Bukalapak Aims for 3 Trillion Rupiah Revenue in 2022

Bukalapak reveals its strategy to pursue profitability in 2022

PT Bukalapak.com Tbk (IDX: BUKA) targets revenue growth of 44%-61% to Rp2,7 trillion-Rp3 trillion this year. Meanwhile, Bukalapak's Total Processing Value (TPV) is also projected to increase by 39%-47%.

In public expose 1Q22 keuangan financial performance Bukalapak, President of Bukalapak, Teddy Oetomo, revealed that the 2022 revenue target has been realized about 28% of the achievement in the first quarter of 2022 of IDR 788 billion.

Then, this year's TPV reached 19% or Rp. 34,1 trillion in the same period from the analyst's target of Rp. 170 trillion. take rate consolidation also grew to 2,31% in the first quarter of 2022, mainly supported by an increase take rate Bukalapak partners by 2,73%.

According to Teddy, the achievement of the company's current financial performance is still relatively low on track. His party focuses on pursuing profitability by monetizing traffic, not only from main business lines, but also businesses outside Bukalapak, such as Hello Bank, AlloFresh, and My Items.

It is optimistic that it can maintain sustainable growth sustain blessing mixed strategy companies to increase product/feature contributions by take rate tall. "Our margin contribution is almost positive. This means that we are now in the next phase, which is no longer improving performance through efficiency like Sales and marketing, but drive revenue growth. Right now we need to cover fixed cost and G&A so that adjusted EBITDA can be positive," said Teddy.

Of course adjusted Bukalapak's EBITDA was still recorded minus Rp372 billion in the first quarter of 2022, but this is 5% better than the fourth quarter of 2021. In addition, the realization of this EBITDA is also due to the investment in AlloBank that must make mark-to-market.

"Projection adjusted Our EBITDA this year is minus IDR 1,4 trillion to minus IDR 1,5 trillion. This might be considered as a widening of the losses, but our target is actually to achieve adjusted Relative EBITDA flat 1% compared to the same period last year," he added.

If Bukalapak can keep the level adjusted EBITDA in June-December is in the same position as the realization as of May, there is a possibility adjusted EBITDA could be better than projected minus IDR1,4 trillion.

Currently, Bukalapak's cash position as of March 31, 2022 reaches Rp. 20 trillion. According to Teddy, Bukalapak has cash runway very long. His party is also still evaluating future investment needs after investing in Allo Bank and Allo Fresh.

Bukalapak Strategy

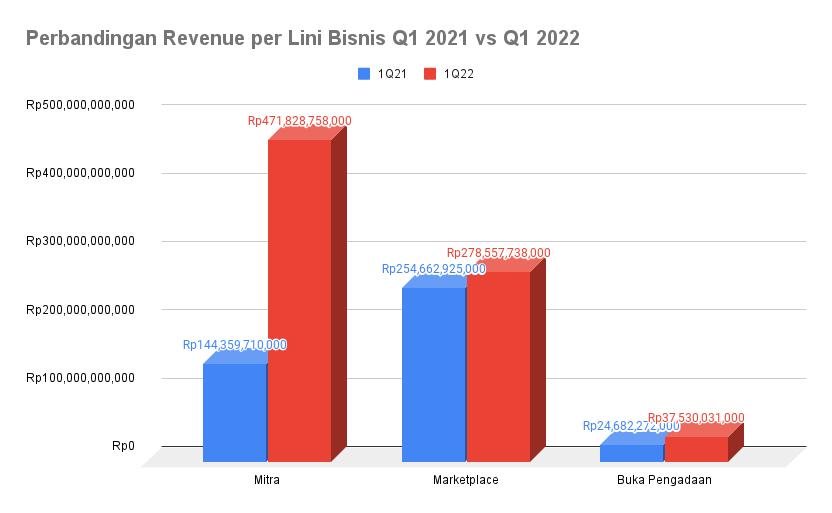

Based on business category, Mitra is the largest contributor to Bukalapak's revenue with a share of 60% or Rp471,8 billion in the first quarter of 2022. Meanwhile, the Marketplace line contributes Rp278,5 billion to total revenue with a 9% annual growth.

Teddy emphasized that the Marketplace business target is not to be a dominant player in the industry. Instead of positioning Bukalapak as 'marketplace for all', the company is now more focused onleverage data held to business lines that have promising growth prospects, namely: marketplace for Gaming My item.

More Coverage:

Currently, Bukalapak's revenue is contributed by three main business lines, namely Marketplace, Bukalapak Partner, and Open Procurement. Bukalapak is also expanding its business vertical by investing in AlloBank and AlloFresh. This is Bukalapak's new way to monetize its traffic.

Through investment in digital banks, continued Teddy, his party seeks to strengthen financial services as the backbone of Bukalapak's entire business line. One of its missions is to increase financial inclusion for shop owners or MSMEs at Mitra Bukalapak. Meanwhile, AlloFresh will focus on providing various FMCG products, both for end users and shop owners who are members of Mitra Bukalapak.

"Integration continues to be carried out thoroughly on Allo Bank and AlloFresh to cover 128 store at Trans Retail. We see that the delivery aspect is no less important than the price. The faster the delivery, the Partners don't have to spend a lot of money to get inventory big. They can order more often so business turnover is higher.

Sign up for our

newsletter