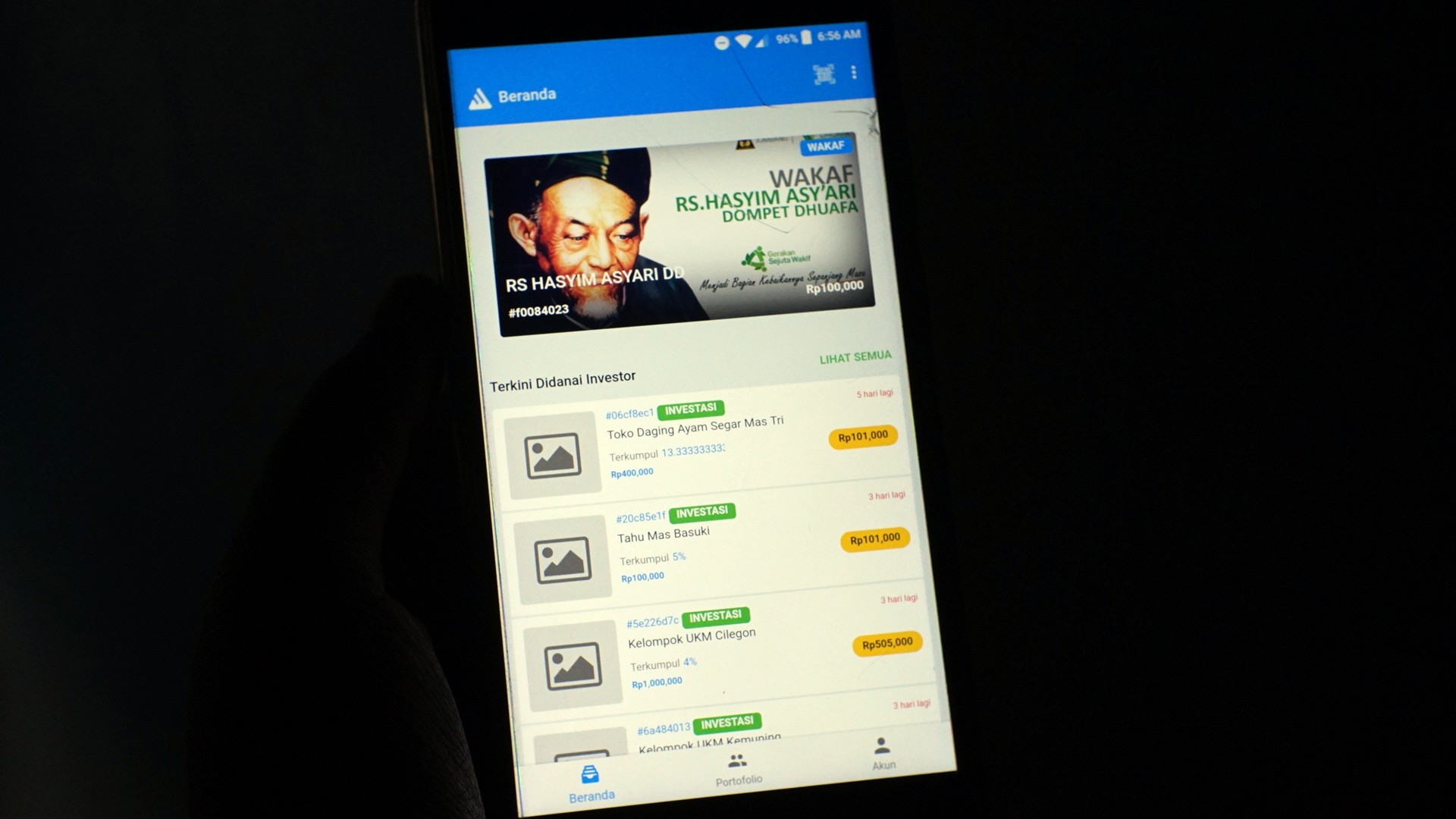

"Ammana" Sharia P2P Fintech Offers Digital Waqf Solutions

Want to disburse financing of up to Rp250 billion throughout 2018

Indonesia as one of the countries with the largest Muslim population in the world, holds a large amount of potential waqf and can be directed to the productive sector. It's just that the huge potential for waqf has not been professionally managed and empowered to become a business opportunity for the Ammana Fintek Syariah p2p lending fintech startup.

The startup founded by Lutfi Adhiansyah, Supriyono Soekarno, and Randy Bimantoro officially started operating in the middle of last year. To confirm the company's position in the eyes of the law, Ammana submitted a permit process from the OJK. The permit was finally successfully pocketed in December 2017, making the startup the first sharia fintech company in Indonesia.

"Ammana is here to facilitate collaboration in digital business funding that is profitable and a blessing for the community, especially in Indonesia," said CEO of Ammana Fintek Syariah Lutfi Adhiansyah in an official statement.

Ammana operates and has the full support of the Indonesian Waqf Board (BWI) and the Productive Waqf Forum (FWP). BWI is an agency that is mandated to provide guidance to Nazir (waqf recipients). Meanwhile, FWP is a forum containing government institutions and organizations to encourage waqf functions to be more productive.

Productive waqf is property that is given so that it can be used for production activities, the results will be distributed according to the purpose of the waqf.

One of the FWP members who signed a partnership with Amman is BNI Syariah. The synergy between the two is in terms of the utilization of sharia banking products and services for the collection of waqf funds using BNI products Virtual Accounts (IT GOES).

Through VA, wakif (people who do waqf) will be facilitated with payments that will be automatically confirmed so that there is no need to input bank codes or enter payment amounts. In addition to Ammana, BNI Syariah has collaborated with 17 nadzhir (waqf institutions) from FWP members.

"It is known that fintech has been seen as a banking competitor with its breakthroughs, but for BNI Syariah this can be synergized in order to build the sharia economy in Indonesia through productive waqf," explained BNI Syariah Retail Fund Division Leader Bambang Sutrisno.

Implement layered risk management

This startup works the same as other p2p lending, connecting wakif with nazir with a digital platform. There are two types of funding that the wakif can choose from, namely musharakah (the parties contribute capital to each other) and mudharabah (100% capital from the wakif).

Musyarakah funding means that wakif together with Sharia Microfinance Institutions (LKMS) contribute capital to each other to finance business actors fostered by LKMS. Meanwhile, mudharabah funding means that the wakif contributes 100% of capital to finance business actors fostered by LKMS.

LKMS are like sharia cooperatives, Baitul Maal wat Tamwil and BPRS (Islamic People's Credit Bank). The institution acts as a field partner in musharaka with wakif. They are also the ones who carry out the functions of assessment, scoring, financing, and collection of business results.

Separately to DailySocial, Lutfi continued the partnership with LKMS as well as Ammana's efforts in implementing risk management. At least Ammana implements security up to the fifth layer. First, starting from the selection for all potential field partners, they must meet the requirements set by Ammana and get a rating from there.

Then, partners use the standard scoring from Ammana every time they assess potential applicants for financing. Not all financing, some of which require guarantees or at least joint responsibility (group financing) to ensure business continuity.

Next, all requests that come in from partners will go through the oversight of the Ammana risk and compliance committee. Finally, all published investment prospects will have information scoring, financing details, and partner ratings. So that all decisions can be transparently seen by the user.

"By definition, our regulator is a technology provider and as a business model provider, what is allowed is to take a commission (fee/ujroh) of the services provided to user. Every disbursement made by Ammana gets a service fee from user."

Ammana's business targets

Lutfi said that currently the company has reached 1.400 organic users and 420 of them are investors. The disbursement that has been realized has reached Rp. 2,5 billion.

He detailed that until the end of the year, the company targets to be able to realize financing of IDR 250 billion, consisting of IDR 100 billion in financing for MSMEs with BMT / sharia cooperatives and IDR 150 billion with the productive waqf program from FWP.

As for the number of investors, it is expected to reach 50 thousand, the number of MSMEs is 20 thousand, 200 BMT partners, and 30 waqf institutions.

"God willing, through Ammana, hopefully more people will feel helped, and waqf worship can be carried out better."

Ammana is currently in the near future has not opened the possibility to raise funds. According to Lutfi, the company still has sufficient funds to run its business, especially since the capital requirements determined by the OJK are sufficient to operate independently.

"Ammana's entire activity is bootstrapped of the three existing founders, none from outsiders. In the future there are plans to open it to other parties, but not in the near future," he concluded.

Sign up for our

newsletter