AFPI and EY Parthenon Research Map the Current Condition of MSMEs

MSMEs in Indonesia are grouped into four major clusters

The Indonesian Joint Funding Fintech Association (AFPI) together with EY Parthenon Indonesia launched a research entitled "Market Study and Advocacy of Indonesian MSMEs" to map the current condition of MSMEs. This research aims to make policies that are right on target.

So far, referring to conditions in the field, the grouping of criteria for MSMEs in Indonesia is quite diverse because each government institution does not yet have a single definition of the MSME segment due to having different agendas, as happened at the Ministry of BUMN, Ministry of Industry, and Ministry of Tourism and Creative Economy. Meanwhile, referring to Government Regulation Number 7 of 2021, the definition of national MSMEs has room for development.

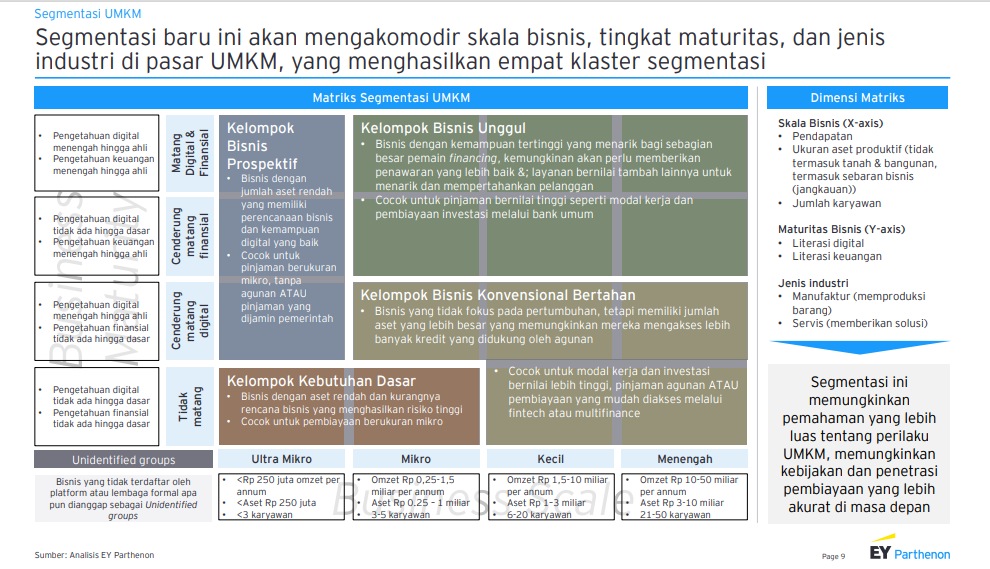

This research categorizes MSMEs in Indonesia into four clusters that are more detailed in order to support decision-making for providing financing that can be more targeted to stakeholders, including P2P organizers, in order to strengthen the economy through MSMEs.

AFPI Secretary General Sunu Widyatmoko said, AFPI feel the need to map the MSME segmentation to find out in more detail about the condition of MSMEs in the country, so that they can provide targeted funding. AFPI members are expected to become the motor for increasing the distribution of financing, especially to reach the market unbanked and underserved.

"In AFPI and EY's research, it is felt necessary to add elements of digital literacy and financial literacy, to strengthen the MSME segmentation that has existed so far. It is hoped that AFPI members can increase visibility of the potential of MSMEs in the future, so that it becomes our real contribution to national economic growth," he said, Friday (14/7).

The four MSME segments are:

- Prospective Business Group: Ultra micro and micro scale businesses with high digital and financial literacy, have the potential for business planning capabilities.

- Basic Needs Group: Ultra micro and micro scale businesses with low digital and financial literacy, resulting in higher potential financing risks.

- Conventional Business Groups Survive: Small to medium-sized businesses with low digital and financial literacy, are focused solely on maintaining their status-quo.

- Superior Business Group: Small to medium-sized businesses with high digital and financial literacy, have the highest attractiveness in terms of funding.

This segmentation is designed to complement the existing MSME segmentation, or those grouped based on business capital and annual income according to Government Regulation Number 7 of 2021.

This new segmentation also accommodates the number of employees, digital and financial maturity level, and type of industry (manufacturing or service in the MSME market), thus broadening the scope of understanding the profile and behavior of MSMEs, as well as encouraging policy formation and more accurate financing penetration in the future.

EY Parthenon Indonesia's Partner for Strategy and Transactions Anugrah Pratama said, the current national definition of MSMEs still has room for development to be adjusted to industries that need it. Through this research, it is hoped that all stakeholders, including the government, will have an integrated definition to be able to align and formulate a stronger strategy for the MSME segment.

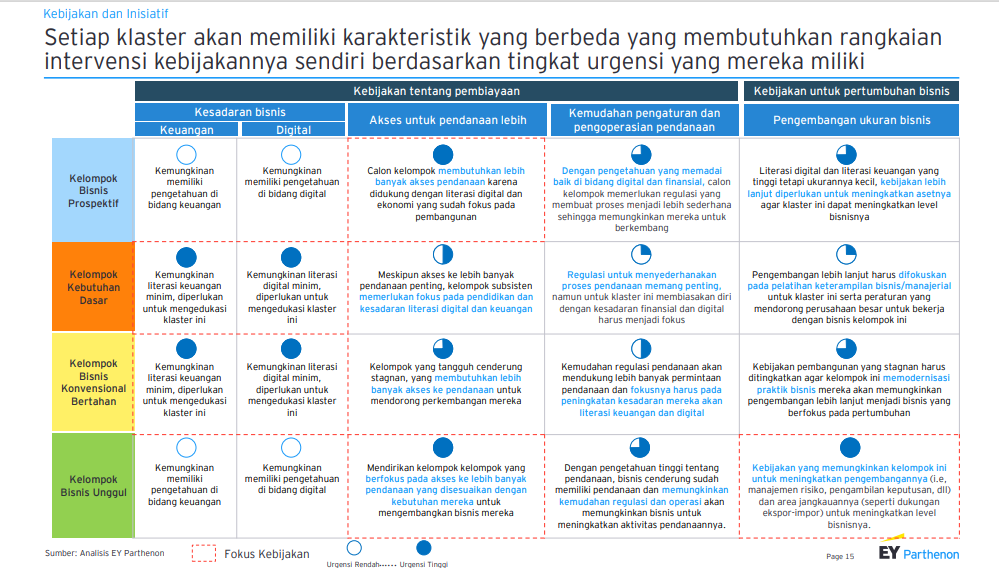

Each of these segments has different problems and solutions. In the research presented, the Prospective Business Group needs policies related to easy access to financing, while the Basic Needs Group needs policies related to increasing their digital and financial awareness.

Furthermore, the Surviving Conventional Business Group requires policies related to increasing digital and financial awareness. Finally, the Superior Business Group needs to increase the provision of financing and access to business development.

"This MSME segmentation answers a number of possible specific financing risks per cluster that must be considered. Each of these clusters requires a series of policy interventions based on their level of urgency. Therefore, taking the right steps is very important so that the financing is not misdirected and avoids widening gaps. getting bigger," he said.

Distribution is uneven

This research also found that the spread of demand for financing across regions is not uniform because it has a unique cluster composition. Demand for MSME financing is still concentrated in Java and Bali, namely 62% of total MSME financing in Indonesia in 2022 and will be 61% in 2026.

In 2022, the total MSME financing supply is IDR 1400 trillion and in 2026 it will be IDR 1900 trillion. Meanwhile, the segment with the highest growth is in Eastern Indonesia on the Ultra Micro and Micro scale (Prospective Business Segment) which has a CAGR growth rate of 23,1% between 2022-2026.

Demand for financing from Eastern Indonesia is estimated to reach IDR 250 trillion in 2026, of which 24% or around IDR 60 trillion will come from the Prospective Business group. However, until now, access to funding is still limited in these areas.

Meanwhile, large-scale businesses that are still immature (Conventional Business Segment Survive) still dominate demand for financing in Kalimantan. This condition requires a combination of financing and awareness programs to help MSMEs grow optimally.

"There's still a lot of potential and we agree [it's] in Beyond Java Bali. Indeed, considering the business, the biggest market is here because growth the biggest. But other [outside Java] are also growing. If mindsetjust come here, market will be saturated. But it should be noted, if you become a champion in Java, it is not certain that [with the same product and strategy] outside Java will be successful because the target audience and habits are different," added Anugrah.

Head of AFPI Public Relations and CEO & Founder of Amartha Andi Taufan Garuda Putra said, "By understanding the different financing profiles in each region, financial institutions including AFPI members can find out the potential funding that can be disbursed. In this way, MSME cluster segmentation can serve as a guide for all stakeholders, including the government in formulating key policy initiatives that are in accordance with their respective regional profiles.”

Previously, EY projected that the total MSME financing needs in 2026 would reach IDR 4300 trillion with a supply capability of only IDR 1900 trillion. That is, there is a difference or gap of IDR 2400 trillion of the total financing needs.

Demand and supply grow at nearly the same growth rate, namely the Compound Annual Growth Rate (CAGR) ~7,2% from 2022 to 2026. This causes the difference in financing to also grow at a CAGR rate of ~7%, so gap will continue to widen due to its positive growth rate.

Sign up for our

newsletter