Aspire Closes 2,2 Trillion Rupiah Series B Funding, Provides “All-In-One” Financial OS for SMEs

Led by a number of local startup angel investors; in Indonesia operates under the name Alumak

Startups neobanks from Singapore Aspire announced the acquisition of series B funding of $158 million (over 2,2 trillion Rupiah), in equity of $58 million and debt of $100 million. The round was led by global growth equity investors focused on fintech with anonymity.

Also participating were other investors, such as DST Global Partners, CE Innovation Fund, B Capital Partners and previous investors, namely Mass Mutual Ventures, Picus Capital, AFG and Hummingbird Ventures. Meanwhile, for investors debt comes from Fasanara Capital.

This round also involves angel investors from multiple startups fintech famous, like co-founder Wise, Taavet Hinrikus; co-founder Qonto Alexandre Port and Steve Anavi; founder Uala, Pierpaolo Barbieri; co-founder Xendit, Moses Lo; co-founder payfazz, Hendra Kwik; and co-founder Clara, Gerry Colyer.

Aspire was founded in 2018 to provide working capital loans to small to medium-sized businesses, but soon after it was founded, the company started taking a multi-product strategy. Its service portfolio includes bank accounts for cross-border businesses (cross border), corporate cards, and automated invoice processing, all of which are linked to financial management software. The company also operates a merger service for a Singaporean company called Aspire Kickstart.

"What we're trying to do is connect traditional banking services with software because we recognize the biggest problem, that the two are completely disconnected," said Aspire Co-founder and CEO Andrea Baronchelli. TechCrunch.

He continued, “We see a world dominated by integrated platforms across multiple business functions such as Salesforce for sales or Slack for communications. We believe the same is true for finance and we are here to build an operating system for Southeast Asia's digital economy.”

Based on the company's product research and interviews with business partners, Baronchelli said that the average SME uses seven providers for their bank accounts, credit solutions, foreign exchange, invoice management and payroll and accounting. Aspire's goal is to be an integrated and comprehensive solution for SMEs.

Most Aspire customers sign up when they need their first business account or corporate card, and then start using other products as they grow. For large SMBs that already have a business account, Aspire tries to attract their attention with value-added products, such as its expense management software or credit solutions.

Aspire credit cards and working capital loans typically start at around $50.000 and can go as high as $300.000, but can be adjusted as the business grows to improve lines of credit. More than 10.000 business accounts have been opened on Aspire, and in total they transact about $2 billion per year, doubling in the five months since May 2021.

Aspire is currently developing a payroll system, considering that many of its clients have employees in various countries. This solution also adds more features to the invoice management tool to make reconciling payments with account balances easier.

In addition to Singapore, Aspire also operates in Vietnam and Indonesia (under the name Alumak). In IndonesiaCurrently, the company offers credit limit products for MSMEs with a nominal starting from IDR 2 million with an interest of 1% per month. The company will release the Business Account service which was previously present in Singapore. This product allows entrepreneurs to receive and send money through the Alumak application and the Aspire Visa Card. At OJK, Alumak has been registered under the IKD rules.

Productive financing trends

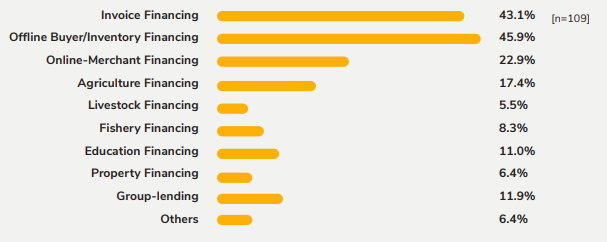

According to the survey results summarized in the report “Evolving Landscape of Fintech Lending in Indonesia" by DSInnovate and AFPI, 75% of survey respondents (146 players ) working on the productive lending sector. While 53% play in the consumptive sector and 6,8% in sharia. However, one platform may have more than one business model.

More Coverage:

Of the total players who play in the productive sector, the majority peddle services through invoice and inventory financing — financing to supplier also included in it.

The productive sector is clearly more promising, especially now that there are around 59,2 million MSMEs spread across Indonesia, this is reflected in the profile of the majority of borrowers in these services (offline and online MSMEs). The issue of capital is still one of the most significant because bank credit facilities have not fully accommodated these needs.

Sign up for our

newsletter