Akulaku Partner with Alipay+ to Expand PayLater Services

Users can now transact Akulaku Paylater at various global merchants belonging to Alipay+

Akulaku announced a partnership with Alipay+ to expand the use of Paylater products. Through this partnership, consumers can transact using payment methods Akulaku Paylater in various merchant global owned by Alipay+.

In his official statement, this collaboration is expected to open access to digital financial services for the consumer segment with limited credit history and those who are not served by formal financial services. Meanwhile, this partnership is called the first Buy Now Pay Later (BNPL) collaboration product for Alipay+ in Southeast Asia.

"Consistently, Akulaku PayLater continues to expand service penetration through strategic partnerships with platforms with network coverage merchant large. We hope that the payment method in Alipay+ can add use case digital financial solutions. This partnership is our commitment to create a more advanced and convenient financial landscape for users," said the President Director Akulaku Finance Indonesia Efrinal Sinaga.

Akulaku PayLater averages 8,6 million transactions per month with the largest user base in Indonesia. Currently BNPL Akulaku connected to various networks merchant leading companies, including Shopee, Bukalapak, Tiket.com, to Alfamart. His party is currently exploring to expand the scope of transactions at various Alipay+ merchants.

General Manager of Global Partnerships Alipay+ Cheng Guoming assessed that BNPL has become an important part of the digital payment ecosystem. Therefore, his party is enthusiastic about this collaboration so that the people of Indonesia and other potential markets can enjoy smooth and convenient cross-border payment services.

For information, Alipay+ first launched in 2020 which allows global business players, especially in the SME segment to accept digital payment methods from various countries and reach hundreds of millions of regional and global consumers. Currently, Alipay+ is connected to one million offline merchants in Europe and Asia, including global platforms, such as Apple, Google, Agoda, and TikTok.

Alipay tries to enter Indonesia

Alipay's journey to enter Indonesia is quite winding. However, the government through Bank Indonesia (BI) has indeed tried to encourage Alipay and WeChat Pay since 2018 to partner with local banks to operate here.

This is because WeChat and Alipay are two digital payment services that are widely used in China. This automatically becomes a big potential considering that many tourists from China are familiar with the platform.

To enter Indonesia, Alipay is known to have explored the potential for cooperation with a number of banks. In notes DailySocial.id, Applications for this cooperation permit have been made, among others, with Bank CIMB Niaga, Mandiri Bank, and BCA.

In this case, the local bank will be the facility (acquiring), is not a facility operator (issuing). For example, BCA will provide EDC machines in merchant visited by tourists from China, such as tourist areas.

Prior to the Covid-19 pandemic, number of tourists from China throughout 2019 it was reported that it reached 2 million people, down 3,1% compared to 2018 which was around 2,1 million people.

Happen paylater

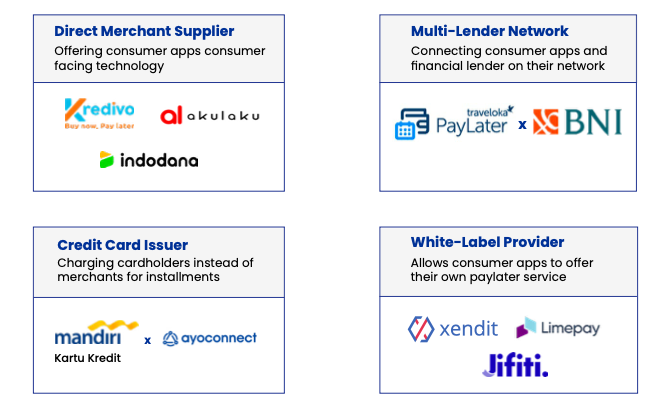

PayLater is one of the innovations to expand access to finance in Indonesia. Moreover, credit card penetration in the country is only around 6% of the total population. Besides Akulaku, multiple platforms paylater which are also competing in the Indonesian market, among them are Kredivo, Home Credit, Gopaylater, to Atome.

More Coverage:

Kredivo which is a startup unicorn in the field paylater first in Indonesia, becoming one of the strong competitors because it has hundreds of networks merchant online and offline, including marketplace large, such as Tokopedia, Bukalapak, Shopee, and Lazada.

Based on reports DSInnovate about "Indonesia Paylater Ecosystem Report 2021", paylater (72,5%) is in the second position of the total fintech products that are most widely used in Indonesia. In the first place is digitalmoney (82,2%) and investment (57,3%). Meanwhile, the market paylater is projected to reach Gross Merchandise Value (GMV) from $889,7 million in 2020 to $8,5 billion in 2028.

Sign up for our

newsletter