Bukalapak Continues to Complete the Service Ecosystem, Starting from Entering Proptech to Car Marketplace

Following BukaSavings and BukaBanguan, a number of new features have been launched, starting from BukaRumah, BukaJualMotor, to Apply for a Credit Card.

Like startup unicorn In general, Bukalapak (IDX:BUKA) shows the ambition to become a super app to accommodate various user needs in one application. Not long ago, platform OpenSavings launched as a digital banking service integrated with the Bukapalak application, in collaboration with Standard Chartered.

Previously they also announced their presence OpenBuilding as B2B marketplace for the fulfillment of construction materials under the auspices of the Partner business.

When examined more deeply, there are currently a number of new services that have begun to be rolled out to the application, increasing the number of feature categories in it. Some of them are BukaRumah, BukaJualMotor, BukaSellCar, Apply for a Credit Card, and so on.

BukaHome is a service proptech, which allows users to find their dream home. Not limited listing property only, in which there is a feature for submitting a mortgage --- in this case Bukalapak cooperates with Bank Mandiri as a strategic partner for financing. Bank Mandiri through its venture unit is a shareholder of Bukalapak, included in the series G . funding round.

While BukaJualMotor is a service marketplace automotive that makes it easy for users to sell their used motorcycles. This complements the existing BukaMotor feature, as a new motor vehicle sales channel at Bukalapak. In releasing this new feature, the company specifically cooperates with Automoto.

On other lines like fintech, service expansion is also intensified. After launching Bukalapak Paylater together Kredivo, they now also provide services marketplace financial products, one of which is related to credit cards and insurance --- similar to what is presented Pay attention.

On one occasion, Bukalapak said that at this time they were indeed expanding the scope of business verticals. A number of products that have been released will be monitored for traction, to ensure compliance with user needs, before finally being massively promoted to the Bukalapak ecosystem --- including consumers, MSMEs, to partner networks.

Take approach in-house and partnerships

To provide a variety of services, Bukalapak uses two approaches. First, they develop services independently (in house) take advantage of available resources. An example is the BukaBangunan feature which utilizes a network of partners that have been built through the Bukalapak Partner.

The second model, they collaborate strategically with a number of partners, both connected through investment actions and B2B cooperation. This has been done for a long time, such as when they spawned the Airfare feature in collaboration with the Reservasi.com platform (PT Reservasi Global Digital).

Regarding partnerships, the M&A strategy is also an option for Bukalapak. A number of massive share purchases were made by the company for a number of businesses, including Ashmore for BukaInvestasi and Lakupon (PT Online Pertama) for the Coupon feature. In addition, Bukalapak has also participated in funding startup EdTech Bolu and e-trade Hijup fashion --- as stated in the prospectus and information disclosure submitted on the IDX.

Product diversification for profitability targets

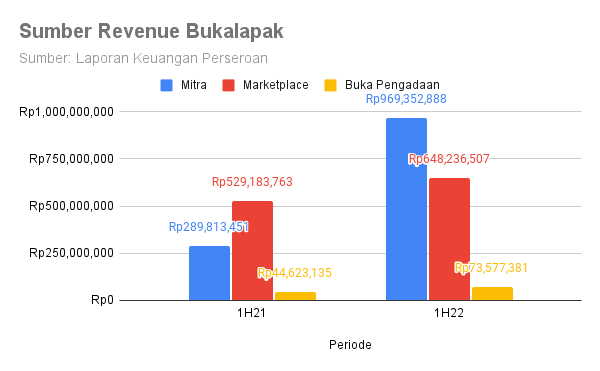

Bukalapak President Teddy Oetomo in a opportunity public expose Last June 2022 said that the company was targeting revenue growth of 44% -61% to Rp 2,7 trillion-Rp 3 trillion this year. This will also have an impact on increasing the Total Processing Value (TPV) by around 39%-47% --- as Bukalapak's main metric.

Until the first half (H1), they have booked half of the target of 1,6 trillion Rupiah.

The purpose of this product diversification is none other than increasing user retention, making the consumer base feel comfortable and served through the ecosystem of features in the Bukalapak application. In the end it will boost the value of transactions in it.

More Coverage:

However, it is undeniable that business competition in all the lines being worked on is indeed very tight --- in addition to business online marketplace which requires Bukalapak to compete with other technology giants such as Tokopedia, Blibli, Shopee, and so on.

Take an example for service proptech, although this business still holds enormous opportunities, but a number of players are already present in this landscape. Legacy players like 99 Group already have a sizable business base in Indonesia, with millions of listing properties in various cities. Their business model is also evolving, one of which is by increasing accessibility in the financing aspect.

Similarly for platforms marketplace motor vehicle. Carro, Carsome, Broom, to Moladin are intensifying business expansion by running C2B, B2B, and B2B2C models.

Bukalapak as a platform with a large user base still has the opportunity to present a value proposition. For example, armed with their transaction data, they can provide a more comprehensive credit assessment to support the integrated financing business on the platform. Including the Partner ecosystem owned; It is known that currently there are around 14 million stalls and MSME actors who have joined as Bukalapak Partners. They are spread in more than 200 cities in Indonesia.

Sign up for our

newsletter