Scalability is the Key to D2C Startup Growth

An omnichannel based approach is needed to scale up the D2C business

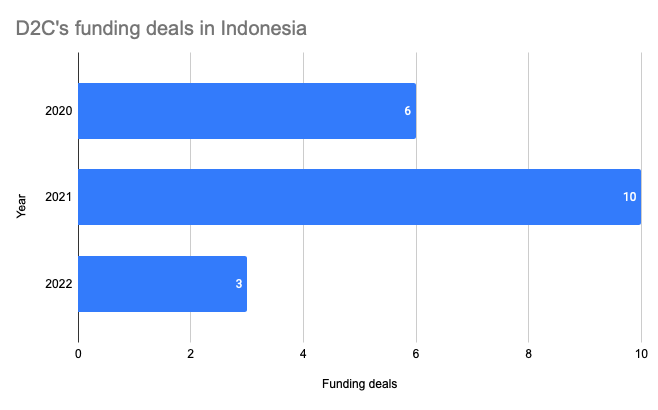

There are a number of reasons venture capital (VC) invest heavily in bisnis direct-to-consumer (D2C) Indonesia. Two of these factors are digital ecosystem support and cost efficiency to maximize profits by cutting multiple layers of the supply chain.

D2C enables the sale of products without intermediaries compared to traditional process chains using networks reseller, minimarketand supermarket. The D2C business model reaches consumers and markets their products through digital channels, such as social media, marketplace, and websites.

Some of the big local brands that have bagged investments from VCs are Kopi Kenangan with $109 million in 2020, and hyperfast which will receive $14 million in 2021.

There are more than 40 Indonesian D2C brands recorded with the majority from the F&B segment, fashionand beauty. Some of them already have a strong buyer community base and have even entered the realm mass retail.

VC Thesis

According to East Ventures VP of Investment Stacy Oentoro, D2C startups are more adaptive in speeding up market entry and building relationships with consumers compared to big brands which have to go through a multi-layered process chain. To drive sustainability, D2C startups also need to know consumers and their purchasing journey so they understand what they are looking for.

"The increasingly embedded use of digital will have a significant impact on value brand of that item. Indonesia's population tends to be young so segment digital native it is also easier to receive services online, innovation, and D2C potential," he said.

The average D2C player takes advantage online presence to introduce and promote its products to the public. Apart from being able to interact directly with the buyer community, D2C startups can cut costs by marketing products on digital channels, such as Tokopedia and Shopee, which are marketplace with a complete payment and logistics ecosystem.

Even though they play in the retail sector, D2C players can still take advantage of technology that allows them to understand consumer behavior and develop products based on more personalized consumer preferences.

The success of D2C in Indonesia cannot be separated from trends in Gen Z and millennial consumer behavior. Research Capgemini said, Gen Z (68%) and millennials (58%) like to order products directly from the brand owner in the last six months. Meanwhile, almost two-thirds (60%) prefer to buy directly rather than buy at traditional retail outlets.

Strengthened again, many Indonesians enjoy shopping online. Throughout 2022, as many as 178,9 million Indonesians recorded transactions online. Referring to research We Are Social, The total value of Indonesian online shopping in 2022 is estimated to reach IDR 851 trillion.

Scalability, both key and challenge

While, Creative Gorilla Capital (CGC) focused on consumer also assess the sector E-commerce Indonesia has entered a mature phase so that the supply chain has become more efficient. Even so, the D2C sector still requires a business-based approach omnichannel so as not to rely too much on e-marketing-commerce and combine it with traditional/modern channels.

It seems that this has been done by a number of D2C startups in a number of operational areas. Saturdays, for example, even reinforces the concept from the start omnichannel to give seamless experience by building concept outlets lifestyles. Others have expanded to large retail chains. Kopi Kenangan markets bottled coffee products at Alfamart and Indomaret outlets, while Somethinc enters through in-store in a number of shopping centers.

BRI Ventures Chief Investment Officer Markus Liman added that investment in D2C does not just refer to the revenue growth aspect. As time goes by, investors need to understand other aspects, such as changes in market behavior and scalability.

More Coverage:

When you have pocketed it product-market fit, at what point should D2C startups scale? Is it vertical expansion or going into supply chain leaders? He believes that there are higher operational risks that D2C startups need to understand compared to startups whose operations are fully managed by a third party.

"Today's D2C challenge is scalability Karena scaling D2C and scaling platforms are two different things. In D2C, for example scaling In inventory needs, this means you have to think about logistics costs. Well, if you have entered supply chain leaders, such as supermarkets and general trade, what needs to be prepared? This is something you may not have thought about tech startups. Key scalability D2C is how it gets into mass retail. Otherwise, how can you try the potential spend bigger?" he explained.

He added that investors also need to understand that determining the valuation of technology and D2C startups will be different. D2C startup metrics are seen from EBITDA or net profit margin, not by GMV. D2C or retail startups that can produce real revenue can get a better investment in the present.

Sign up for our

newsletter