Financial Recording Application "Moni" Debuts, Supported by Achmad Zaky as Investor

One of its unique features is that it provides automatic recording services of transactions in various applications

Leveraging relevant data sources, the official lifestyle financial recording platform "Moni" is launched. Founded by Ahmad Faiz Nasshor, an alumni of the University of Manchester as well as ex-Product Manager of Bukalapak, along with several colleagues who have experience working in companies unicorn, the application wants to make it easier for the public to manage finances.

The initial version of Moni utilizes data from application and email notifications -- related to financial transactions. For example, a user makes a transaction at Tokopedia, buys food at GrabFood, and money transfers through Bank Jago, Moni will record all these transactions automatically. Currently Moni has been integrated with more than 15 application products; at the end of the year, the target is to reach at least 25 products.

"The various data sources available are expected to help achieve Moni's vision to make personal financial management easy and fun. In the future, Moni can become a one-stop solution for all topics related to personal financial management and automatic record keeping is the foundation to achieve that dream," said Faiz.

After receiving funding from angel investorsAhmad Zaky, in the future Moni also has plans to carry out an advanced stage of fundraising. Currently, the company is still exploring with several investors.

"There are a lot of plans that we want to achieve this year, but in general our target is to make Moni's automated recording process more accurate and support more products," said Faiz.

Feature advantages

For now, Moni has not launched a monetization strategy on the platform. Their focus is on making products to solve the problems that 60 million millennials and middle class in Indonesia in terms of personal financial management.

"In the future, the company has identified several potential revenue streams. One of them is the existence premium members who will give benefits especially for Moni users in terms of features or other programs," said Faiz.

Unlike other similar platforms, Moni focuses on free automatic note-taking. Most financial recording applications available today do not provide automatic record keeping.

Moni also puts forward local flavors. Of the applications that provide automatic logging, there is very little integration with local products. Even though Indonesia currently has a lot of new financial products such as GoPay and OVO.

"The variety of data sources used will make the data that can be provided by Moni become more complete. In the future we will continue to look for new data sources that are used to make Moni's automatic records more accurate," said Faiz.

Until now there are already thousands of users registered on Moni with growth which is claimed to be quite high. After launching the integration feature with email at the end of May 2021, the number of new registered users increased by 3x per month with an increase in the number of transactions recorded by more than 10x. This is because with the email integration, Moni can record automatic transactions from more than 15 products that users commonly use, ranging from E-commerce to motorcycle taxi online.

"Currently Moni is only available in the Android version, but we already have plans to develop an iOS version. Moni is currently available on the Play Store and can be downloaded freely," said Faiz.

The pandemic drives transaction growth online

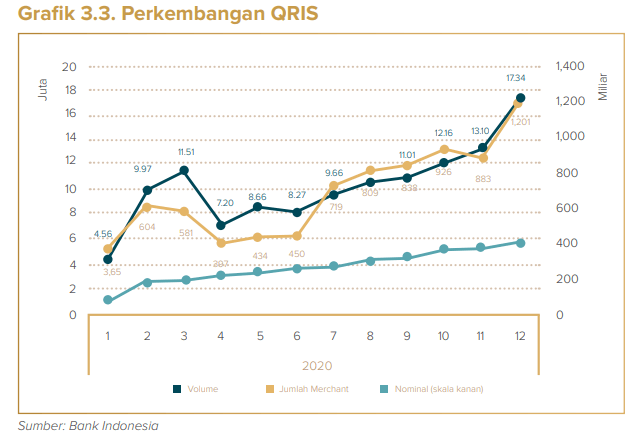

The pandemic has had a significant impact on Moni's business. One of them is, more and more people are diverting their transactions from offline menjadi online, including the shift in the mode of payment from cash to QRIS which is increasing. Bank Indonesia noted that in 2020, the growth of its use was increasing.

Data from BI also recorded an increase in digital transactions which reached 201 trillion Rupiah in 2020, up 38,62% from 192 trillion Rupiah in 2019. Changes behavior from the community has a positive impact on platforms such as Moni, because automatic recording can only be done from transactions made digitally.

More Coverage:

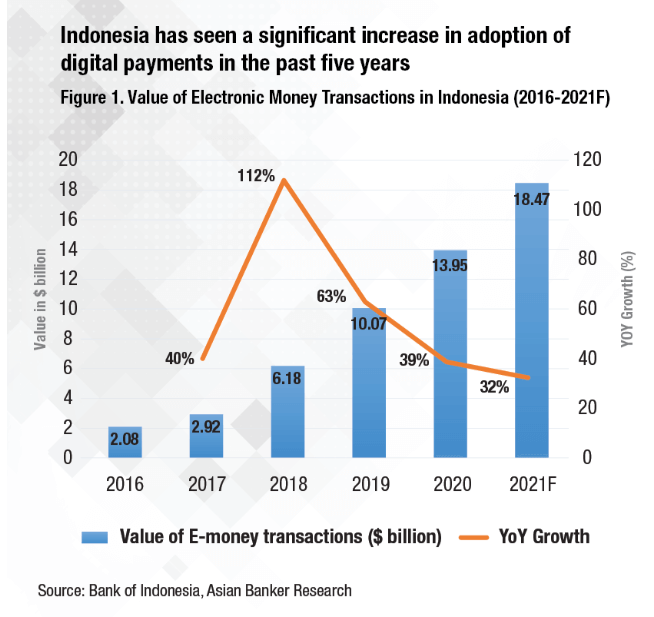

It was also recorded that the use of electronic money reached 24 trillion Rupiah during June 2021, an increase of 60% compared to the same period in 2020.

"These facts show that the use of Moni as a personal financial management application is currently becoming increasingly relevant along with the increasing needs of the community," said Faiz.

The increase in digital payment transactions reflects the development of digital financial literacy of the Indonesian population. This also indicates an increase in service acceptance fintech and E-commerce in the homeland. BI estimates that the absorption of digital transactions will continue with E-commerce and electronic payments grew 33,2% and 32,3% in 2021, respectively.

Sign up for our

newsletter