Accelerate Product Innovation, Amartha "Acquihire" Software Company from Surabaya

All employees will join and the old office will be rebranded to become “Amartha Development Center Surabaya”

Startups p2p loans Amartha announced acquire against a software company from Surabaya Twiscode (PT Dapur Rumah Sejahtera) with an undisclosed value. Full Twiscode talents will join as a team engineer Amartha to accelerate product and technology development plans.

To DailySocial, Chief Commercial Officer Amartha Hadi Wenas explained that companies need talent engineer in quick time to realize all of Amartha's post-funded innovation and expansion plans. His party saw that Twiscode met all the criteria needed by the company.

Moreover, both of them have quite good business relations through a number of collaborations that have been established before, so that the reputation and quality of Twiscode's talents have been proven. “Because we already know each other so there is chemistry, they also want to be part of Amartha to realize that mission, "said Wenas.

Senior Vice President of Engineering Amartha William Notowidagdo added, pandemic and trends work from home (WFH) is proof that fulfilling digital talent can be done without having to depend on supplies in Jakarta alone.

"Now talents in the regions also have the same opportunity to contribute to startups like Amartha," he said. After acquire, the entire Twiscode team of 47 people became part of the Amartha R&D office, named “Amartha Development Center Surabaya”.

Technology development plan

Wenas continued that there is still a lot of scope for technology at Amartha that can be improved to make it better. At Amartha itself there are three technology segments that are focused on, namely from the side Actioncalendar, internal, and borrowers.

For example, for segments Actioncalendar, later allowing per Actioncalendar can fund each project in Amartha starting from IDR 100 thousand from the previous minimum of IDR 5 million. "Then from bank registration and verification there are things that can be accelerated even more in the future."

Then, from the internal side, because 1/3 borrowers do not have yet smartphone, then Amartha needs presence field officer for the verification and disbursement process of funds which is assisted through a separate application. The latest technology that is being prepared is the process of disbursing loan funds directly cashless.

“We want to improve coverage field officer us so that their productivity becomes higher."

William mentioned other technology to help with verification and attendance borrowers is to present features face recognition, no longer has to be a manual process with signatures. This solution is to overcome conditions in the field, which para borrowers The majority are illiterate and whose fingerprints cannot be read using a biometric machine.

In maintaining TKB, apart from taking advantage of attendance field officer and absenteeism, Amartha applies four groups with 92 parameters for credit scoring, including business parameters, demographics, ability to pay, and willingness to pay. All these parameters are created specifically for the segment underserved, so it is different from most p2p players.

"So our survey is not about whether he can pay or not, but from the survey by looking at the condition of his house, for example using LPG or kerosene, whether there is a refrigerator or not, the floor of the house is still dirt or tiles, and so on. In the future we will definitely evolve. "

One of the scoring parameters that is currently increasing is borrower awareness to smartphone needs. The supporting factor is none other than the children of the borrowers for school. This need gradually increases borrowers' awareness of social media.

"When usage "Social media is increasing, we will combine it with 92 parameters considering that digital adoption in villages will increase in the future," concluded Wenas.

The company released Amartha Plus with three features, namely Warung Loan Non Mitra, Warung Loan Mitra, and Amartha Pulsa/PPOB. In the first feature, the company becomes the product's financial partner paylater for stall partners who are included in the Sampoerna Retail Community (SRC) network. This collaboration allows SRC's stall partners to pay the due date for each stock purchase.

Next for the Warung Loan Mitra feature, it allows stall partners on the Amartha network to purchase FMCG product stock wholesale through Tanihub, an agritech partner that is partnered with the company. As of now, it has operated at 11 points in East Java, there are more than 100 partners who shop regularly, and there are more than 4 thousand SKUs available.

More Coverage:

Lastly is Amartha Pulsa which has better service straight forward for purchasing credit and PPOB. This service has been used at 93 points out of 497 points in the Amartha network.

Development

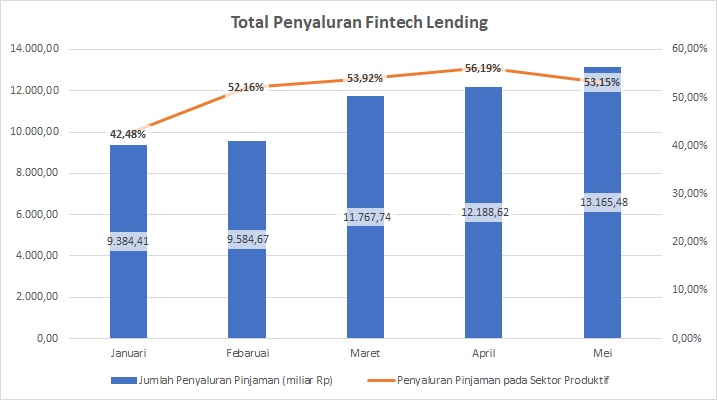

Throughout 2021, the industry still continues to show signs of growth. According to OJK statistical data as of May 2021, there are 118 organizers conventional and 9 sharia. In total, the total assets owned reach 4,1 trillion Rupiah. The platforms also managed to accommodate around 8,7 million lender accounts (p2p) channeling 13,8 trillion Rupiah of funds.

To maximize this momentum, a number of strategic actions have been taken. Most recently they appointed their ex Minister of Communication and Information Rudiantara as Commissioner. In June 2021, they also just received an investment of 107 billion Rupiah from Norfund, which is an institution owned by the Norwegian government. This continues the previous acquisition of 405 billion Rupiah from a round led by WWB Capital Partners II and MDI Ventures.

Sign up for our

newsletter

Premium

Premium