Notes on the Indonesian Fintech Industry in the First Half of 2019

Starting from industry dynamics, the role of associations, to regulatory developments

Financial technology (fintech) become one of the most attractive landscapes in Indonesia. Starting from unicorn until new players take turns presenting innovations in digital financial products. In the first half of 2019, DailySocial record various information regarding the dynamics of the industry. These include news about new players (30), new products/features (24), collaboration between companies (13) and funding for startups fintech (8)

Regarding the new players, the scope is quite diverse. There are playing in the sub-sector p2p loans like practice, e-money like Zipay, aggregator such as Aiqqon, to venture capitalists such as BRI Ventures who will focus on investing in fintech.

For startup funding fintech, until July 2019 there were 13 transactions. Although most did not mention the value, from the 4 startups that disclosed the nominal, a total of $22,3 million was obtained. A total of 7 transactions are the initial round, the rest are Series A and Series B.

When compared to last year, as reviewed in Fintech Report 2018, the number of transactions did increase even though the total value was far below it. In the same period, Modalku (series B), CekAja (series C), Investree (series B), and Kredivo (series B) managed to make more than $80 million.

Another highlight is the increasingly intensive collaboration, both among digital players and with conventional institutions. For example, GoPay collaborated with Google to bring payment options on Google Play. LinkAja helps the Banyuwangi City Government to increase the efficiency of tax payments. Ovo cooperates with a number of to present the installment feature without a credit card.

This collaboration, in addition to improving service capabilities, is considered effective in capturing a wider customer segmentation.

Fintech lending OJK permission

As of August 7 2019, there are 127 players registered with OJK – 9 of them provide sharia-based services. What's new, this year OJK has also begun to provide a way for players to get "business license" status, as the next level after getting "registered and supervised" status.

As of this writing, there are 7 players who have obtained business licenses, namely Danamas, Investree, Amartha, Dompet Kilat, Kimo, Tokomodal and UangTeman.

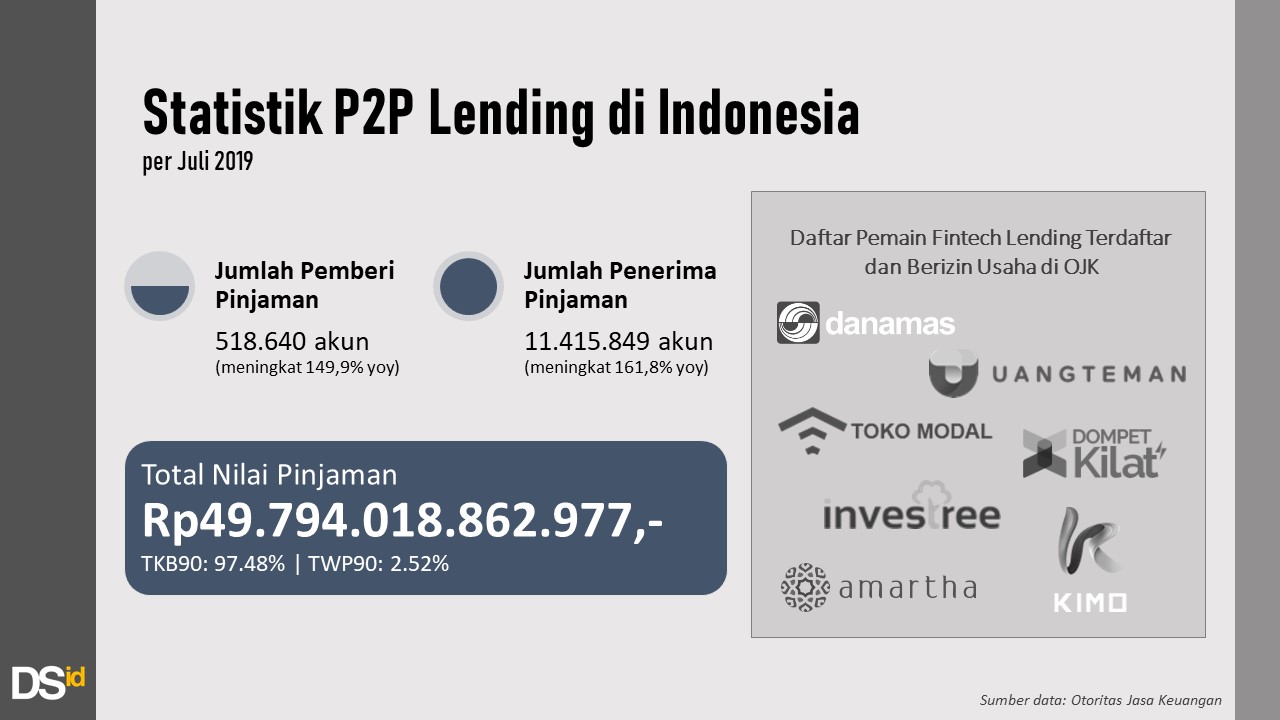

Overall for the line of business p2p loans OJK noted that there was a growth in transactions. At least until July 2019 the value of the loans disbursed was approaching 50 trillion Rupiah with a pretty good TKB90 rate. Participants, both from the side of borrowers and lenders, also continue to grow.

For information, TKB90 is a measure of the success rate of the organizers p2p loans related to transaction settlement within a maximum period of 90 days from maturity. While TKW90 is the size of non-performing loan or default, namely default in the settlement of obligations more than 90 days from the due date. OJK asks each organizer to inform the TKB90 as part of transparency.

QR Code payment standardization

At the beginning of May 2019, Bank Indonesia inaugurated the Standard Indonesian QR Code (QRIS) as the first step in digital transformation in the Indonesian Payment System (SPI) in helping accelerate the development of the digital economy and finance. Simply put, with QRIS, one QR Code can be accessed by various payment services – for example, in a shop, it is only enough to have one code, Ovo, LinkAja or GoPay users can pay by scanning the same code.

One of these initiatives is to make it easier for the public as users, in the midst of the growth of server-based digital payment services. Every year there is always a new platform, although there are fewer than last year, throughout July 2019 there were 3 companies that already had licenses e-money, namely OttoCash, LinkAja and Zipay.

Strengthening the role of association

Beginning in 2019, the OJK issued a letter appointing the Indonesian Joint Funding Fintech Association (AFPI) as official body which accommodates information technology-based money lending and borrowing service providers (p2p lending) in Indonesia. Based on POJK No. 77/POJK.01/2016 Chapter XIII Article 48, then all p2p loans in Indonesia must register as a member of the AFPI.

AFPI will become OJK's strategic partner in carrying out the regulatory and supervisory functions of the organizers who are its members and play a role in supporting various corporate consumer education and protection activities. fintech in Indonesia.

The authority also appointed the Indonesian Fintech Association (Aftech) as the Association for Digital Financial Innovation Providers (IKD), aiming to build an effective supervisory system. IKD here is related to segment fintech which so far have not been regulated by the OJK. This is a term from OJK which refers to it as innovation, not as an industry. So far only two industries fintech that have been regulated, namely p2p loans and equity crowdfunding.

"This year the fintech industry, especially payments and financing, is getting more mature, both in terms of regulation and in terms of the ecosystem. We will see more collaborations to support our efforts to become a market leader,” said Editor-in Chief DailySocial Amir Karimuddin commented on the development and projections of Indonesia's digital finance industry.

- This article is an introduction to the 2019 Fintech Report which will be published by DailySocial in the near future which comprehensively reviews data and information on the Indonesian fintech industry. In order not to miss the update, please register your email to subscribe to the official newsletter DSPatch.

Sign up for our

newsletter