Observing the Actions of Chinese Investors for Indonesia and ASEAN

Trends in China cannot be 100% replicated for this highly fragmented region

China is not only the second strongest economy in the world, now they are also the leader of the technological innovation competition in various aspects through its giant internet companies.

Whereas in the past the Bamboo Curtain country was dubbed a copycat country because it created cloned products for companies in Western countries. This assumption is now outdated, in fact the trend is now reversed.

In the report made South China Morning Post titled China Internet Report 2019, the easiest example is how China pioneered the model great app. Its success has attracted local developers in other countries to follow, such as Gojek, Line, Facebook, to Uber.

China is also leading for social commerce and short videos. The pioneer is ByteDance. His managed application, TikTok, managed to overtake Facebook in the United States with the highest number of downloads.

China's Penetration in Southeast Asia

Menurut Organization for Economic Cooperation and Development (OECD), in ASEAN with an estimated total population of 651 million, the average per capita income was around $4.600 in 2018. This figure is equivalent to China's real income in 2007, representing an 11-year gap between the two countries.

There are conditions and situations that make the habits of Indonesians and other ASEAN countries more or less similar to those of China. The closest example is the massive growth of internet and smartphone penetration.

Professor Nanyang Business Boh Wai Fong explained, China is successful because of the digital economy that was born through applications for smartphones. Chinese people react very positively to it, for example using their smartphones for online shopping.

"People [investors] expect the same trend to prevail in Southeast Asia," he was quoted as saying by the South China Morning Post.

Report e-Conomy SEA 2019 shows 90% of the population in ASEAN use smartphones for online shopping. Whereas almost a decade ago, the ratio was only one in five people who could access the internet.

It is also predicted that the digital economy will reach $300 billion by 2025. This means that ASEAN is a new market opportunity with strong GDP growth and the right macro factors.

These considerations offer Chinese investors new confidence that they can bring Chinese-style experiences and business models that can be replicated.

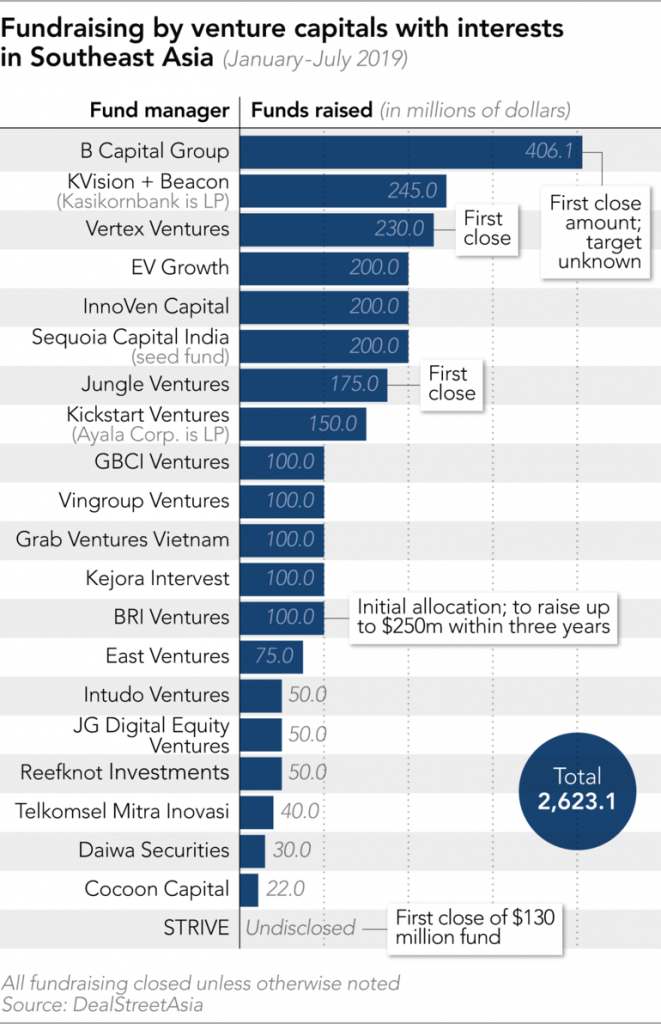

Quoted from Financial Times, nominal investment from Chinese VCs in ASEAN more than quadrupled to $667 million in the first half of this year, from $148 million in the same period in 2018. Overall total startup investment in ASEAN stood at $3,4 billion, up 300 percent for the same period.

In contrast, investment from local VCs for Chinese startups in the same period fell by 60%, to $9 billion.

Two of its biggest VCs, Qiming Ventures and GGV Capital, have established representative offices in Singapore. Both were early investors for Alibaba, Xiaomi, and Meituan-Dianping. When combined, the two have managed funds of $10,2 billion.

The flight of Chinese investors to ASEAN is supported by many factors. From within the country itself, the growth of the digital economy is slowing because it has reached the point of maturity.

Menurut Qiming Venture PartnersInvesting in Chinese startups in telecommunications, media and technology is already too expensive. That's why they run to startups with similar segments in ASEAN.

China's two internet giants, Tencent and Alibaba, have been doing it diligently through their activities in-house M&A over the years to score the next unicorn.

Tencent explained that its portfolio consists of more than 700 companies. Meanwhile, its competitor, Alibaba, has around 350 companies. Their portfolio that has proven to be an Indonesian unicorn is Gojek and Tokopedia.

"If you look at the Chinese, they are not content to just be number one there. Alibaba and Tencent, they are all growing (to other regions)," said Gobi Southeast Asia Managing Partner Kay-Mok Ku.

On the other hand, the unicorn company over there is in gloomy times, an attractive investment of more than $100 million was much less in the first half of the year. The reason for this is the declining valuation of the IPO and poor market sentiment.

This slowdown is felt by the company late stage with a proven business model, break even (breakeven) and can IPO. Investors are worried that when the IPO, the yields are not as expected. Some examples occur in China.

Therefore, these investors are much more careful when they want to invest in new companies.

The entry of the "Winter is Coming" period is none other than the impact of the trade war between China and the United States. Finally influencing investors to be pessimistic about outlook Chinese companies and increasingly believe in entering into a safe investment country.

Southeast Asia is the first stop

Kay-Mok Ku continued, there are three types of Chinese investors. First, the tech giants that already have Arm CVC itself. Second, venture capitalist companies with Southeast Asian partners. Lastly, former employees of tech giants who set up their own VCs.

"They are all looking at the 'bigger picture' and moving into emerging markets 'is the logical path' for now," Ku said.

According to him, ASEAN is the first stop because investors will target other potential countries such as the Middle East and Africa. Even to another developing country, India.

Ant Financial, for example, recently opened fund special for $1 billion to fund startups in ASEAN and India.

Their entry into ASEAN is a form of risk mitigation. In China, startups that are considered mature are e-commerce, ride-hailing, and p2p lending. Therefore, the investment pattern when entering ASEAN will be more or less similar in that Chinese investors are more interested in segments that are consumer oriented.

"If you put yourself in the position of a Chinese starting a startup in ASEAN, there is a reference model, it's easier (for Chinese investors) to understand."

This is different from the startup preferences that investors from western countries are looking for. They are more looking for startups that focus on deep tech, high-tech engineering innovations that require a long research and development time.

This difference in preferences indicates that there is no direct competition between the two investors. It could be said, western investors just missed a golden opportunity.

Similarities between Indonesia and China

The close similarity between Indonesia and China is cognate, both are located in Asia. Geographical proximity, became the most important advantage for Indonesia when it was awarded as China's 10 years ago. But maybe that's not what the country with the second largest economy is thinking.

Historically, the two countries have had diplomatic relations since the beginning of China's formation. Had ups and downs, but strengthened since the leadership of Joko Widodo in the first period until now.

The direction of President Jokowi's government from the start has been to change the orientation of the economy towards digital, just like what China has done. Various literatures that strengthen Jokowi's vision are increasingly appearing. Chinese investors are also busy appearing with a myriad of coffers that are ready to be channeled to startups.

However, according to Financial Times, they arrived a little late because local investors came first catch up with domestic prospects. Examples are Alpha JWC Ventures with Funding Societies (the parent of Modalku) and OnlinePajak.

In 2015, while both founders were at Harvard Business School, Alpha JWC funded Funding Societies at an early stage with a nominal value of $1 million. SoftBank only entered when the startup launched a Series B round. The same conditions also occurred for OnlinePajak which eventually attracted Sequoia and Warburg Pincus to invest.

The above conditions contrast with what happened in India. There, almost every startup isbacking US or Chinese investors.

The largest investment track record from China is through Alibaba, which invests in Tokopedia in 2017. The investment brought Tokopedia as a unicorn, follow Gojek in the same year.

Another similarity can also be seen from the phase of the startup movement, which is also similar to the one previously described by Kay-Mok Ku. Not surprisingly, the unicorns born in Indonesia come from the most familiar segment in the eyes of Chinese investors.

Next year's trend sees patterns from China

Still quoted from the China Internet Report 2019, this report also highlights China's ambition to lead the 5G technology network. The country has the most 5G patents, 5G pilot projects in 50 cities with a population of 167 million.

In addition, China wants to be leading country for three technology sectors, fintech, AI, and blockchain. This trend has a close correlation with conditions in Indonesia.

Here, the development of fintech is starting to spread to the next vertical, not only focused on payments and lending. Starting to spread to insurtech, wealth management, credit scoring, even began to push digital banking. It is certain that fintech will remain an interesting topic.

Meanwhile in China, the incumbent, Alipay and WeChat Pay, continue to develop their innovations and expand their presence on the international scene to serve their people while traveling. Indonesia gets the concentration allotment, the BUKU IV bank is busy attracting these two players so that they can serve Chinese tourists.

Likewise for AI, the product development of its startup players (such as Qlue, Nodeflux, Kata.ai, Bahasa.ai, Snapcart) is growing, collaborating with cross industry sectors. The function of AI is now increasingly recognized that the adoption of AI can improve the efficiency and effectiveness of humans in better analyzing a business direction through collaboration with machines.

As a distraction, China was able to develop rapidly due to a combination of three factors, namely a rapidly growing middle-to-high economic population, advanced technological capabilities, and strong government support. It is also supported by high internet and smartphone penetration.

The above factors are not fully present in Southeast Asia, especially Indonesia. Therefore, back to the original premise: Trends in China cannot be 100% replicated in South East Asia. The reasons are short: there are differences in people's habits.

It's the same when Uber or a technology company from the United States wants to enter China, but in the end they have to gulped because many sides are difficult to penetrate.

Let's look at startups that touch the elements of grassroots, namely agritech, healthtech, and edtech. Many believe that the three will shine even more because the trigger factor comes from the agenda of the Indonesian government itself which wants to focus on this sector.

Election of Nadiem Makarim as Minister of Education and Culture and Andi Taufan (CEO Amartha) and Belva Devara (CEO Ruangguru) as Special Staff to the President, has something to do with it all.

In agritech, for example, comparing Tanihub with Meicai. Both of them connect farmers with B2B buyers, but conditions in Indonesia are still different when faced with payment transactions.

Farmers here still prefer to receive cash to reduce the time spent going to the bank. In a discussion, Co-Founder and President of TaniHub Pamitra Wineka agrees that the key that makes Meicai grow is an efficient and integrated digital payment system.

He believes conditions in Indonesia will change in the future when the digital payment ecosystem is more mature and e-wallet has entered the countryside.

Indonesia still depends on foreign investors

Solution replication in the realm grassroots between China and Indonesia is not fully possible. Then the next question is whether Chinese investors still have room to raise their business octopus? Of course it's still there.

Indonesia is experiencing a shortage of investment from within the country. The government is trying to encourage outside investors to enter, so it puts the task to the ministry led by Luhut Binsar Pandjaitan.

Lippo Group Founder's Response Mochtar Riady Ovo's money-burning strategy has become an interesting spotlight. How the perception of building a company the old way is still so attached in Indonesia.

In order for a company to run sustainably, it must have a strong foundation so that it can withstand various shocks. However, in the technological era, this method is not compatible, which is emphasized in the mindset what's new is the pursuit of growth, then profitability.

As long as you burn money with full calculation how outcome what you want to get, of course it will not be a problem to get to profitability. Outside investors with an open mindset can help with that.

The mistakes made by SoftBank and WeWork should be a serious slap in the face for not just any investment. Moreover, the sluggish condition of domestic investment in China, as well as an additional note so as not to make the same mistake.

These various conditions are a good sign for Indonesia and ASEAN because there will be less momentum playing. The startup assessment here will be more realistic and the founder will be more grounded and focused on good products.

Sign up for our

newsletter