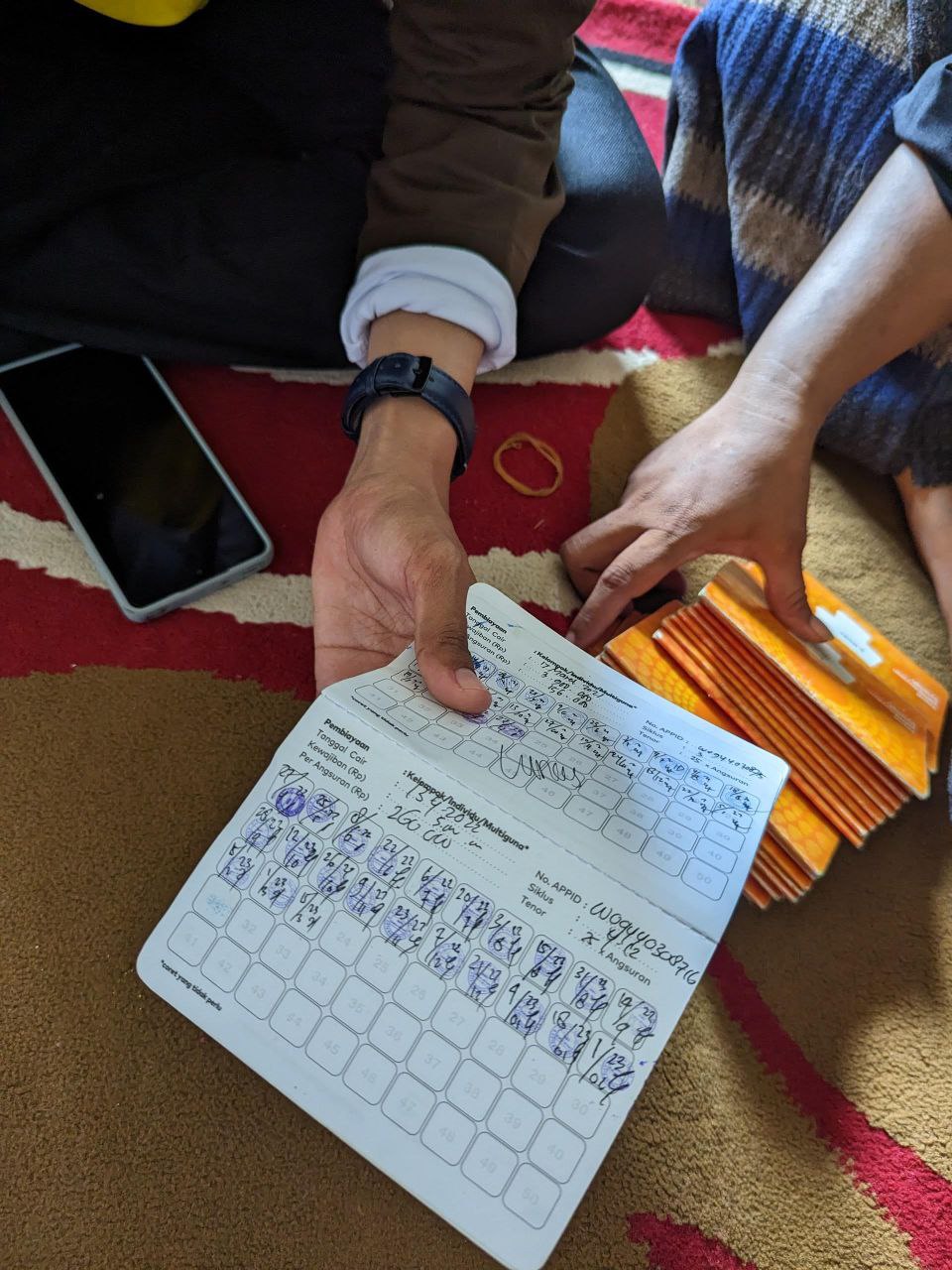

"The first year I got Rp. 5 million in capital because at that time I needed capital to buy raw materials. I was given financing and guided on how to do it, the process. The second year, the financing increased to Rp. 15 million. I bought a machine to help make processing easier," said Ita .

Along with the rapid growth of her dodol cake business, Ita received financing from BTPN Syariah of up to IDR 30 million during the 2020 pandemic. Now Ita's business has managed to generate a turnover of IDR 60 million per month with a net profit of IDR 6 million-IDR 7 million and employs eight employees. Even Ita's dodol cakes have been exported to Malaysia.

"When it comes to Covid-19, we fall up and down. At the beginning of Covid-19, we had lost Rp. 50 million, but BTPN Syariah was still trusted and given Rp. 30 million. We will build again from there."

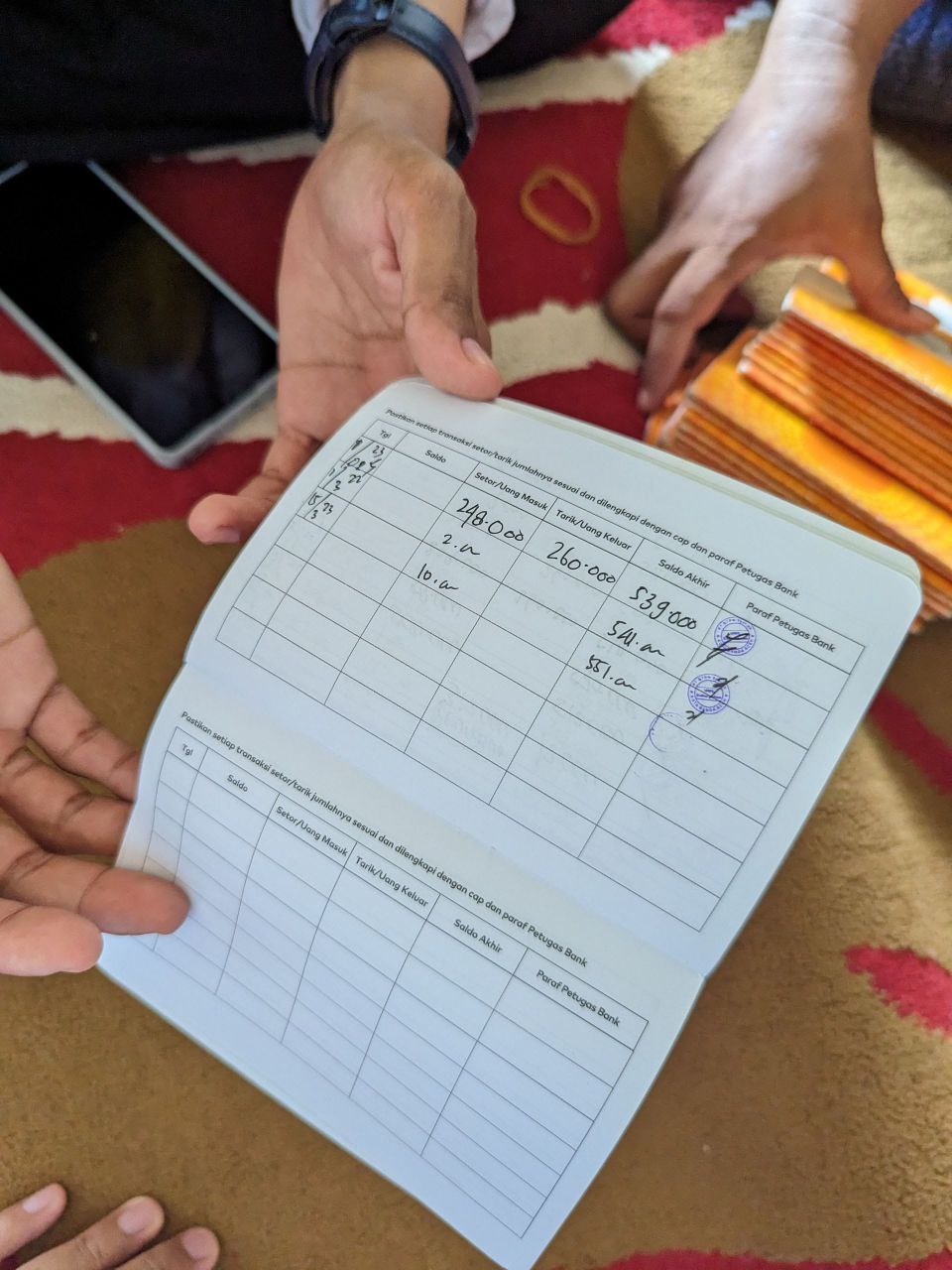

Compared to having to borrow from a bank or other financial institution, Ita reasoned that she feels at home as a BTPN Syariah customer because there is no collateral, billing is like family because the staff comes to her house once every two weeks, and provides mentoring sessions. Even when the officer arrives, he can immediately set aside some of his income for savings.

Besides Ita, DailySocial.id also had the opportunity to visit a center in Aceh, named Nila Lampuuk which has been running for five years. This center has 23 tough mothers, some of whom have laundry business, selling wet cakes, traveling herbs, and grocery stalls. The average loan ranges from IDR 3 million to IDR 6 million. The installments are for one year and the bills are paid in cash every two weeks.

For the record, in BTPN Syariah, the center can be said as a group consisting of one chairman and several members who each have their own business but are in groups to help and strengthen one another. One center usually consists of women, mostly housewives, who are trying to supplement their family's income by doing small, home-scale businesses.

Each center is led by a center head, who is elected by acclamation by members. These centers are reached by the bank through a field officer called the Community Officer (CO). These COs were selected from among young people from the environment around the financing centers. A CO usually handles around 20-25 centers, with around 300 customers.

Every day, the COs are on duty to tour the group of centers which are scheduled to meet every two weeks, visit the homes of customers who apply for financing to conduct surveys, provide consultations to customers, and build new centers.

In Aceh alone, there are 297 active COs who are at the forefront of providing services to customers and channeling financing. Their main role, apart from serving customers, is also being a role model in building superior customer behavior, namely Dare to Try, Discipline, Hard Work, and Mutual Assistance (BDKS).

"Before the Nila Lampuuk center was established, I was told by a friend in another village who told me it existed loan paid every two weeks for all types of business. I asked for his cell phone number, then started building members from four people now there are 23 members," said Trini, head of the Nila Lampuuk center.

The story of Ita and Trini is that they represent 79 thousand inclusive women in 5.685 centers served by BTPN Syariah throughout Aceh.

Complete package for Exact Sharia Financing

The productive underprivileged financing provided by BTPN Syariah for these centers is called the Sharia Financing Appropriately, which is unsecured financing provided in the form of business capital for productive underprivileged communities, especially women. This group financing aims to build four characters in customers, namely Dare to Try, Discipline, Hard Work, and Mutual Assistance (BDKS). It is hoped that these four behaviors can spread so as to achieve a social order that has economic strength in an area.

Not only providing access to finance and business capital, Right Islamic Financing also seeks empowerment through regular training and mentoring in the fields of financial knowledge, entrepreneurship and health.

BTPN Syariah concocts the Right Syariah Financing product with a complete package to provide changes to the lives of underprivileged customers, including:

- Financial Package: Business capital assistance provided to customers to answer the needs of building and developing a productive business. This assistance is then returned in the form of bi-weekly installments. Customers also get other additional benefits, namely life insurance for customers and husbands, savings, and free installments every Eid Al-Fitr. After 3 cycles have been successfully passed, the customer will have the opportunity to obtain financing for home improvement and children's education.

- Empowerment Program: Customers can continue to improve skills and knowledge through ongoing mentoring programs covering health, entrepreneurship and community development topics.

- Membership System: Customers are grouped in a center whose members are self-selected by the customer, led by a Head of Setra who is chosen by the members of the center.

- Assistance: Each center will be assisted by a trained field officer or called a Community Officer (CO). The CO regularly serves and provides assistance to customers by meeting at customer locations.

Not only for Muslims

Even though BTPN Syariah sells sharia products, its target customers are all religious people, not just Muslims. One example is BTPN Syariah customers in Bali and Kupang (East Nusa Tenggara), which are dominated by Hindus and Christians.

The Head of BTPN Syariah Bali Area Financing Dony Aditya said that 90% of his customers were not Muslim. At the beginning of the company's business in Bali in 2015, with a team that mostly wore headscarves, she admitted that there was fear in increasing market penetration in these non-Muslim-based areas.

"We explain our business is sharia banking. But our services are not limited to Muslims. Many of our customers or field workers are also non-Muslims. This is a form of sharia banking not only for Muslims. After all, all the contracts we use, we translate it in a language they can easily understand," said Dony as quoted from Indonesian CNN.

The sharia banking business is not related to religion, even though it uses contracts according to Islamic law. So the concept is introduced with notes, the business run by financing customers is a type of halal business. For example, not selling pork or alcohol. So that businesses for religion such as selling cymbals for Hindu worship are allowed.

Sign up for our

newsletter