Multi-Asset Investment Apps Drive Upward Trend for Retail Investors

On average, retail investors invest in mutual funds (29,8%), stocks (21,7%), and crypto assets (21,1%) with a range of placements of up to IDR 1 million per month

App presence wealthtech with multi-asset investment is claimed to be one of the factors driving the upward trend of retail investors. This is because they can integrate multiple asset classes to expand their portfolio, monitor their assets, and help plan for long-term goals.

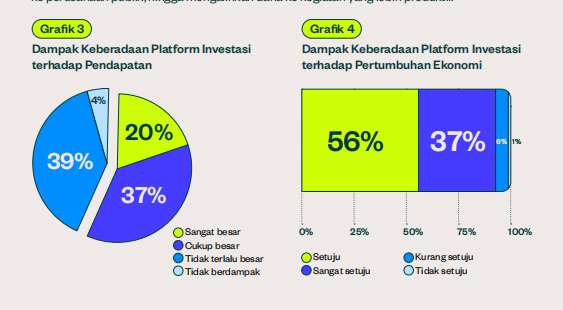

According to a study entitled “Impact of Multi-Asset Applications on Retail Investor Growth” ypublished by Pluang and the Center for Economic and Law Studies (CELIOS) research institute, stated that more than half of the 3.530 respondents surveyed felt that the existence of a multi-asset application platform had a positive impact on their income.

As for the profile of these respondents, the majority are from Java and Bali, with an age group of 24-35 years (45%), and their main occupation is private employees (38%). Of this population, the majority of respondents said they invest to increase passive income and long-term investment goals, such as setting up an emergency fund, retirement fund, and children's education fund.

When asked further, the majority of respondents stated that the existence of an investment platform had a positive impact on retail investor income and economic growth. They have the perception that investing can increase state revenue through tax revenue, expand job opportunities through funding to public companies, and divert funds to more productive activities.

CELIOS Executive Director Bhima Yudhistira explained how retail investors perceive their digital investment behavior. “[..] Investing in digital investment platforms is considered an act of contributing to the improvement of the information technology sector, assisting corporate funding, and the employment creation effect of investment. This is a positive indication that the digital investment platform is able to encourage the creation of investment-oriented society or people who are investment literate.”

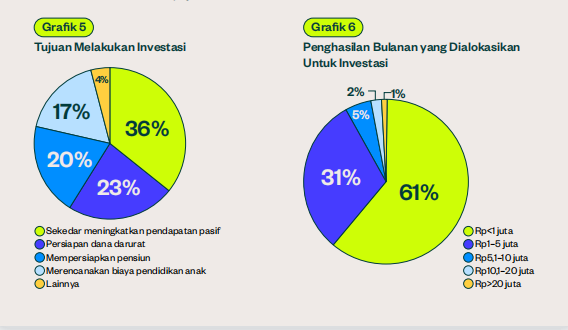

Furthermore, the majority of respondents stated that they invest to increase passive income (36%), prepare an emergency fund (23%), and prepare for retirement (20%). The monthly allocation of income to invest is less than IDR 1 million (61%) and IDR 1 million-IDR 5 million (31%).

According to data CoFTRA, the figure above is directly reflected in the conditions in the crypto asset. CoFTRA observed that as much as 70% of crypto asset investors allocate their income with an investment nominal of under IDR 500 thousand. Supported by other data, KSEI data shows that as of April 2022, 60,29% of capital market investors are under 30 years old, on average they are still in the early and mid-professional careers.

"This shows that access to crypto investments is getting easier with more affordable nominal to start investing in crypto assets," said Head of the Bureau of Market Development and Development of CoFTRA, Tirta Karma Senjaya.

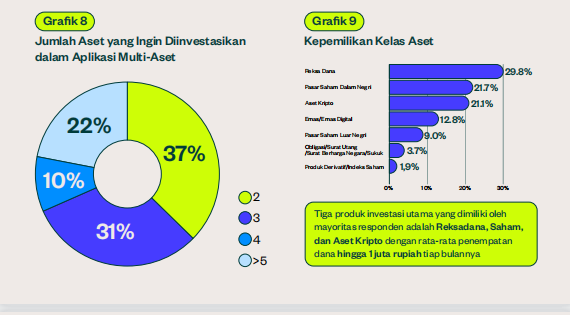

Respondents also stated that the existence of multi-asset applications made the majority of them want to add investment instruments up to two (37%) to three asset classes (31%). In addition, 80% of respondents also want to learn about other investment products.

Respondents stated that they have at least three main investment products, namely mutual funds (29,8%), stocks (21,7%), and crypto assets (21,1%) with an average placement of funds of up to IDR 1 million per year. the month.

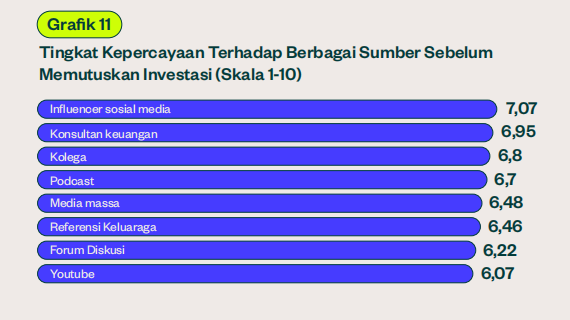

This study highlights the high preference of the respondents to have an influencer finance on social media (fin influencers) as a reliable source of information. Based on the available options, respondents have fin-fluencer with first rank. Then followed by recommendations from financial consultants, colleagues, and podcasts.

Pluang and CELIOS recommend capacity building for these influencers to provide valid and educational financial literacy.

More Coverage:

Co-founder Pluang Claudia Kolonas conveyed, this study is Pluang's commitment to increasing the scope of financial literacy and inclusion, as well as accelerating the economic growth of technological innovation in the financial sector in Indonesia.

“With technological innovation in the digital finance sector, this study on the retail investment sector is expected to open up a lot of space to build a conducive digital financial ecosystem. [..] Also as a reference that can be the basis for making policies that encourage the acceleration of the digital financial sector,” said Claudia.

Sign up for our

newsletter