Plans IPO in 2023, UangTeman Strengthens Sustainable Business Strategy

Just booked series B2 funding in mid-February 2020

In 2020 there are many plans that will be launched by UangTeman. One of them wants to focus on running a sustainable business and achieving even better profits.

To DailySocial, Founder & CEO of UangTeman, Aidil Zulkifli, said this year the company will also focus on offering more low-interest loan products to SME players in the micro business segment.

"The micro here that we focus on are those from B and C who have a food stall business to other small businesses that need additional capital. Not only lowering interest, UangTeman also wants to reach more of them."

Previously, UangTeman often offered loans with high interest rates. This year the company decided to lower interest rates and focus on micro business owners as the target user.

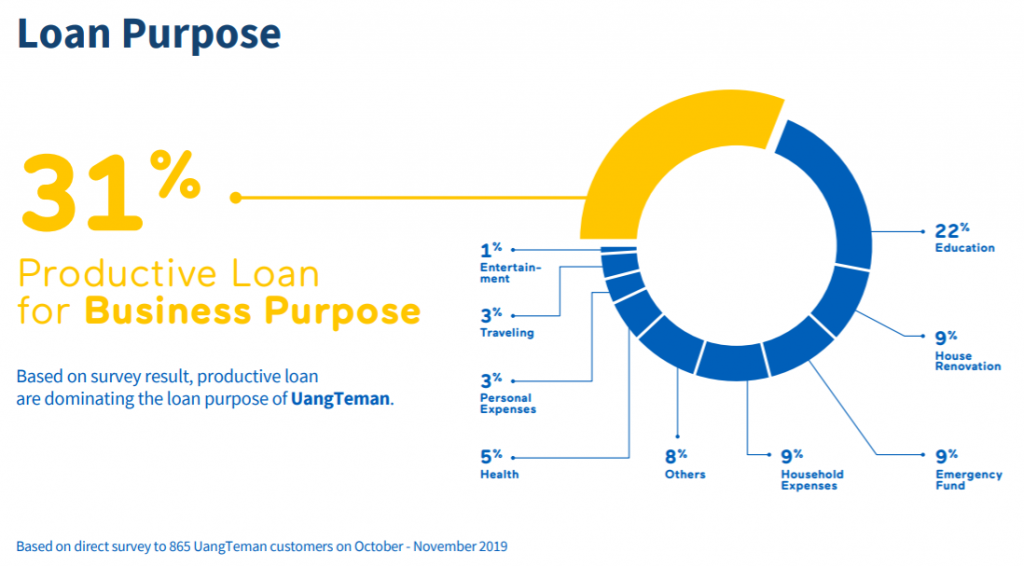

In a survey conducted internally by the company, it was revealed that almost 31% of loans received were productive loans for business purposes. According to Aidil, the survey results prove that those who fall into the category of underbanked or those who do not have an account account to a credit card, the most ideal to be given a loan.

"We also see that micro-businesses, which are currently being targeted by financial services to digital wallets, are the most effective for providing profits to companies. Compared to loan products that are consumerism as KTA or PayLater, said Aidil.

To expand the ecosystem, the company also plans to add partnerships with financial institutions, startups to banks in the near future. It is hoped that through this collaboration, we can increase channel take advantage of superior products from each partner. One of the products that will be launched in the near future is loans to employees of large companies such as factories which will later be facilitated by banking partners.

Market opportunity lending As targeted by UangTeman, it is indeed very large. By demographics unbankable adult age which reaches 92 million people, plus 64 million SMEs spread across various regions, products fintech loan-based has a pretty bright future.

No doubt there are 2019 in 144 similar to UangTeman registered with OJK. Until 2019, the number of loans distributed has also reached 60,4 trillion Rupiah, facilitating around 14,3 million users.

With the current number of players in Indonesia, both targeting consumers and SMEs, it is important for players like UangTeman to present product differentiation -- beyond service quality which must always be improved. Some players in similar sectors have even claimed to be valued centaur, alias has posted capital of more than US$100 million, including KoinWorks and Investree.

IPO plan for 2023

Currently UangTeman has around 82 thousand active users and 1 million application downloads. The company has also provided services in 14 cities in Indonesia.

Asked whether UangTeman will expand to other big cities in Indonesia, Aidil said that he has no plans in the near future. For now, the company's focus is on how to make a profit in 14 cities.

"In accordance with our commitment, which is to have an IPO in 2023, it is hoped that the company can collect profits according to the requirements specified if the startup plans to conduct an IPO," said Aidil.

More Coverage:

Mid-February the company has also announced series B2 funding. It is not stated how much the investment value will be received, but the company plans to use the series B2 funding to improve technology and speed up the process of accepting loan applications from users.

Currently the company claims, one person deployed is able to collect 100 applications. With the help of technology is expected to speed up the process to 200 applications in one day. UangTeman is also planning to add a team engineer.

Investors involved in this series B2 funding stage include ACA Investments and Pegasus Tech Ventures. Previous UangTeman has closed the first round series B1 funding last year 2019. Investors at this stage include the KDDI Open Innovation Fund and the Global Brain Corporation. Overall UangTeman has raised US$10 million in Series B funding.

"This funding also signifies investors' trust in us. For this reason, developing technology is expected to accelerate business growth, collect profits and run a sustainable business. shareholder to investors," said Aidil.

Sign up for our

newsletter