Bloody Wins the Hearts of Viewers "Streaming" Video

OTT player competition in Southeast Asia is not just a content or price war

The regional video OTT platform is starting to catch on its breath entering its fifth year of operation. Southeast Asia can be said to be difficult to become a dominant player in the market because the characteristics of the targeted consumers are likes to compare prices and likes to be pampered with various choices. Hooq became the first platform to collapse by filing for liquidation at the end of March.

"Multi-market video OTT is a capital-intensive business and requires long-term investor commitment as the path to profitability is fraught with challenges and requires a large amount of resources," said Vivek Couto, Managing Partner of Media Partners Asia. Variety.

He continued, "Hooq has the advantage of being a first mover when it was launched five years ago. But perhaps what was initially considered strategically important for a [Singtel] group focused on moving upstream to content as it brings benefits and proximity to their core business [telecommunication], becomes non-core even unimportant if more capital investment is required to scale. successful in Southeast Asia."

Hooq's financial report in March 2019 showed less than satisfactory results. Revenue rose to $21,9 million from the same period in the previous year of $10 million, but this was accompanied by an increase in loss before tax to $62,5 million from $56,6 million.

Hooq implicitly "blames" the market landscape and other companies for this incident. In its official statement, the company said that over the last five years there had been "significant structural changes in the OTT video market and its competitive landscape".

"Content costs remain high and the willingness of consumers in developing countries to subscribe is increasing steadily amid an increasing array of choices. Due to these changes, viable business models for independent OTT platforms are becoming increasingly challenged."

Behind Hooq, Iflix has been gasping for breath since it first started operating in 2014. They laid off more than 50 employees. Iflix CEO Marc Barnett explained that this was the company's response to the uncertainty of the impact of the Covid-19 pandemic throughout the world.

"The industry is not immune to unprecedented circumstances. Our decision to reduce headcount came after careful consideration and in conjunction with other cost-cutting measures, to ensure the company survives this period of indefinite and uncertainty," said Barnett quoted from Deal Street Asia.

He revealed that the company remains focused on driving the business to break-even in 2021 and these steps are part of the company's strategy to stay on that path. "We are naturally doing all we can to support the affected staff both professionally and personally."

Layoffs are Iflix's choice to reduce the burden so that plans to list on the Australian stock exchange run smoothly. The Australian Securities and Investments Commission determined that Iflix may be forced to redeem more than $47,5 million convertible loans if not listed on an exchange on July 31, 2020.

Iflix's IPO plan was actually going to take place at the end of last year, but was postponed because the company had to make a number of efficiencies by laying off most of its senior levels. Since 2016, it is recorded that they have carried out a series of layoffs to remain gradual amidst the pressure from the emergence of global OTT players.

Barnett's efforts to break even require significant improvements within the company. The company's net loss widened in 2018 to $158,1 million from a deficit of $120,4 million the previous year. As a result, its net cash flow was narrowed by reducing operating cash in 2018 from $67,4 million in the previous year to $25,5 million.

What is wrong?

Omdia OTT video analyst Tony Gunnarsson explained that Hooq failed due to lack of capital. There were even reports they were unable to pay for the number of original productions that had been planned.

"In general, OTT video is a very tough business, and the history of the internet is one with a string of failed video services. "To be successful, OTT video services must have access to a stable source of capital to pay for exciting new content, a viable technology suite and reliable customer service," he said as quoted by Asian campaigns.

Companies must also advertise regularly to acquire new users. Even though Hooq has access to funds, with the support of Singtel, Warner and Sony, there is no guarantee that it will be successful. Essentially, without long-term contracts and without being tied to other products and services (such as cable TV, mobile or broadband contracts), OTT video services remain in the hands of customer loyalty. Very hard to reach.

Five years since its launch, Hooq has only reached 1 million subscribers in 2019 in five countries. This achievement is not a good result for the service streaming with the support of large investors.

Another opinion was expressed by VP Media Partners Asia Arravind Venugopal. He explained that when Hooq was launched, the enthusiasm was quite credible and measurable. They want to deliver content over mobile devices/networks at affordable prices.

"On paper, the pedigree is right. Hooq, alongside Iflix and Viu, is going after the middle and bottom of the consumer pyramid that Netflix doesn't yet serve. At the time, the vision and belief was that Hollywood content would succeed. Amid piracy of western films and series which is rampant in this region, offers an idea to make this content affordable to the public," explained Arravind.

However, the challenge lies in implementing this idea which has many obstacles, starting from market structure, consumer behavior, content choices/economic conditions, and technology availability. The problem is, in the countries Hooq travels to (excluding India), paying for content is not part of consumer habits.

FTA TV Consumption (free-to-air) is much more dominant and serves as the main source of local content for the community. In many cases, FTA channels also carry western content that isdubbing or translate in local language. Apart from that, there are local and international sports broadcasts with a massive audience base.

“Convince people to subscribe monthly [even if it's a smaller amount than pay cable TV] and then consume the content on-demand [vs. FTA TV], over their mobile data networks [and in those countries data costs are relatively high], was one of the big early stumbling blocks."

The next challenge is content choice. Western films and series are mostly available on cable TV or, if you have more funds, subscribe via Netflix. This reduces customer reluctance to subscribe to other services, such as Hooq and Iflix. Even though the cost of content is significant compared to taking local content.

So far, people in Southeast Asia prefer local language content or Asian content, as has been successfully proven by Viu and Iflix's experiment in showing content from South Korea.

On the other hand, local content is mostly produced by and for cable TV and FTA. Meaning Hooq and Iflix need to pay premium rates to get access to the best PH writers and companies. This increases their content budget.

If you choose as advertising video on demand (AVOD), the competition now has to deal with people who access YouTube, Facebook, and similar platforms. Competing in the advertising sector means not only having to build a completely new product or service, but also a relevant team.

"Hooq has started down that road. Putting a team and some products in place to address this. But there's still a challenge ahead, bringing in enough viewers to enjoy free content. That achievement can be sold to advertisers."

Gunnarsson added, Hooq is aware that in order to keep its initial spirit alive, the company has changed its business model several times in the last few years. For example, adding free content, a freemium model (no ads), lowering prices, and creating daily subscription packages. In India, Hooq is marketed as an English language content aggregator.

"While we recommend OTT video services be flexible and responsive to local markets, I think services need to be very careful about sustaining brand recognition and things like this [can] ultimately backfire and leave a lot of consumers confused."

Global players with large capital

Regional players will continue to be pressured by the onslaught of global OTT which has brought in a lot of capital. Most of them started India as their first expansion because the majority of the population can speak English and its population is second only to China.

China is not on the radar because the country has tightly closed access to foreign players with a series of strict regulations.

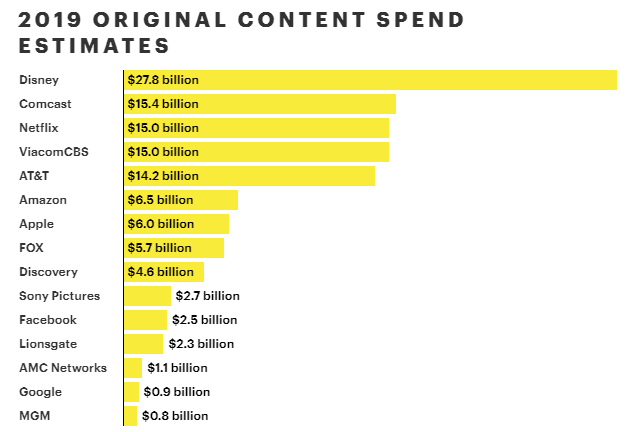

In providing content, Netflix is preparing to have long-term debt securities. For example, this year it has about $14,6 billion of long-term debt on its books. Previously, the company issued about $2,2 billion in bonds last fall and an additional $19,1 billion in content spending obligations.

The spending budget continues to increase in value from year to year, in line with the incessant influx of other players with deep pockets. In 2018, Netflix's budget reached $12 billion, up from $9 billion. Then, the figure was $15,3 billion in 2019 and this year the budget is $17,3 billion.

According to the firm BMO Capital Market, Netflix will continue to invest in content and is predicted to reach $26 billion in 2028. This is a fantastic figure to maintain its throne as a player. video streaming top.

Company income also increases. They last year earned $20,1 billion, up 27,62% from the previous year's $16 billion. Netflix pocketed a net profit of $1,85 billion, up 54,13% from the previous year's $1,21 billion.

These profits are obtained entirely from subscription fee what consumers pay per month. The United States is Netflix's largest consumer. It is estimated that 54% of the country's population are its customers.

In total, Netflix has more than 167 million subscribers. In the fourth quarter of 2019, there were an additional 8,8 million new customers. This achievement is said to be amazing, because at the same time Apple and Walt Disney released the service video streaming.

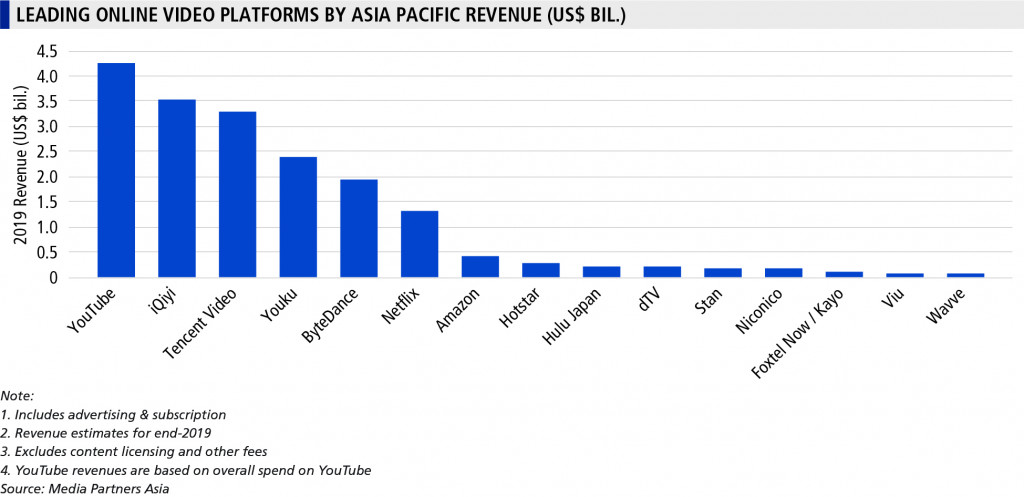

Elaborated further, especially in Asia Pacific, including Japan, South Korea and Australia, and India, the number Netflix subscribers reached 16,2 million people. Among the four regions, the contribution of this region is the lowest.

Media Partners Asia estimates that in 2018, there were more than 8,5 million subscribers in 2018 for the APAC region. Southeast Asia contributed around 11% of this figure or around 935 thousand customers. This figure is estimated to be even higher, especially now that you can subscribe via credit (Indonesia).

The price for the cellphone package is IDR 49 thousand per month, or half the price cheaper than the basic package of IDR 109 thousand.

"We see that Indonesia has viewing time (screen time) which is two times higher than the average global user," said Netflix spokesperson Kooswardini Wulandari as quoted from Kompas.

Other global and regional OTT players who are openly present in Indonesia and compete with Netflix are Amazon Prime Video, HBO Go, and Apple TV Plus. Apart from using a credit card, payment can be made via credit and GoPay (Google Play) and Dana (for platforms made by Apple).

Apart from players from the United States, the internet giant company from China, Baidu, released its own OTT service iQiyi to Southeast Asia, including Indonesia. Payment for this service can be made using credit.

We haven't talked about Disney Plus, which is a giant content network. Indonesia is definitely on Disney's radar, even though it's currently a service streaming It started with India via local video streaming service Hotstar in early April 2020.

TechCrunch reported that in less than a week Disney Plus Hotstar had attracted eight million subscribers. Hotstar itself is classified as a service streaming famous with more than 300 million subscribers. Disney Plus itself, since its release less than five months ago, is claimed to have more than 50 million subscribers around the world.

Many people are hunting for Southeast Asian markets

Netflix's prestige is threatened by the existence of these global players. Before they started aggressively, Netflix hooked up the Indonesian government (via the Ministry of Education and Culture) to train local talent to make films that will be marketed through its global platforms. It was stated that the company had prepared funds of $1 million for this collaboration.

The government is actually still "gray" about the presence of Netflix, for example Kemenkominfo who are concerned about the spread of negative content. The Ministry of Finance also continues to target foreign OTT players, including Netflix, regarding tax payments.

The number of Indonesian content in the Netflix catalog is increasing. Original content production has been tested through the film "The Night Comes for Us" and the documentary series "Street Food" which covers the story of a legendary food maker from Yogyakarta in one of its episodes.

Apart from Indonesia, they are actively producing content with a number of famous filmmakers, such as Malaysia (The Ghost Bride), Thailand (The Stranded), Taiwan (Nowhere Man and Triad Princess), and South Korea, where now you can't count the number of original content on your fingers.

HBO doesn't want to lose. Even though it's not as big as Netflix, a number of Indonesian filmmakers have been invited to produce content, such as the horror film Dead Mine, the series Halfworlds, Folklore, and Serangoon Road.

As a regional player, Asian content is the choice for Viu, which was founded in 2016, to attract users and so far their premise is right.

Viu Indonesia Country Manager Varun Mehta explained, Viu is now known as a provider of Asian entertainment content. For this reason, the company continues to strive to increase the production of local content to satisfy customers in Indonesia.

He continued, although entertainment content from South Korea is popular, tastes are different when comparing consumers in Jakarta and Medan, for example. The latter prefers local content.

In early March 2020, the company began introducing content from Thailand as the next wave of regional content in Southeast Asia. This availability is thanks to its partnership with GMM and One31.

"We usually release around 25-40 drama episodes with various titles every day. The availability of new content is the main factor why consumers continue to access Viu," he explained as quoted from Bisnis.com.

The company also attracts local Indonesian filmmakers to produce content on Viu. The latest data shows Viu's monthly active users are nearly 41 million in 16 countries and it was watched for more than five billion minutes last year.

The Asia Pacific online video market in 2024 is expected to cross the $50 billion mark according to Media Partners Asia. Last year it was estimated that there would be an increase of 24% from the previous year. They also said that the SVOD model will experience adjustments, while the AVOD model contributes to the majority of revenue.

The seven largest APAC clusters will sequentially dominate the online video market in 2024. They are China, Japan, Australia & New Zealand, India, Korea, Taiwan and Indonesia.

Local players

Of all the countries in the Southeast Asia region, the biggest business cake is in Indonesia. The report of Statista predicts that Indonesia's revenue for OTT will be $161 million with 21,9 million users this year. This value increase reached double digits compared to 2019.

This prediction seems to be true because the impact of the Covid-19 pandemic and the work from home policy has resulted in high consumption of OTT services. Telkomsel noted an increase in data consumption for work support services, instant messaging communications, online games, and streaming videos. Other telecommunications operators also reported similar gains.

Domestically, many players have emerged, such as Genflix, Vidio, GoPlay, KlikFilm (Falcon Pictures production house), MaxStream and UseeTV Go (Telkom Group), Mola TV, FirstMediaX. FTA TV stations also released such as Vision+ and RCTI+, both of which belong to the MNC Group.

Vidio, Genflix, UseeTV, and FirstMedia They have been operating since 2014. Of the four, video it could be said to have the fastest traction. This application occupied first position on the Top Chart of the App Store and Google Play during the pandemic.

To DailySocial, VP Brand Marketing Vidio Rezki Yanuar said, Vidio's journey was able to reach its current stage because of the strength of local content which is varied and can target all age groups. However, a wealth of original content for OTT platforms is a must.

"It cannot be denied that original content can be seen as the strength of the OTT brand itself which can show the identity and quality of the brand. Specifically, for us, original content is “anchor content"Just like every terrestrial television station broadcasts which has its own soap operas or flagship programs," he explained.

The increase in original content from various OTTs will increase the volume of diversity so that gradually the quality of Indonesian viewing will continue to hone from day to day. Unfortunately, Rezki is reluctant to detail the Vidio content spending budget per year.

In its catalog, Vidio presents international shows such as films and series from various Asian countries, from South Korea, India and Hollywood. Then, national and international TV shows, educational, religious, children's animation, and thousands of sporting matches from various branches. Local film shows are also enriched from the latest releases to nostalgia.

He said that in March 2020, the number of active Vidio users reached 62 million people, up 30% from the previous month. It is predicted that this trend will increase in line with the government's recommendation to work from home and the ban on going home. The largest demographic of users is 25-34 years (41%), over 35 years (35%). Men are the largest users at 59% compared to women at 41%.

Apart from enriching content, price is of course part of the "sensitive” for Vidio users. Prices for subscriptions start from IDR 15 thousand (1 week), IDR 29 thousand (1 month) and IDR 300 thousand (1 year).

From the catalog collection and subscription prices, Vidio's target users cannot be compared to Netflix. The video is more directed at mass market with the lower middle class. This difference in strategy shows that each OTT has its own market.

The rapid expansion of global OTT means that regional and local players must be prepared with counter strategies. The more "local"The solution that consumers get will make it easier to gain loyalty. This method is ultimately used by various local OTT players.

Moreover, as explained by Arravind Venugopal, getting into the habit of paying for programs that can be obtained when watching TV at home for free is not an easy task for Southeast Asian people, including Indonesia.

The governments in each country are also united in making fair rules of the game so that they comply. Blocking is certainly not a wise choice because consumers have the right to choose which ones they want to enjoy. The more prohibited it is, the easier it is to bypass because of the sophistication of VPNs.

Sign up for our

newsletter

Premium

Premium