OTT 2022 Summary: Disney+ and Netflix Dominate Indonesian Market Share

Meanwhile in the region, Netflix and Viu dominate the market; also discusses the increasingly lively content localization being intensified

Development video streaming continues to be an issue of interest to Indonesia with the fourth largest population in the world. DailySocial.id compiles various sources regarding the competition for popular OTT platforms that are widely used by Indonesians and what content is most enjoyed throughout 2022.

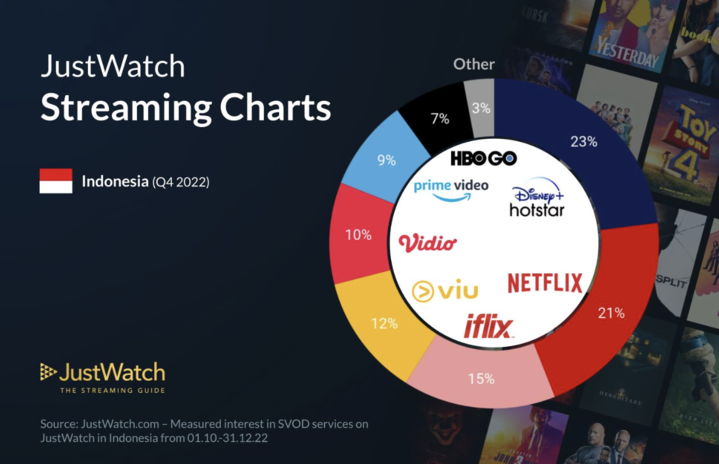

In the latest released data JustWatch, Disney+ Hotstar dominates the OTT market with a market share percentage of 23%. Then, sequentially followed by Netflix (21%), iflix (15%), Viu (12%), Vidio (10%), Prime Video (9%), HBO GO (7%), and others (3%).

Vidio is again the only local OTT platform, with a double-digit increase from the previous year.

This market share figure is even more telling when comparing its growth from data in 2021. At that time, Netflix was the leader with a market share of 21% and Disney+ was (22%). Meanwhile, Vidio numbers are still single digit (5%) is 7th, after Prime Video.

The interesting information is that, even though it's only been in its infancy, Prime Video has been able to record significant growth. This OTT will only become official in Indonesia on August 1 2022, along with other ASEAN countries, namely Thailand and the Philippines. In JustWatch data, in 2021, Prime Video's market share was at 7%.

Regional data

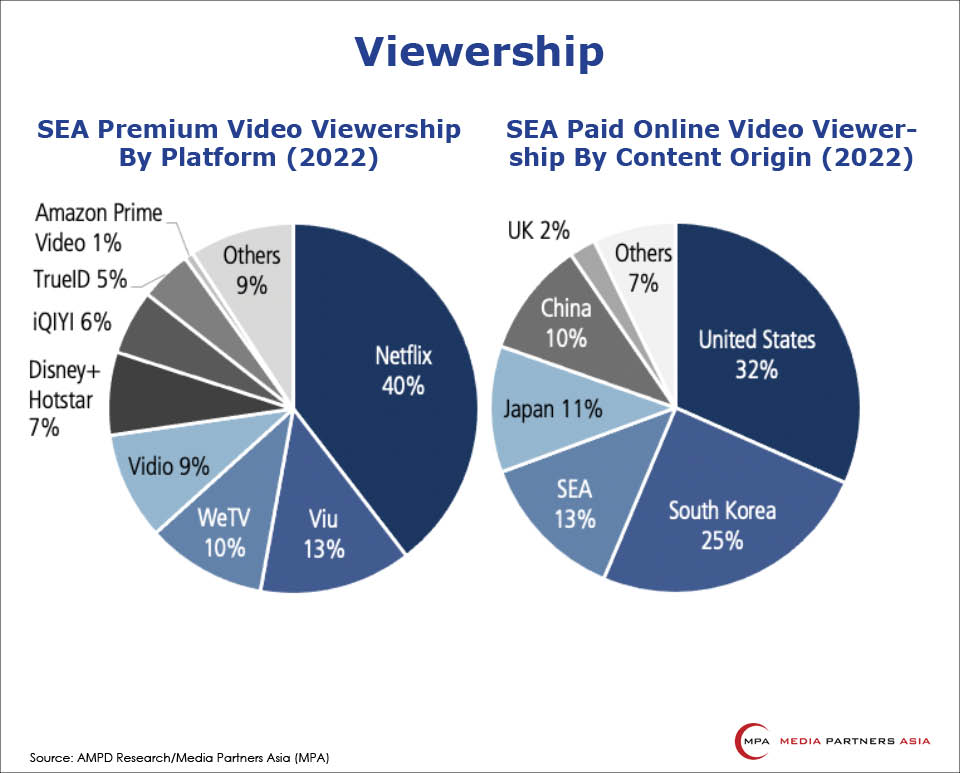

In the report entitled "SEA Online Video Consumer Insights & Analytics", in five ASEAN countries (Indonesia, Malaysia, Philippines, Singapore and Thailand), Netflix and Viu took the top three positions with the highest number of paying subscribers and a combined market share of 52%.

It was also explained that throughout last year there were 48,4 million customers who paid for SVOD services (subscription video on demand), with growth of almost 4,6 million new customers in the fourth quarter of 2022. This is the highest growth since the second quarter of 2021 with 5,1 million new users.

When compiled, there are 2022 million paid users who have just joined throughout 11,8. Indonesia is said to have contributed 50% to growth in the fourth quarter and 51% for the whole of 2022.

Meanwhile, Vidio and Viu were the biggest contributors, accounting for 51% of new subscribers. “Both platforms have built strong customer acquisition funnels through models freemium, with a growing focus on paid content and subscribers,” the report said.

Indonesia and Thailand remain the largest SVOD markets in Southeast Asia in 2022, retaining 75% of aggregate SVOD subscriptions. Netflix, Viu, and Disney account for 52% of total SVOD subscriptions in Southeast Asia.

MPA analysts said that Prime Video's localization efforts in Indonesia, the Philippines and Thailand were successful in creating strong appeal with a net addition of 400 thousand new users. Indonesia is the strongest market for Jeff Bezos' OTT, its momentum is driven by content from Korea and local.

Not only that, Prime Video also imitates the initial strategy used by Disney+, namely collaborating exclusively with telecommunications operators with the largest user base in Indonesia, Telkomsel. In this collaboration, every user purchasing a data package can enjoy unlimited content on Prime Video. There is also a dedicated local team tasked with marketing content at full scale, so the experience is truly localized.

Although Amazon is a bit late in introducing its services in ASEAN. However, the potential of the industry video streaming The region's offering of 180 million consumers with 8 billion hours of OTT content per month across the region, according to a study from The Trade Desk, makes the achievement quite impressive.

Content localization

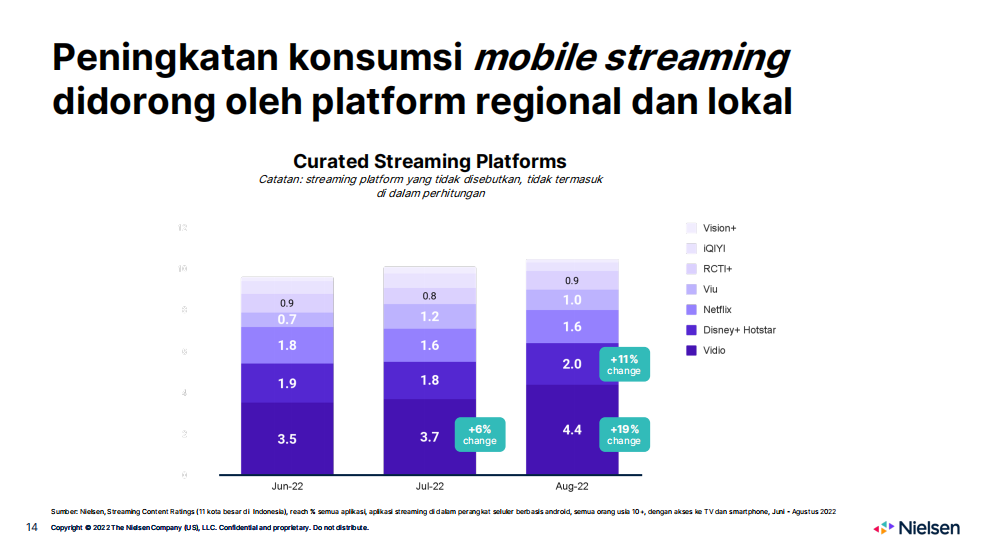

Menurut report Nielsen Streaming Content Ratings, explained that Vidio excels as a local OTT that produces 40 original series content a year. The number exceeds the combined series funded by Netflix and Disney+ in Indonesia.

This strategy has succeeded in making Emtek's OTT the OTT with the highest consumption growth outside of YouTube. After Vidio, the next position is filled by Disney+, Netflix, Viu, RCTI+, iQiyi, and Vision+. This report is based on a survey of 3.700 individuals in more than 11 large cities in Indonesia. The research was conducted during June-August 2022.

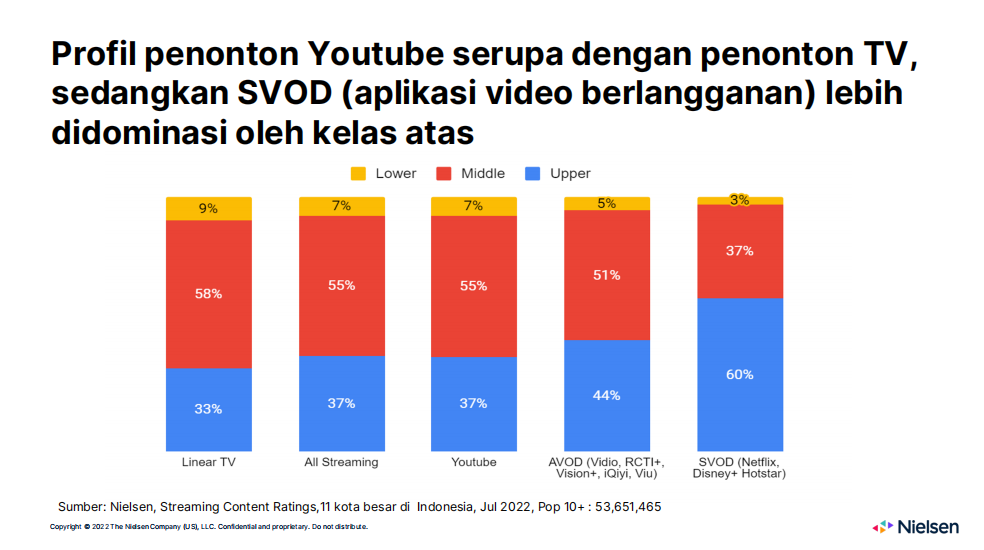

Nielsen also explained that each platform has its own character in attracting viewers (data as of July 2022):

- Vidio: local and sports content

- Netflix: international films and series

- Disney+ Hotstar: kids and family movies

- Viu: Asian/Korean content

- RCTI+: sports and soap opera content

- iQiyi: Asian and western content

Another interesting point revealed is that the OTT (especially SVOD) user profile is dominated by the upper class (60%). Nielsen categorizes these SVODs as Netflix and Disney+. Second, the AVOD category (advertising video on demand) is dominated by the middle group (51%), which consists of the Vidio, RCTI+, Vision+, iQiyi and Viu platforms. The composition of the largest middle group is centered on linear TV with a share of 58%.

MPA goes into more detail about the Vidio. According to the MPA report, in Indonesia, Vidio leads premium online video interactions with a 25% share in 2022. Vidio's FIFA World Cup is a key contributor to growth. After the World Cup, level churn will be determined by customer demand for new local and international football and new local drama series.

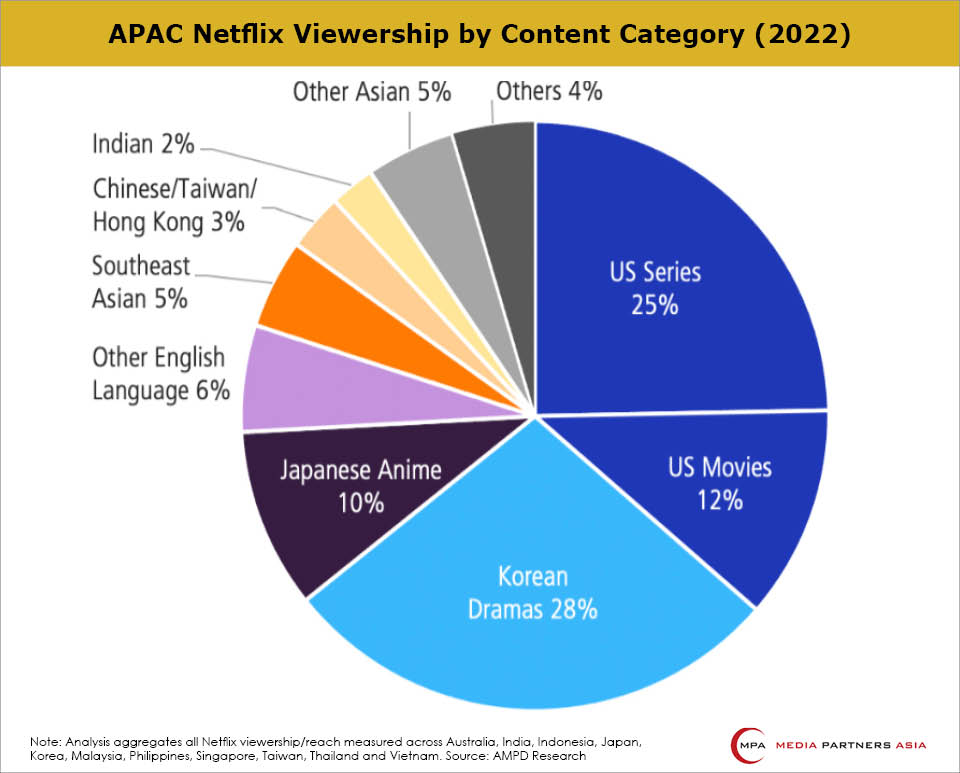

Furthermore, the report explains that of all SVOD platforms, US content dominates with a market share of 32%, followed by Korea (25%). Meanwhile in Indonesia, local content controlled 23% of the audience market share for that year in the Southeast Asian market.

MPA executive director Vivek Couto predicts that by 2023 OTT players will be heavily focused on customer retention, churn management and implementing price increases, especially in markets like Indonesia which are heavily prepaid.

“Key players will continue to invest in localization and strategic marketing of Korean, US and sports premium content, but with the backdrop and investor mantra of capital efficiency,” he added.

Netflix

Continuing from MPA report, it predicts Netflix's local content investment of $1,9 billion this year (representing 47% of revenue) will be driven by Korea and Japan, followed by India, Australia and parts of Southeast Asia. According to MPA analyst Dhivya T, Netflix's content investment in APAC has a global impact.

"Japanese series and anime, along with Korean dramas and films, as well as films from Indonesia and India, have ranked high among titles streaming top globally for the last 12 months until January 2023," he said.

Throughout 2022, Netflix released 29 exclusive Korean dramas, six of which were among the top 10 achieving titles in APAC in 2022, according to MPA subsidiary AMPD Research.

Interestingly, the report argues that Korean dramas are the top streaming premium video category, capturing nearly 32% of total views. However, Dhivya added that it remains to be seen whether Netflix will continue to invest in three to seven new Korean dramas per quarter because the return on investment is still minimal, but the costs are expensive.

Meanwhile, on an APAC regional scale, it is highlighted that there are four superior Netflix content from each country, such as Mismatched (India), The Whole Truth (Thailand), Mom, Don't Do That! (Taiwan), and The Big 4 (Indonesia). MPA predicts that among Netflix's eight largest markets in APAC, India and Indonesia will continue to have the highest growth.

The reason is, in the fourth quarter of 2022, there will be nine original films from India which have succeeded in driving the number of impressions and strong ARPU (average revenue per user) growth.

Allegedly as a way to increase the number of users, in February 2023, Netflix will reduce subscription fees. Basic Package (Basic) from previously IDR 120 thousand to IDR 65 thousand/month and Standard Package from IDR 153 thousand to IDR 120 thousand.

Alive

Diversifying content not only from Korea has also become Viu's agenda amidst intense competition. MPA noted that Viu's three to five exclusive Korean dramas per quarter II-IV drive subscriber growth. Combined with content variety shows and drama provide competitive differentiation.

More Coverage:

"Efforts to present original content and content acquisition free-to-air (FTA) also has an impact on retaining customers."

Viu CEO and Managing Director of PCCW Media Group Janice Lee said, expanded Viu Original content and enhanced distribution partnerships at the local and regional level are driving the growth of new Viu users, increasing engagement, and deliver strong growth in SVOD and AVOD revenue in 2022.

"Looking ahead to 2023, we continue to focus on delivering a great suite of content offerings to our audiences, with most markets returning to pre-pandemic levels[..]," explained Lee.

Viu's parent, PCCW Limited, listed income growth by 45% to $206 million through 2022 and achieve positive EBITDA for the first year. Monthly active users (monthly active users/MAU) grew 13% year-on-year to 66,4 million and paid subscribers grew more than 45% to 12,2 million. The contribution of users from the 16 countries where Viu operates is not explained.

However, it is claimed that this achievement has made Viu in the top position in the MAU category for 12 consecutive quarters and ranked second in paid subscribers and streaming minutes throughout the Southeast Asia region.

Last year, Viu presented a number of Viu Originals, such as Again My Life, The Law Cafe, and Reborn Rich. This latest drama is also distributed globally to more than 170 countries. The company hosted the actors to visit fans and interact directly. According to Lee, these off-screen activities will continue to be carried out in order to increase direct engagement.

"Entering 2023, with strong growth in both MAUs and paid subscribers, Viu's strategy is to deliver great content and more face-to-face experiences to fans while capitalizing on strong growth in the premium subscription and digital advertising markets across the region," he concluded.

Sign up for our

newsletter

Premium

Premium