Danamas Commitment to "Upgrade" Entrepreneurs Through Productive Credit History

The target is to disburse loans of up to IDR 3 trillion. Contribution from Traveloka PayLater is getting eroded

The informal business sector has a very high contribution to the country's economy. According to data from the Indonesian Ministry of Cooperatives and SMEs, the MSME market share is around 99,99% equivalent to 62,9 million units of the total business actors in Indonesia in 2017. The workforce absorbed is also the largest, reaching 97% nationally.

Most of them do not qualify for credit because there are no neat records related to their business. When there is none, then hope to enter the category bankable and get banking facilities just at the corner of the eye.

Danamas, a p2p lending fintech startup owned by the Sinar Mas Group, revealed its commitment to "upgrading" MSMEs that unbankable menjadi bankable. They have their own understanding of this. According to him, there are only two segments, namely: served and unserved banks. No, unbanked, unbankableand bankable.

"We use that term because actually everyone can go to the bank, but there are people who have accounts but cannot be served by banks. So that people are not served by banks, we call them unserved and served bank, said the President Director Danamas Dani Lihardja to DailySocial, Monday (24/2).

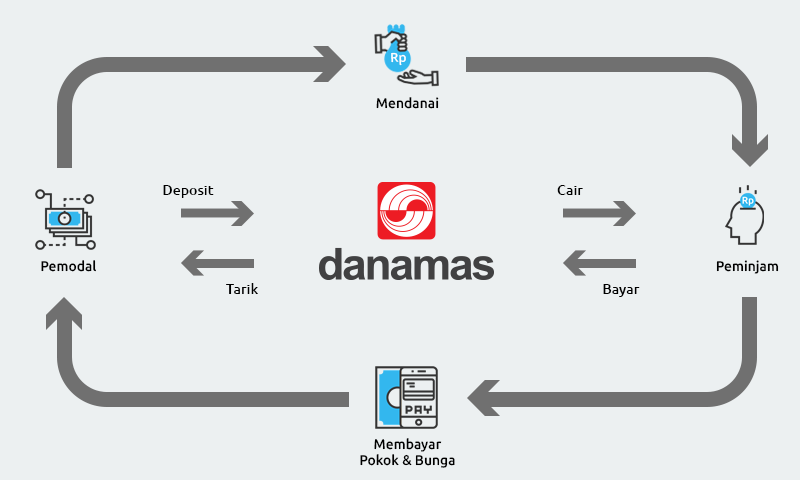

Danamas is the first p2p fintech startup to have obtained a permit from the OJK since 2017. The concept they use is different from what other fintech lending is used to. They do not want to give borrowers in cash, but through intermediaries. Sources of loan funds come from investors.

Dani explained that from the start, Danamas used this concept as a risk mitigation measure for bad loans. In his view, the main cause of bad credit is the use of funds that are not in accordance with the initial application, even though the form of loan they take is business capital credit.

"From the beginning our concept was not an online loan, after going through the analysis we wanted the loan not to be consumptive. We have a vision and mission to empower productive businesses that are now unserved."

He continued, "Hopefully once they get into served bank, the credit interest he gets from the bank is 16% a year, at best 9%. This is smaller than the first time I borrowed from Danamas, which had an interest rate of up to 29%. After that, if the business continues to increase, they can become investors, so the cycle goes round."

Danamas . business concept and performance

Given the different concepts, Danamas has formed its own ecosystem consisting of three elements, namely borrowers, investors, and third parties represented by distributors, coaches, managers, or cooperatives. Investors cannot provide funds directly to borrowers, but must go through a third party to control it.

"The condition is that you want not the borrower does not receive credit in the form of money. If you have a shop, we will ask who the biggest distributor is, we will send the money to the distributor. Customer just send list things to buy."

In line with efforts to reduce risk, the company uses the concept of a branch office to monitor all loans that occur in that location. As of now, there are 22 offices spread across major cities, such as Medan, Pekanbaru, Jambi, Cirebon, Bandung, Surabaya, Pontianak, Makassar, Manado, and Sorong.

Every time a new office opens, the company will create an ecosystem in each potential segment by creating a list of prospective borrowers who are eligible and in accordance with the criteria at Danamas and look for third parties to monitor the entire loan portfolio. When the potential segment in that location has been worked on, the company will move to look for the next potential.

With this concept, actually all business segments can be financed as long as there is an ecosystem. However, for now the segments that have received loan facilities from Danamas, include pulse traders, grocery stalls, corn farmers, duck and chicken egg entrepreneurs, and paper collectors.

Of all these businesses, the largest loan disbursement is credit merchants with a share of around 50 percent. Next, 25% of grocery shop owners, the rest are divided into corn farmers, egg farmers, paper collectors and others Traveloka PayLater.

According to Dani, about 10 percent of pulse merchants who have taken loans from Danamas have obtained credit facilities from banks. They have passed and received credit from the bank. Most of them take credit to buy the shop from the owner in installments from the bank.

"The priority for banks is to choose Bank Sinarmas, they will immediately accept them. Just show the credit history at Danamas to the officer, they will definitely pass. Other banks can too, there are BPR, BRI, or BNI, it's just that they usually need additional assessment because it has its own criteria."

"Usually, when banks see their credit history and pay correctly, they tend to give it right away. Unlike the previous condition, when they want to take KUR, the bank immediately rejects it because there is no piece of paper," he continued.

As for accumulatively until today (27/2), Danamas has disbursed loans amounting to Rp1,9 trillion. There are more than one million loan applications approved and submitted by 350.540 active borrowers. Meanwhile, there are 142.941 registered retail investors and five institutional investors.

Dani also said that the company provides consumer loans, but it is limited to borrowers who meet the criteria.

Contribution from Traveloka PayLater eroded

Danamas is the first partner that Traveloka has hired when it released its PayLater product average 2018. Dani said that at that time, the total distribution of Danamas reached Rp1,4 trillion cumulatively. The biggest contribution came from Traveloka, amounting to Rp. 1 trillion and the rest was commercial distribution to pulse merchants.

Currently, PayLater's contribution is getting eroded at Danamas, even though he said it was getting minimal, although he didn't mention the exact number. This condition occurs due to many factors.

First, the target users of Traveloka PayLater are mostly formal workers who are not in line with the company's vision and mission that wants to target the informal and productive segment. As a result, Danamas cannot expand its customers for more productive loan needs.

"Traveloka PayLater users are customers who have educate and here there is no informal element because most of them are white necklace. So this is different from our vision and mission which wants to raise the unserved so served."

Second, funding partners for Traveloka PayLater continue to grow. Besides Danamas, there are now Caturnusa, BRI, and BNI. However, Dani will not stop his cooperation agreement with Traveloka. "From the start, we were not exclusive. We were willing because the ecosystem is the same as ours. Borrowers don't accept money. If the ecosystem is different, we don't want to."

Next plan

Danamas is currently preparing financing products for sellers on e-commerce platforms and oil palm farmers. The company's funds are slowly being directed to provide financing that is in line with the main business of the company holding company, These include palm oil and paper printing.

"We are working on the scheme for these two new segments, but the point is that the ecosystem has already been formed here, so it is very possible for us to work on it."

In terms of performance, the company targets the disbursement figure to reach Rp3 trillion in accumulation. This increase will be spurred by adding two other branch office locations in Solo and Pekalongan.

"On average, we distribute Rp600 billion per year, now we want double. driverFrom the addition of branches, there used to be seven, last year there were 15, now there are 22 offices. From each branch, we are targeting to be able to create their own ecosystem."

In terms of company structure, Dani said that Sinar Mas Multi Artha (SMMA), a unit in the financial sector under the Sinar Mas Group, is still the majority shareholder in Danamas. Next, there is Itochu Corp which entered in 2017. The total capital pocketed by the company from these two investors is said to be around IDR720 billion.

He also emphasized that the company's position is not in seeking external funding.

"Because it is supported by an ecosystem from SMMA, all facilities and infrastructure have been prepared. So we have made profit from the start. We just need to find an ecosystem that we can lead to banks or finance. That's why we are not looking for investors because we feel there is no need," he concluded.

Sign up for our

newsletter