Bank Danamon and Doku Release E-Wallet Application "D-Wallet"

Features for opening customer accounts and credit applications will be developed

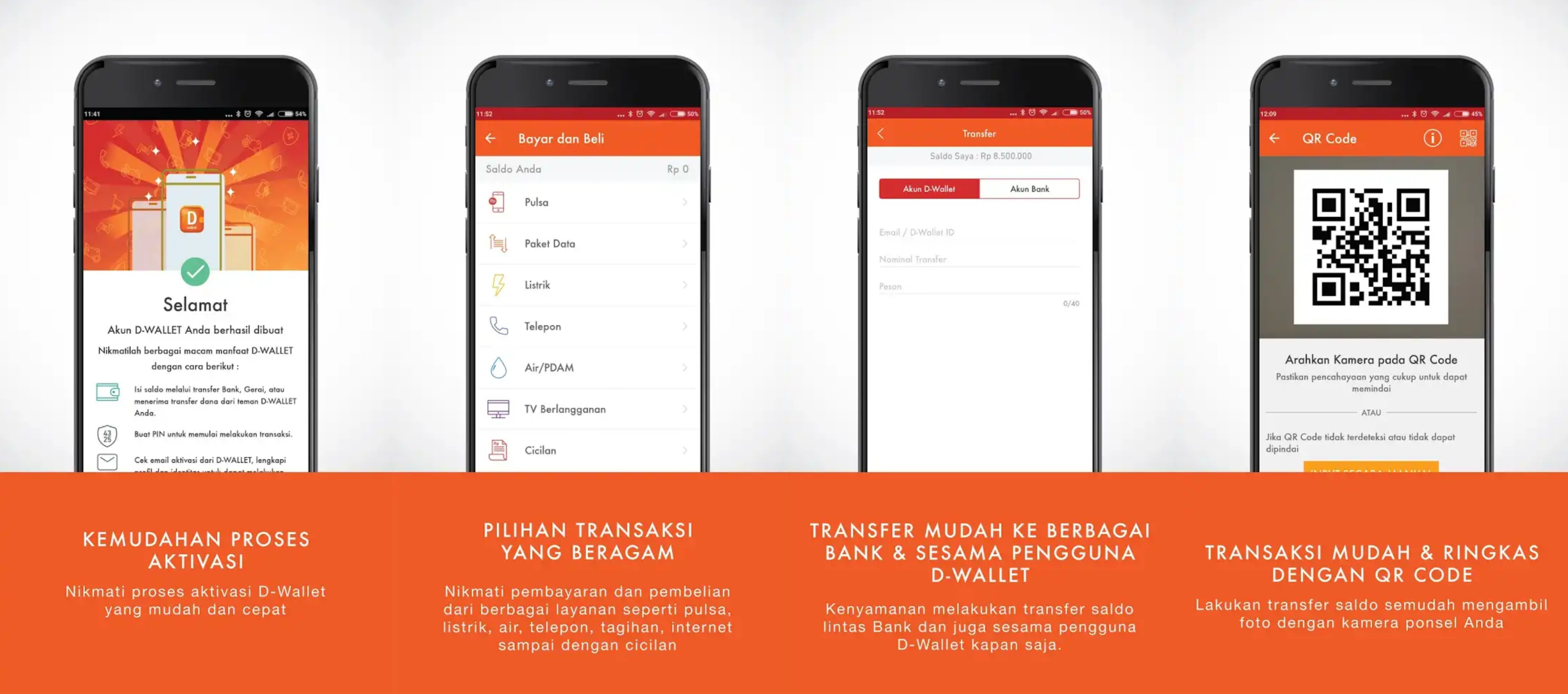

Bank Danamon launched the D-Wallet digital wallet application as an effort to get closer to customers from various segments. The application is the result co-branding with Doku as its technology partner.

"D-Wallet is part of our commitment to improve service quality while providing added value for customers and the wider community. The jini initiative also supports the non-cash movement set by the government," explained Bank Danamon SME, Consumer Banking and Branch Network Director Michellina Triwardhany, Tuesday (13/3).

The appearance of D-Wallet is UI/UX similar to Doku. Likewise, the features that customers can take advantage of, ranging from purchasing vouchers, investment products, purchases at all online merchants that have collaborated with Doku, offline purchases, and cash withdrawals at minimarket outlets.

Even though the customer experience presented is the same, according to Bank Danamon Consumer Lending and E-Channel Head Djamin Nainggolan, this is just the first step for banking before launching special features that will only be available in D-Wallet. This feature will lead to new users, who will eventually become Bank Danamon customers.

"It's okay to overlap [D-Wallet and Doku features] because this means wanting to give a lot pintu which new users can enter. Which way they are more comfortable entering. For Doku, this is an alternative to customer acquisition through a new channel. As for us, development is towards one access with more seamless services," he explained.

Just like accessing Doku, D-Wallet customers can choose two types of users, either regular or premium. Each has advantages and disadvantages. Regular users only need an e-mail address to register, but the maximum balance limit is IDR 1 million.

Meanwhile, premium users have a maximum balance limit of Rp. 10 million, but they must do e-KYC by including their ID card. In addition, premium users can transfer funds to Bank Danamon or other bank accounts.

In the future, Bank Danamon will bring the D-Wallet application with more specialized features to attract new customers. Some of the features that are being prepared are account opening, KTA offers, and others.

Djamin targets in its long-term target, D-Wallet can attract one million new users in the next five years.

Soon to announce another collaboration

For Doku, co-branding with Bank Danamon is the first step the company chooses in order to acquire new users. SVP of Consumer Product Doku Ricky Richmond said that his party will announce a similar partnership with two other banks this year.

"This is the first time for Doku co-branding with a bank. Next, there are two more banks that will be like this," explained Ricky.

For business models co-branding Like this, the management of the technology behind the application will be handled by Doku, but the storage of funds and customer service is managed by Bank Danamon. Doku will receive a commission generated by Bank Danamon from non-interest income (fee based).

So far, Doku's total active users have reached 1,9 million people with around 800 large merchant partners, plus 20 thousand SME players from all industries. Doku is now directly connected to 15 major banks in Indonesia for top up and withdrawal of funds.

Sign up for our

newsletter