How is the New Behavior of Fintech Application Users during a Pandemic?

Globally, there is a change in behavior that makes users more active and longer using financial applications.

The pandemic situation does not only encourage accelerated growth of app usage in the financial services sector such as fintech and banking, this difficult period is also suspected to be one of the factors in changing user behavior when using it. Financial services that adapt to be easily accessed via mobile platforms, also make users have new preferences and usage patterns.

Then, to what extent does this change in behavior occur when viewed globally? In this article, we will discuss changing the behavior of app users fintech and banking which are summarized from Adjust's Mobile Finance Report 2020.

Users are More Active in Using Applications

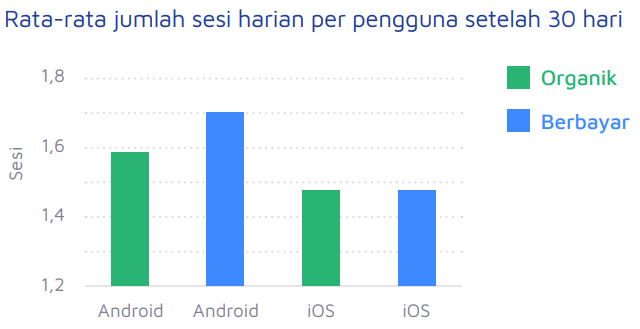

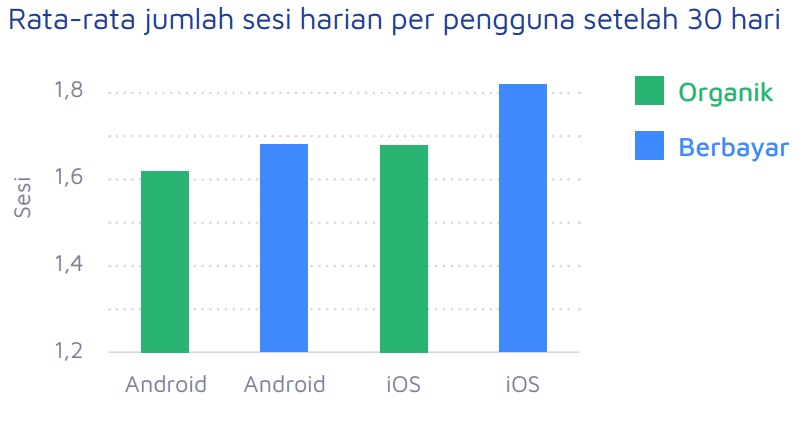

Activities that must be carried out in a limited manner during this pandemic make users have more time to use financial services through applications directly from home. According to Adjust's data, users of payment, banking, and investment apps became more active in using the app thirty days after using the app.install application.. This activity can indicate a better retention rate and show users not only use the application for one-time use, but continue to actively use it for thirty days after using the application.install the application.

From the same report, this user activity occurs in two types of users, organically acquired and paid users although with its own dynamics in each type of application. From the perspective of marketers and app owners, this fairly long live duration can also be used for them to do new targeting or also re-engage users who are starting to show decreased activity within the app. This can be done by creating new marketing campaigns or offers, so that old users are again encouraged to interact in the application.

Users Spend More Time Inside the App

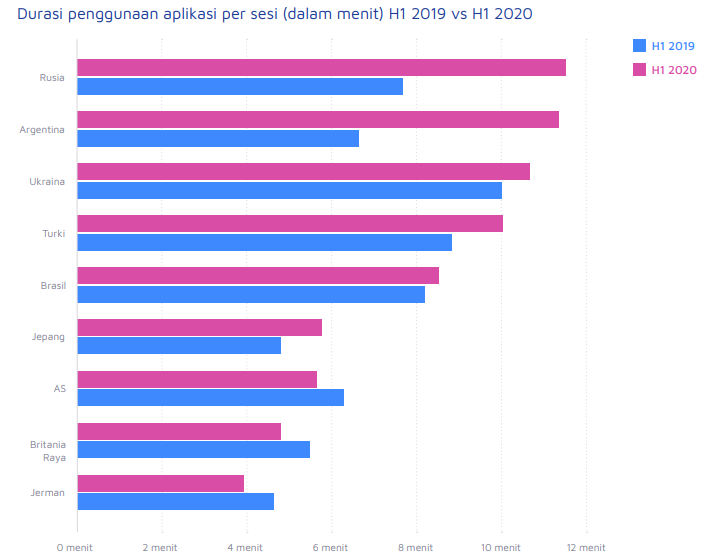

In addition to a significant increase in terms of number of sessions and app installs In the financial services category, Adjust's data also shows that users spend more time using financial services applications during this pandemic. For comparison, in the first semester of 2019, financial service users had an average of 7,7 minutes per session in the application, while in the same period in 2020, it increased to 8,35 minutes per session or an increase of 8,9 % globaly.

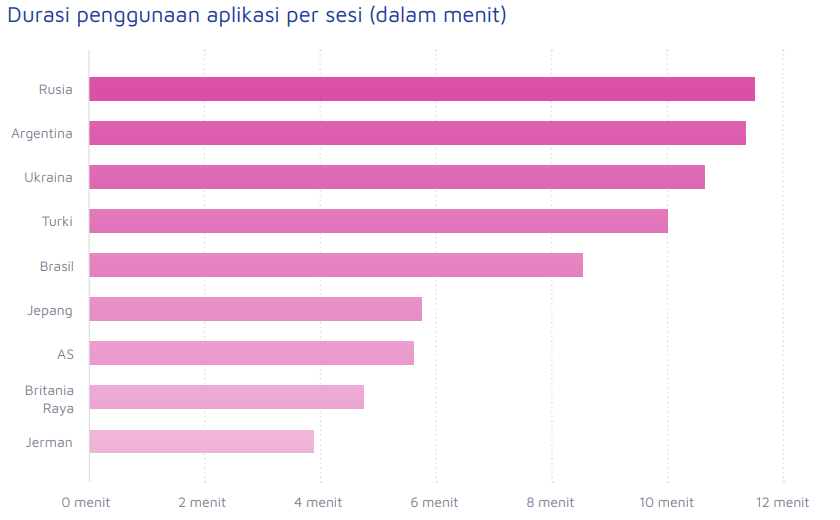

If we look deeper, this increase occurred significantly in the second quarter of 2020, which is when the policy lockdown or social restrictions began to be imposed almost all over the world. Russia is the country with users who spend the longest time using the application (11,5 minutes per session), followed by Argentina (11,3 minutes per session). In addition, Ukraine (10,6 minutes per session) and Turkey (10 minutes per session) also showed average usage that was above the global average.

Duration of use of financial services applications per session

Menurut Adjust's Mobile Finance Report 2020, the length of time spent using this application also tends to have a correlation with the country with a proportion unbanked tall one. One approach that can be used by owners of financial service applications for new users who also have a new bank is to provide an educational approach. So that it can invite longer interest and use to explore these services.

When compared to the usage time of the previous year, Argentina was the country that experienced the highest growth of 72%. Other countries that also recorded quite high growth were Russia and Brazil, which amounted to 50%.

This change in user behavior can be a lesson for service owners fintech to understand new marketing needs adapted to the new habits of its users. One of the challenges found by application developers is how users can continue to use their applications.

For that, an easy experience, tailored, and seamless pattern, and supported by attractive offers from the application can help encourage users to continue to use the application of financial services provided. If retention of existing users can be overcome, marketers can focus on acquiring new users to continue growing their business.

You can also find out more about behavioral changes in users of this banking and financial service application through Adjust's Mobile Finance Report 2020 which can be downloaded via the following link.

Disclosure: This article is sponsored content endorsed by Adjust.

Sign up for our

newsletter