Are you an SMEs? Know 9 Features and Products at Aladin Bank that are Useful for Business

There are features and products in Aladin Bank that are useful for your business.

For those of you who are SMEs or own a business, know that there is one digital bank which can help your business. Its name is Bank Aladin Syariah. To convince you, find out the features and products of Aladin Bank here.

Before explaining the features and products of Aladin Bank, consider a quick review of Aladin Bank.

What is Aladin Bank?

Aladin Bank is PT Bank Aladin Syariah which manages its business based on sharia principles. Aladin Bank facilitates access to digital Islamic banking services to serve all levels of society and build partnerships with industry players from various sectors.

You can download the Aladin Bank application on the Google Play Store and App Store. Then, Aladin Bank has several products that can help your business. Curious? Come on, find out the features and products below.

Aladin Bank features and products

The following are 9 features and products at Aladin Bank:

Business-style savings

As the name implies, this product is made specifically for customers who have businesses. When making transactions, this feature ensures the smooth running of your business with competitive profit sharing and a sense of calm in accordance with sharia principles.

The benefits that you can get from this product are free administration fees, light initial deposit, profit sharing according to sharia principles, access to e-statement or monthly account statements.

However, opening a Ala Bisnis Savings account is done at the head office of Bank Aladin Syariah by filling out and signing the application for opening a savings account and submitting the required documents for opening an Ala Bisnis Savings account.

Business-style deposits

Apart from Business-style Savings, there are other products aimed at businesses and MSMEs, namely Business-style Deposits.

Just like the Ala Bisnis Savings, the benefits of this product are free of administration fees, light initial deposit, profit sharing according to sharia principles, access to e-statement. You must also go to the head office to open this account and bring the required documents with you.

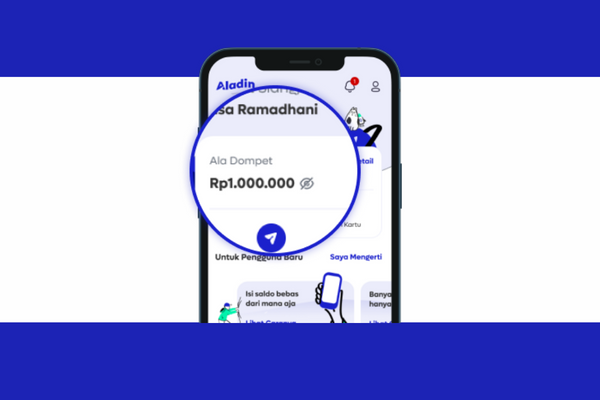

Wallet Style

The product this time is the main account product at Aladin Bank because after registering in the Aladin Bank application customers will automatically get Ala Dompet. Ala Dompet is used for daily needs such as shopping, bill payments, transfers, etc.

Apart from being free of administration fees, the following are the advantages of Ala Dompet:

- Management based on mudharabah contract.

- Transactions can be made through applications or debit cards.

- Free cash withdrawals and bank admin fees anywhere.

- Can monitor transactions or account mutations in the application and can download e-statement or the report.

Dream Style

Do you want to have business capital savings? Want to own a home? Or have other dreams? Then use the Ala Impian product at Aladin Bank because you can create 20 savings accounts with one account.

There is no timeframe for this one product, so you can withdraw and deposit funds at any time. In addition, there are no admin fees and minimum balance requirements.

What needs to be remembered, Ala Impian is used for saving, so you cannot make payments. purchase, and transfer to another bank yes.

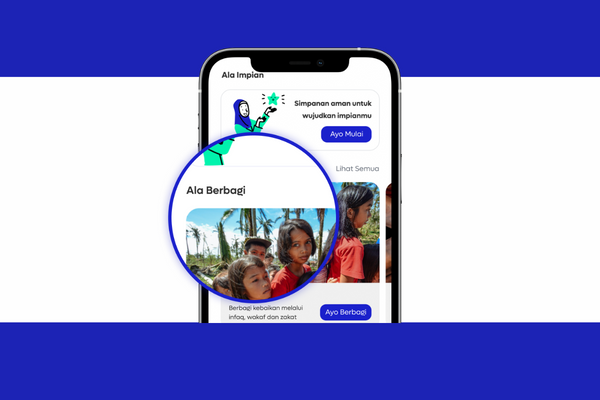

Sharing Style

Ala sharing is a donation feature in the Aladin Bank application. Currently there are 4 donation products available, such as Zakat (Mall, Profession, Fitrah), Infaq, Waqf, and Qurban.

You can donate directly from the Aladin Bank application and without admin fees. However, a discounted fee will be charged for transactions adjusted by each institution that works with Aladin. However, Aladdin ensures that each institution will not deduct more than 12,5% per donation transaction.

Aladdin Debit Card

After you open an account, you will automatically get a debit card with 19 digits. Normally, debit cards at other banks only have 16 digits.

This is one of the shortcomings of Aladin Bank because there are not many merchant which can accept transactions from debit cards with 19 digits.

However, there is no additional charge for making a debit card and your debit card can be activated directly through the application.

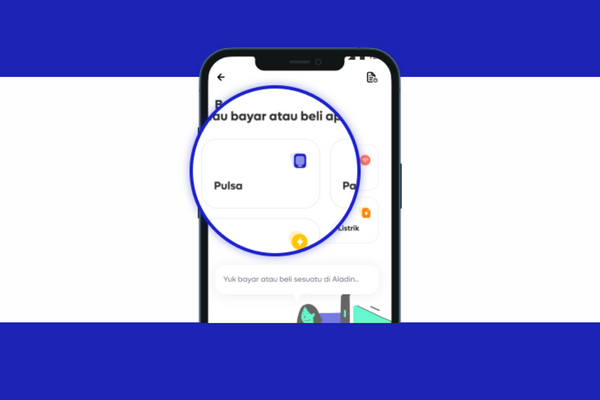

Pay and Buy

With the Pay and Buy feature, you can make bill payments and purchases. However, this feature is still limited because it can only pay and buy credit, data packages, prepaid PLN, and postpaid PLN.

Withdraw and Deposit Cash

Aladin Bank ATMs are still limited in Indonesia, but with this feature you can withdraw and send money through the nearest Alfamart. However, you have to spend IDR 5.000 per withdrawal and deposit.

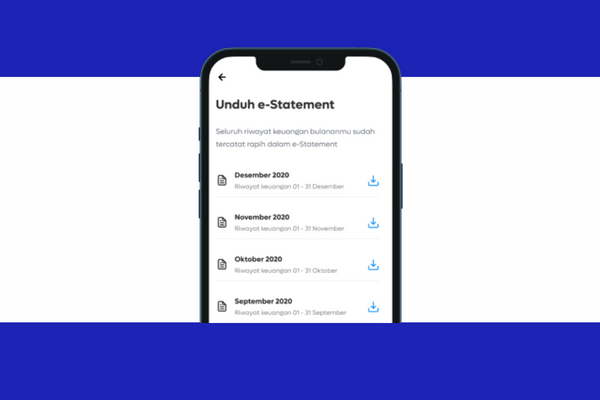

E-Statement

The last feature provided by Aladin Bank is E-Statement. This feature contains a summary of transactions made by customers during a certain period of time.

It can be said that E-Statement is an account mutation. You can check your transaction report and can download it.

What about the features and products of Aladin Bank? After reading this article, do you want to use this digital bank to help your business? Whatever it is, I hope this article is useful!

Sign up for our

newsletter