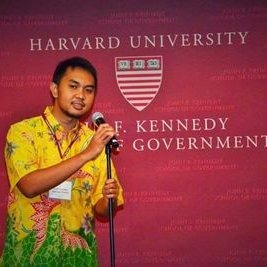

Andi Taufan Believes That Perseverance Will Bear Success

As a solo founder, Taufan talks a lot about his struggles with the current problems and hopes

This article is part of DailySocial Mastermind Series featuring innovators and leaders in the Indonesian technology industry to share stories and perspectives.

As a solo founder, it was a struggle to drain the blood, sweat and tears of Andi Taufan Garuda Putra in building Amartha. Various coloring stories ranging from one by one Co-founder leaving and the dilemma between education and the company. All of this led him to a peer-to-peer lending facility that has successfully distributed Rp1,25 trillion in loans to more than 200 million micro-entrepreneurs in remote areas.

He started this journey with a dream to realize financial inclusion throughout Indonesia. It is not easy, considering the loan business is full of loopholes and potential fraud. But with the basis of perseverance, he managed to climb a high cliff where micro-businesses can contribute more to the Indonesian economy today.

Meanwhile, recently he was trusted to be a member of the presidential expert staff during the second term of Jokowi's administration.

The following is a more complete story about Andi Taufan Garuda Putra's journey in a question and answer session with the DailySocial team.

For starters, with an academic background in business. How did you come to think of starting Amartha? What is the basis for building something that has a social impact?

At first, I studied higher education in the business field with no aspirations to become an entrepreneur. My parents themselves pursued careers as professionals, I also plan to follow in their footsteps. Likewise with a master's degree, solely to support a professional career that supports welfare. When you are successful, you can give charity to those in need. My definition of success is very simple, turning 50 years old without worrying about a gloomy future.

After completing my undergraduate degree, I worked at IBM for two years as a business consultant. This work involves oil companies to implement IT systems in remote areas. When exploring the corners of the countryside, I found gap which is quite wide between suburban and urban areas, such as in Jakarta. This is what prompted me to take action, how can I contribute to this. During that time, I decided to create something that had a target. Rather than just helping conglomerates get richer, it's better to create something more useful for small businesses to grow more.

At that time, it was still early 2000, no one was talking about fintech or application platforms. After digging around for ideas, I finally set my heart on it microfinance. This sector has a clear target, when injecting the first funds, will be immediately visible, as will the value of the benefits. This also gives rise to multiplayer effects In the family, apart from building a business, their children can also grow while getting a decent education.

Initially, Amartha only took the form of a cooperative. Can you explain in detail the journey of building this business into a platform peer-to-peer lending?

One day, I visited an area in Bogor district called Ciseeng. While touring the village, I met many people and talked about problems that often arise in the area. Most of those remaining are mothers, their husbands are working elsewhere, some are in the city. Like the head of the family who has a modest income, wives also have to work part time for the sake of the family's welfare.

Based on this phenomenon, I think they will really need help. I started offering small loans, starting from 500 thousand for 100 people in the first year. Talking about productivity, they use the loan money for useful things, such as buying a sewing machine and so on. Most of them are quite responsible and repay the loan on time. We also grew by providing loans to a thousand people in the following year.

After five years of serving more than 7000 people in rural areas, we found our own challenges in this business. Ultimately, microloans are not just about money, they create hope. They start making plans for business and family, and then want more loans. With bad credit and other problems, we almost ran out of money while the question "Amartha is going bankrupt, right?" attack from various sides. This is very difficult, even for me.

Then I found out that microfinance alone is not enough in this internet era. We are back with an innovation to raise funds from the community, you could say peer-to-peer marketplace lending. With partners and quality loans, I did it pitching with our early stage investors [BEENEXT and MidPlaza]. They seemed to like this idea and through various obstacles, Amartha finally officially operated as an online platform in 2016.

The momentum is there, then several p2p platforms are joining the Indonesian market. The fintech industry is starting to enter its heyday. In this case, you are also encouraging the OJK to form regulations regarding the p2p industry which is still in its infancy. Amartha also became one of the early retainers in the p2p industry who received official permission from the OJK at the beginning of 2019.

Talking about crucial times, how do you respond to this situation and be able to bounce back?

I think around 2014-2015. People are starting to have a crisis of confidence in Amartha, I myself also doubt that I can continue this business. I was thinking about creating new innovations, then good news came from Harvard. In the same year, investors began to arrive when difficult times approached Amartha.

This becomes a dilemma, when you have to choose between education and a company. Then I took the initiative to talk to investors and they allowed me to continue my studies on the condition that this platform be released immediately. It happened in 2016, when I was working remote in the US with the help of Aria and a team of developers. It is a blessing to have a team that is always supportive and a positive environment.

Being a solo founder is a challenge for me. In 2009, I had partners, until one by one they left due to the circumstances at that time. I tried again in 2014 with several new partners until finally two people dropped out and the other one had other priorities. I realize that there is always a Co-founder at every stage of the Amartha business, this is an important point. Meanwhile, the existing C-levels are now very important in supporting this business to a higher level.

What is Amartha's target at a further level?

That is when we can exceed the limits of peer-to-peer lending. We are very good at providing microloans to women in rural areas. Staying true to our mission to provide equal prosperity for people at the bottom of the pyramid. If we had to define wellbeing, it would be reducing their living costs, providing affordable products, so they can set aside money for savings, and start investing. How can Amartha expand beyond p2p lending? This is not only about initial capital support but also to provide other products that can improve their quality of life.

How can we ensure that the company can stay true to its current commitments?

The key is to understand the various problems that occur. As a lending business, there will definitely be problems regarding payments past the due date, gaps in regulations, and the potential for fraud. If we don't try to understand, we will never get better. What I have learned to date, we have 2.500 employees, is how to build a team with a mission. Their passion must be aligned with the company's overall mission. This aims to instill a sense of belonging in every employee. Once that is fulfilled, they can start exploring and moving towards one goal. This is quite challenging but worth fighting for.

As one of the pioneers of peer-to-peer lending platforms in Indonesia, who/what is it? role model for Amartha?

I am referring to the US and European markets. They already have unicorn LendingClub in the US, and the European market with Funding Circle and Prosper. There has never been anything like this in Asia. Therefore, with a different customer base, I started working with what we had. Given the fact that most of Indonesia's population is at the bottom of the pyramid, Amartha created a business model that targets the mass market and high-quality borrowers.

In this p2p lending landscape, have there been any issues with banking or other departments regarding financial inclusion?

From the start, we have clear responsibilities for each division. Everything the company does does not escape the banking infrastructure. On the other hand, for banks to enter this segment, it will be very draining. Amartha has the capacity to provide services and vice versa. All of this comes back to trust and we will value collaboration more than competition.

Since this trend started to develop in 2016 and more and more players appeared in 2017. In 2018, the illegal problem emerged, even though it wasn't us, it still had an influence. It is said that OJK will overcome all problems this year and associations also have their own responsibilities. I see that the future will be full of collaboration, not only funding with banks but something more solid and intense. Then, there will be new companies offering more sophisticated products to carry out financial inclusion. However, I always look at all new founders in a positive light, because that's what we need, more aggressive and positive people.

For more than 10 years you have worked hard, sweat and tears to build this company. Have you ever intended to create something new?

It's still too far away for me to think about that. Amartha is still in its infancy, we also have a different business scale from Google or other elite companies. Especially with new responsibilities as presidential expert staff. At the moment load I've had a lot.

Startup activists are often called politically blind, but you can change that. What makes you interested in accepting this 'trust'?

We have a sincere president and I am happy to support him. We discussed small businesses in Indonesia. He wants to make changes, so that the bureaucratic machine can move more quickly towards future trends. This is a mandate for Indonesia to occupy the top 4 positions in the world with the strongest economy. It must be built with positive energy and optimistic people. I, along with other staff, believe that this is a small step to create confidence to take Indonesia to a higher level.

With a startup frame of mind medium-high pace it's fast, Is there any clash of cultures what happens in interactions with bureaucracy?

It is our job as presidential expert staff to provide innovative thinking and breakthroughs when the president drives the bureaucratic train with technology and digital approaches. First look at the goal, currently I haven't encountered any clashes. Luckily, I was still given the opportunity to work both feet at Amartha, therefore, I can balance the startup with bureaucratic matters for now. Let's see what will happen six months from now.

Looking back on the years from building your startup to its current achievements, what can you say to early stage entrepreneurs who are experiencing difficult times like you did?

If I could say something, try to stay true to your long-term goals, because persistence will pay off in the end. For those just starting out, it's not about the individual, or the money, or the technology. Precisely when you find one thing to focus on and don't leave room for distraction. Obstacles are part of the journey. The real failure is when we stop.

-This article was written in English, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium